Oct-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

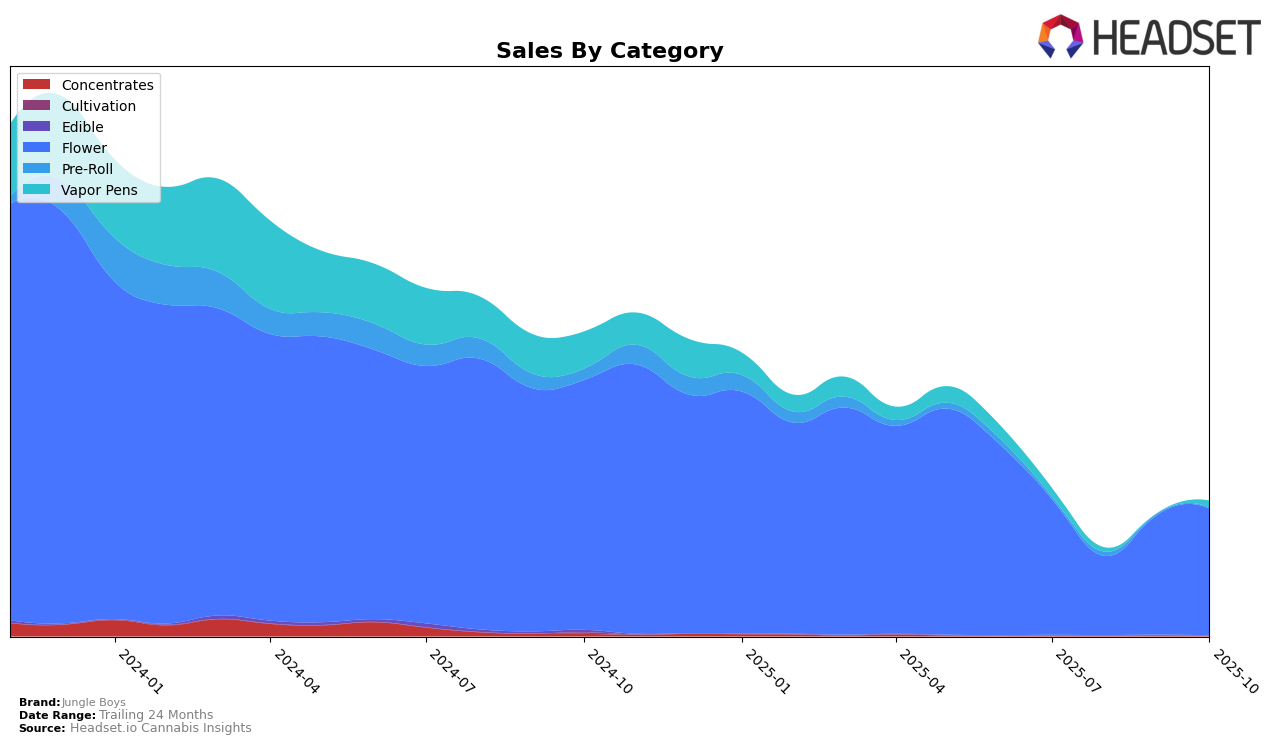

Jungle Boys, a prominent cannabis brand, has shown varying performance across different states and categories. In California, the brand has maintained a steady presence in the Flower category, with its rank fluctuating but consistently remaining within or close to the top 30. Notably, in October 2025, Jungle Boys secured the 28th position, a recovery from the 46th position in August 2025. This upward movement indicates a positive trend in consumer preference or possibly effective marketing strategies. Despite the dip in August, the brand's resilience is evident as it climbed back to its earlier standings, reflecting a robust product appeal in the Californian market.

However, Jungle Boys' performance in other states or categories is not as prominent, as the absence of ranking data outside California suggests that they did not make it into the top 30. This could highlight either a strategic focus on the Californian market or challenges in penetrating other markets with the same level of success. The sales figures in California also show a notable recovery from the August dip, with October sales reaching $805,115. This recovery aligns with the improved ranking, suggesting a correlation between sales performance and market positioning. Overall, while Jungle Boys demonstrates strength in California's Flower category, their presence in other regions and categories might require strategic adjustments to enhance visibility and competitiveness.

Competitive Landscape

In the competitive landscape of California's flower category, Jungle Boys has experienced fluctuating ranks over the past few months, indicating a dynamic market position. Despite not being in the top 20 brands, Jungle Boys showed resilience by improving its rank from 46 in August 2025 to 28 in October 2025. This upward trend suggests a recovery in sales performance, potentially driven by strategic marketing or product innovation. In contrast, 3C Farms / Craft Cannabis Cultivation also improved its ranking from 37 to 29, closely trailing Jungle Boys. Meanwhile, Team Elite Genetics experienced a slight decline, moving from 28 to 30, which may indicate a shift in consumer preference or competitive pressure. Decibel Gardens showed a consistent upward trend, surpassing Jungle Boys by reaching rank 27 in October. Yada Yada maintained a strong presence, consistently ranking in the top 30, which highlights the competitive intensity in this market. These dynamics emphasize the importance of strategic positioning and adaptability for Jungle Boys to maintain and enhance its market share in California's flower category.

Notable Products

In October 2025, the top-performing product for Jungle Boys was C@*!# Bonez Smalls (10g) in the Flower category, which climbed from the fifth position in August to secure the first rank with a notable sales figure of 3699 units. Frosted Gelato Smalls (10g) also showed strong performance, rising from the third rank in September to the second in October. Strawberry Runtz Smalls (10g) slipped one position from second in September to third in October. Kush Sorbet Smalls (10g) made its debut in the rankings in October at fourth place. Private Reserve (3.5g) entered the rankings at fifth place, indicating a competitive market for Jungle Boys' Flower category products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.