Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

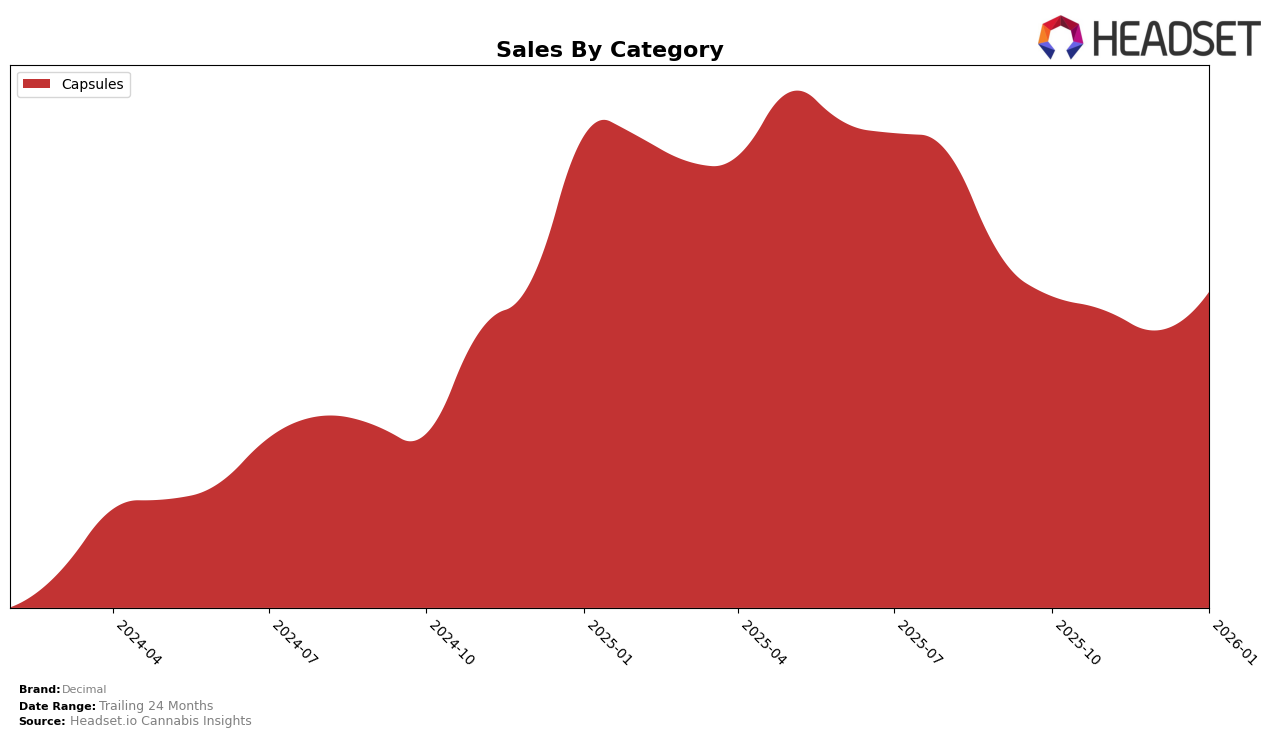

Decimal has maintained a consistent presence in the Capsules category in Ontario, holding steady at the 7th position from October 2025 to January 2026. Despite fluctuations in monthly sales figures, with a notable dip in December followed by a recovery in January, Decimal's ability to sustain its rank indicates a stable consumer base and effective market strategies. This consistency is significant given the competitive nature of the cannabis market, where brands frequently jostle for prominence. The continuous 7th rank suggests a solidified position within the top tier of the Capsules category, though it also highlights potential areas for growth to break into higher ranks.

Interestingly, Decimal's absence from the top 30 brands in other categories or states, as inferred from the data, could be seen as both a challenge and an opportunity. While this might indicate limited geographical reach or category diversification, it also suggests potential areas for strategic expansion. The brand's focus on maintaining a stronghold in Ontario's Capsules market might be a deliberate strategy to build a loyal customer base before venturing into other segments or regions. This approach, while cautious, could pay off in the long run if Decimal decides to leverage its established reputation in Ontario to expand its footprint across other states or categories.

Competitive Landscape

In the competitive landscape of the Capsules category in Ontario, Decimal has maintained a consistent rank of 7th place from October 2025 through January 2026. This stability in rank suggests a steady market presence, although it trails behind key competitors like Emprise Canada and Indiva, both of which have consistently held higher ranks at 5th and 6th, respectively. Despite Decimal's consistent ranking, its sales figures have shown a slight fluctuation, with a notable dip in December 2025 before rebounding in January 2026. In contrast, Simply Bare and Stigma Grow have maintained lower ranks, with Simply Bare consistently at 8th and Stigma Grow experiencing a brief drop to 11th in November 2025. This competitive environment highlights Decimal's need to strategize for growth to close the gap with higher-ranking brands and capitalize on its stable market position.

Notable Products

In January 2026, Decimal's top-performing product was THC 10 Softgels 30-Pack (300mg) in the Capsules category, maintaining its number one rank consistently since October 2025, with sales reaching 1001 units. The THC Capsules 90-Pack (900mg) climbed back to second place after dropping to third in December 2025, indicating a notable recovery in popularity. The CBD:THC 1:1 Balance Softgels 30-Pack (150mg CBD, 150mg THC) secured the third position, showing stable performance with slight fluctuations over the months. CBD Capsules 90-Pack (1800mg CBD) held steady at fourth place throughout the observed period, reflecting consistent demand. Lastly, the CBD/THC 5:5 Balanced Softgels 90-Pack (450mg CBD, 450mg THC) remained in fifth place, despite a significant dip in sales compared to previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.