Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

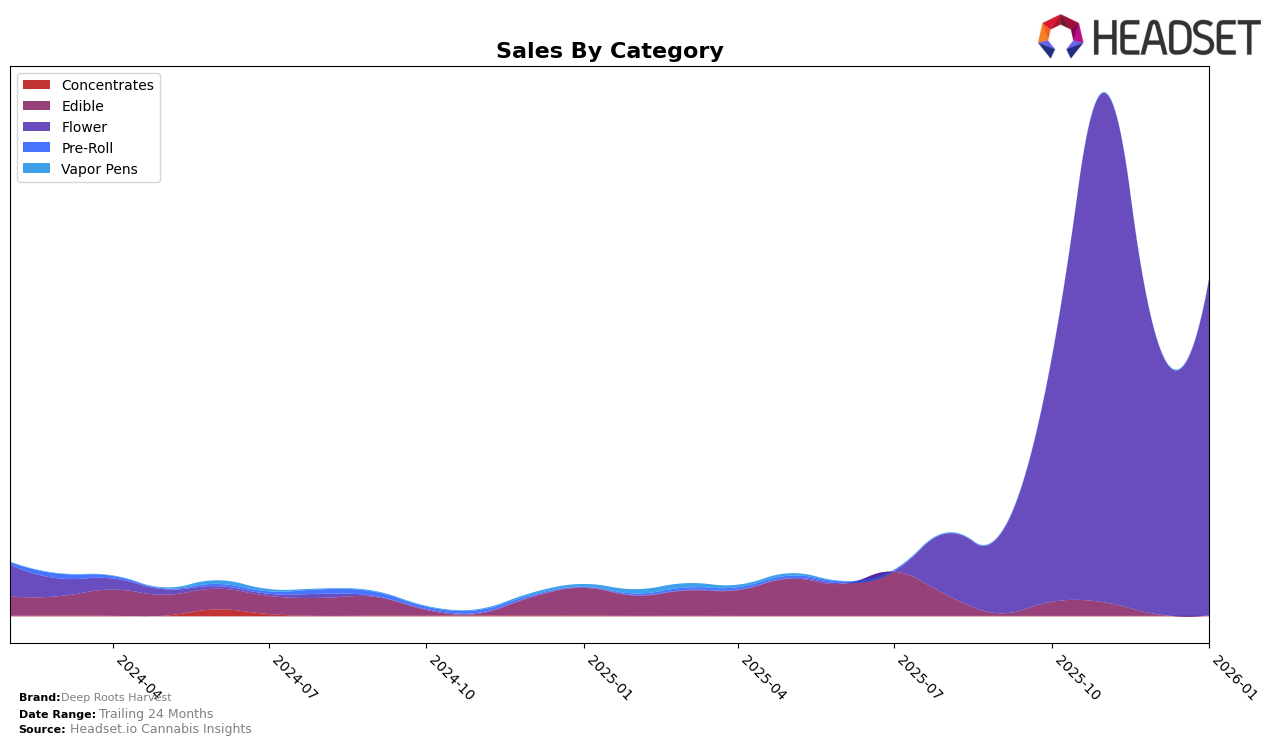

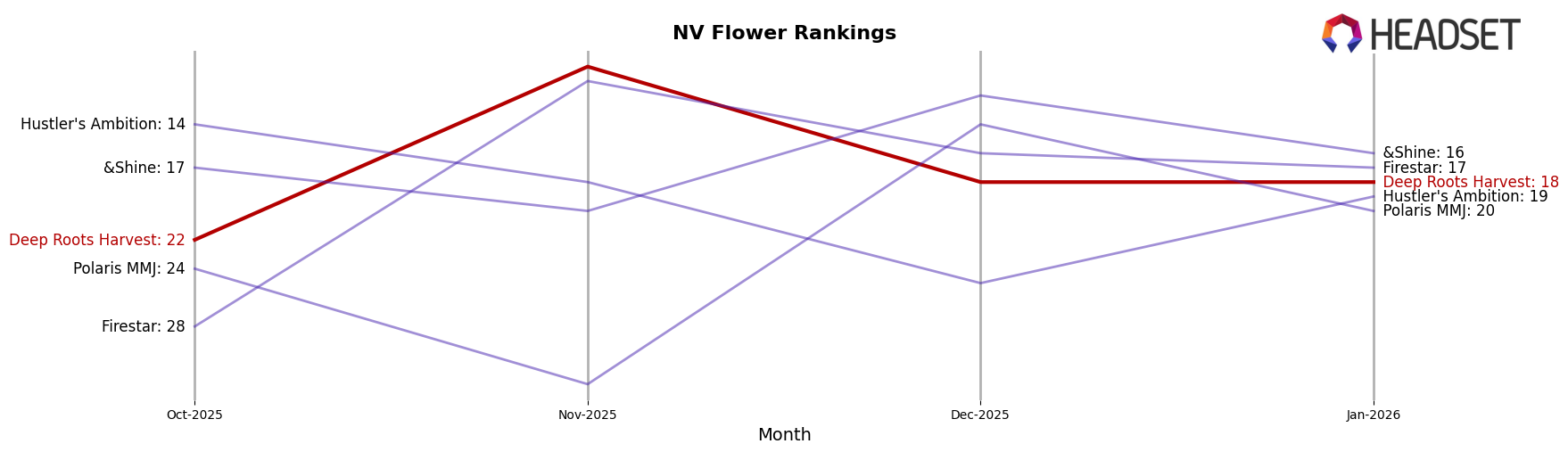

Deep Roots Harvest has shown varied performance across different product categories and states. In Nevada, the brand's presence in the Edible category has seen a decline, dropping from the 29th position in October 2025 to falling out of the top 30 by November 2025. This absence from the rankings could indicate a need for strategic adjustments in their edible offerings or marketing tactics. Conversely, their performance in the Flower category has been more promising. The brand climbed from 22nd in October 2025 to 10th in November 2025, suggesting a strong consumer preference or successful promotional efforts in that segment.

Despite the initial surge in the Flower category, Deep Roots Harvest experienced some fluctuations, settling at the 18th position by January 2026. This stability, albeit lower than their peak, may point to a consistent consumer base or challenges in maintaining the earlier momentum. The sales figures reflect these movements, with a notable increase from October to November 2025, before stabilizing. Such trends highlight the dynamic nature of the cannabis market in Nevada and underscore the importance of adaptability and targeted strategies in maintaining a competitive edge.

Competitive Landscape

In the competitive landscape of the Nevada flower category, Deep Roots Harvest has experienced notable fluctuations in its rankings and sales over the past few months. Starting from October 2025, Deep Roots Harvest was ranked 22nd, but it saw a significant improvement in November, climbing to the 10th position, before settling at 18th in both December and January 2026. This indicates a strong performance in November, likely driven by a strategic push or seasonal demand, as evidenced by the sales peak during that month. In contrast, Polaris MMJ showed a less consistent trajectory, with rankings varying from 24th to 32nd, and then improving to 14th in December, suggesting volatility in their market presence. Meanwhile, Firestar and &Shine have maintained more stable rankings, with &Shine consistently outperforming Deep Roots Harvest in terms of sales, particularly in December and January. Hustler's Ambition also presents a competitive challenge, showing resilience despite a drop in December. Overall, while Deep Roots Harvest has shown potential for rapid growth, sustaining such momentum against competitors like &Shine and Firestar will be crucial for maintaining and improving its market position.

Notable Products

In January 2026, Deep Roots Harvest's top-performing product was ZCake x Mai Tai (14g) in the Flower category, leading the sales with an impressive 2,209 units sold. Velvet Sundae (14g) secured the second position, followed by Humble Mint (14g) in third place. Lemosa (14g) and Reno Runtz (14g) rounded out the top five, ranking fourth and fifth respectively. Compared to previous months, these products have maintained strong positions, with ZCake x Mai Tai (14g) consistently dominating the sales charts. The rankings indicate a stable preference for these specific flower products among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.