Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

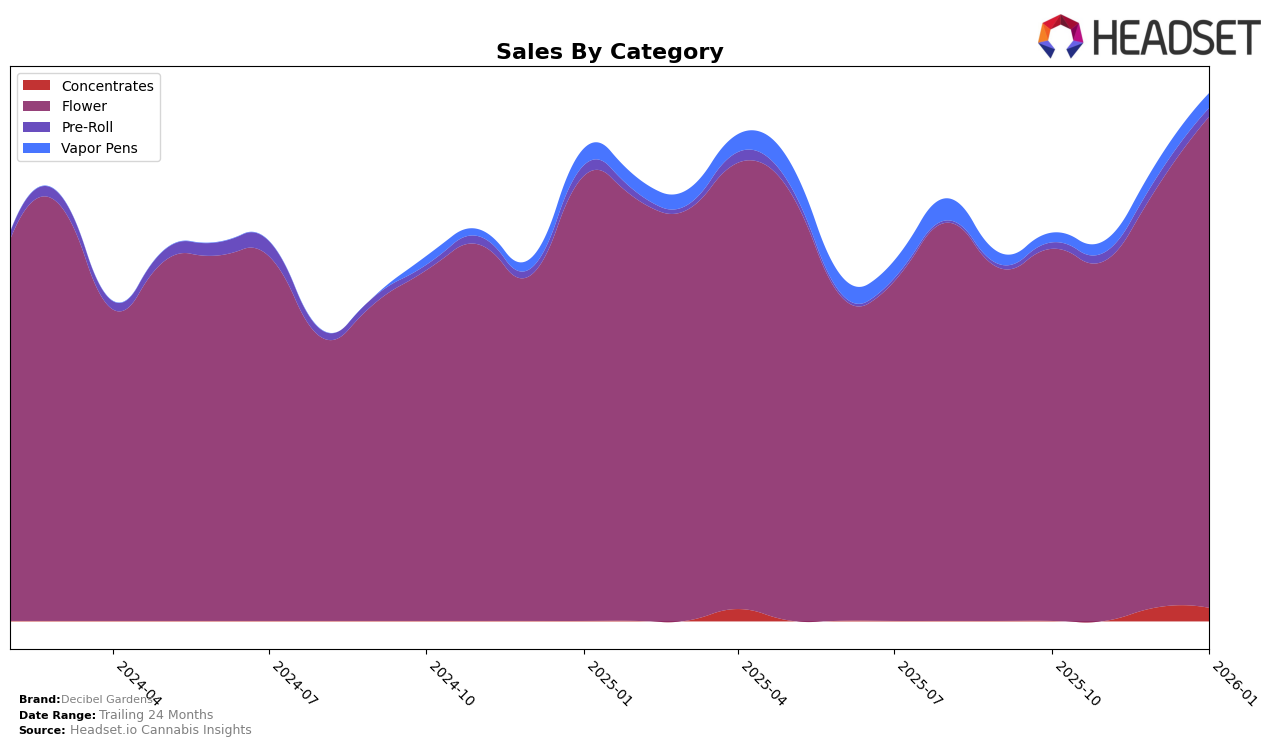

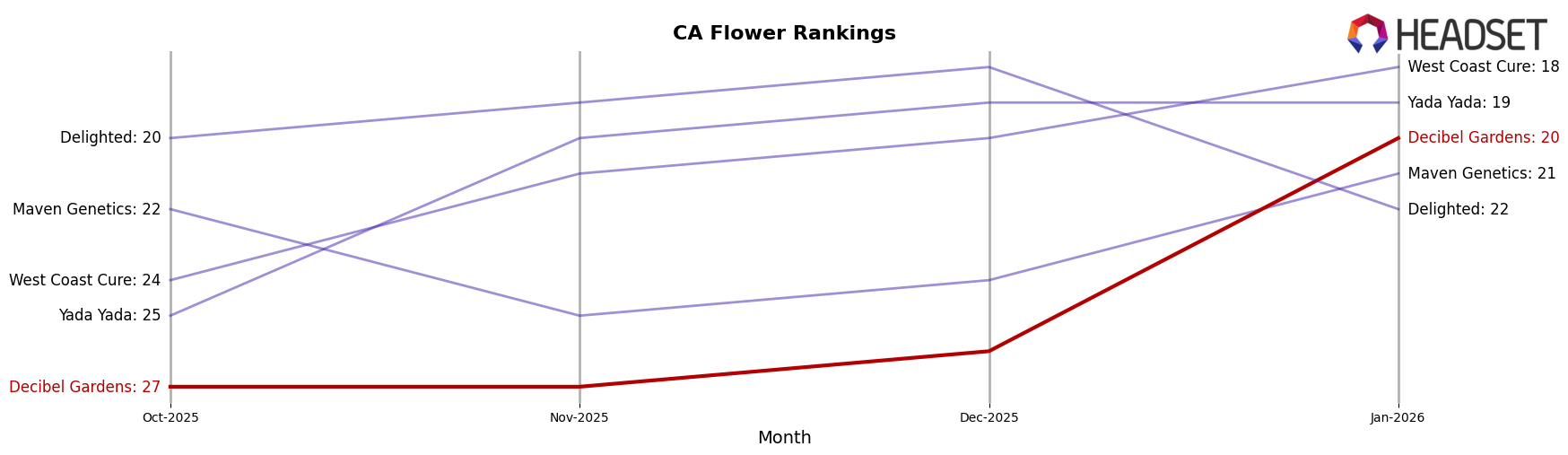

Decibel Gardens has shown varied performance across different product categories and regions. In the California market, their presence in the Concentrates category has been less prominent, with the brand not making it into the top 30 rankings from October 2025 through January 2026. This indicates a need for strategic adjustments or increased marketing efforts in this category. Conversely, their Flower products have demonstrated a positive trajectory, moving from the 27th position in October and November 2025 to 20th by January 2026, suggesting effective brand positioning and consumer preference in this segment.

The sales figures for Decibel Gardens' Flower category in California reflect a healthy upward trend, with notable growth from October 2025 to January 2026. This increase in sales indicates a strengthening market presence and possibly an expanding customer base. However, the absence of rankings in the Concentrates category during the same period could signal a missed opportunity or a focus on other categories. Monitoring these shifts and strategically leveraging insights could be crucial for Decibel Gardens to optimize their market performance further.

Competitive Landscape

In the competitive landscape of the California flower category, Decibel Gardens has shown a notable upward trajectory in its rankings from October 2025 to January 2026. Initially ranked 27th in October and November 2025, Decibel Gardens improved to 26th in December and made a significant leap to 20th by January 2026. This upward movement is indicative of a positive trend in sales, contrasting with competitors like West Coast Cure and Maven Genetics, who have experienced fluctuations in their rankings. Yada Yada maintained a relatively stable position, while Delighted saw a decline from 18th to 22nd in January. Decibel Gardens' consistent improvement in rank suggests a growing consumer preference and effective market strategies, making it a brand to watch in the competitive California flower market.

Notable Products

In January 2026, the top-performing product for Decibel Gardens was Roswell 47 (3.5g) in the Flower category, maintaining its number one rank for four consecutive months with a notable sales figure of 5750 units. Miyazaki Mango (3.5g) also held steady in second place, consistently performing well since October 2025. Alien Orange (3.5g) rose from its fourth position in previous months to secure the third spot, indicating an increase in popularity. Watermelon Punch (3.5g) slipped to fourth place, showing a decrease in sales compared to December 2025. Benjamins in Space (3.5g) entered the rankings in January 2026, debuting at fifth place, suggesting a promising start for a new entrant.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.