Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

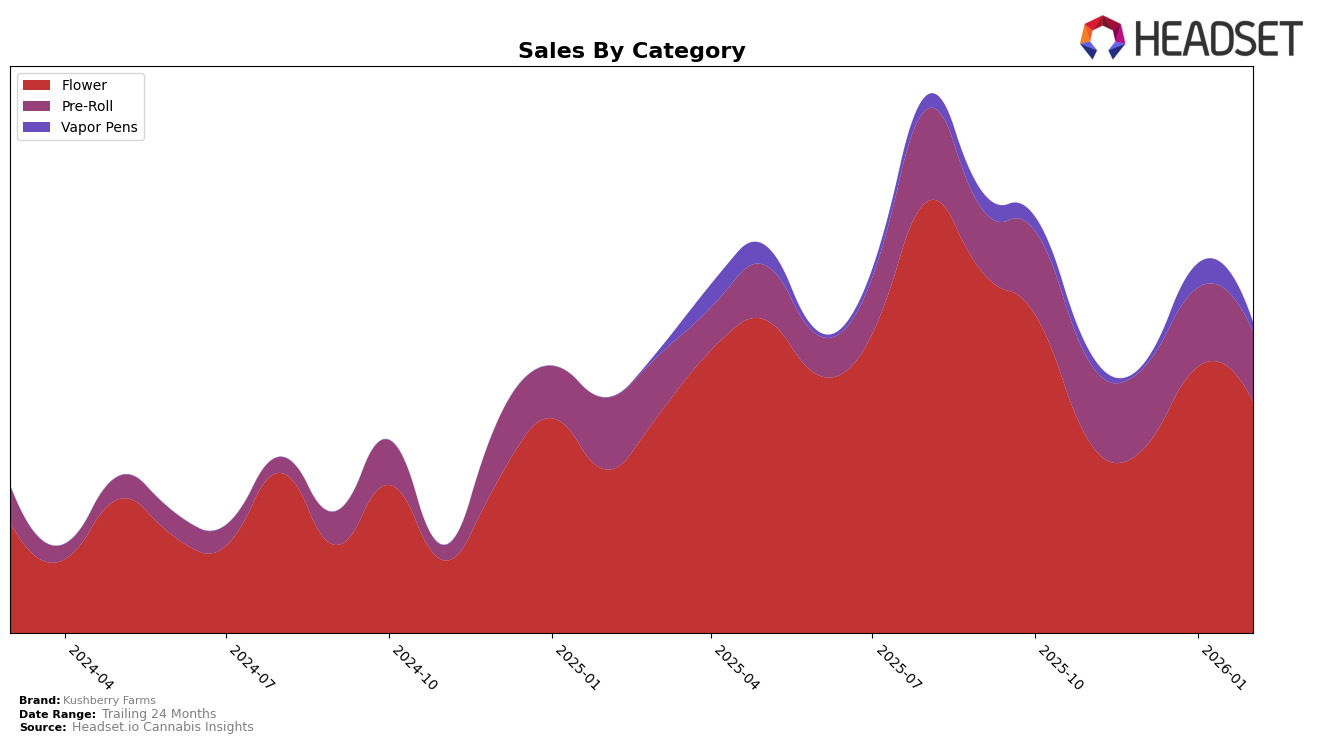

Kushberry Farms has demonstrated notable performance in the Nevada market, particularly in the Flower category. Over the months from November 2025 to February 2026, Kushberry Farms experienced a significant upward trajectory, moving from 14th to 10th place before settling at 12th in February. This indicates a growing preference for their Flower products among consumers, as evidenced by a notable increase in sales, peaking in January. The Pre-Roll category remained consistently strong, maintaining a top 10 position, although there was a slight dip from 8th to 10th place in February, which suggests a need for strategic adjustments to regain momentum.

Conversely, Kushberry Farms faced challenges in the Vapor Pens category within Nevada. The brand was not ranked in the top 30 in December 2025, which highlights a significant gap in market penetration or consumer preference during that period. Although they managed to climb back to 38th in January, the subsequent fall back to 51st in February suggests volatility and potential issues in maintaining a stable presence in this category. This fluctuation could be a point of concern, indicating the need for targeted efforts to enhance product appeal or market strategies in the Vapor Pens segment.

Competitive Landscape

In the competitive landscape of the Nevada Flower category, Kushberry Farms has demonstrated a notable upward trajectory in its rankings over recent months. Starting from a rank of 14th in November 2025, Kushberry Farms climbed to 10th by January 2026, before slightly dropping to 12th in February 2026. This positive trend in rank is mirrored by its sales performance, which saw a significant increase from November to January, before a slight dip in February. Comparatively, Solaris has shown consistent strength, maintaining a top 10 position from December 2025 onwards, with sales consistently higher than Kushberry Farms. Meanwhile, Grassroots experienced a sharp decline in rank from 6th to 14th by February 2026, indicating potential volatility. Neon Moon made a remarkable leap from outside the top 20 in November to 11th in February, showcasing a rapid growth trajectory that could pose a future challenge to Kushberry Farms. This competitive environment underscores the importance for Kushberry Farms to sustain its sales momentum to maintain and improve its market position.

Notable Products

In February 2026, the top-performing product for Kushberry Farms was the Dutch Hawaiian Pre-Roll (1g) in the Pre-Roll category, ranking first with a notable sales figure of 5713. The Dutch Hawaiian (3.5g) from the Flower category climbed to the second position, showcasing a consistent rise in popularity. MAC 1 Pre-Roll (1g) dropped to third place after holding the second spot for the previous two months. Kush Mints Pre-Roll (1g) made its debut in the rankings, securing the fourth position. Slurty Pre-Roll (1g) maintained its fifth-place ranking from December 2025, indicating stable demand.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.