Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

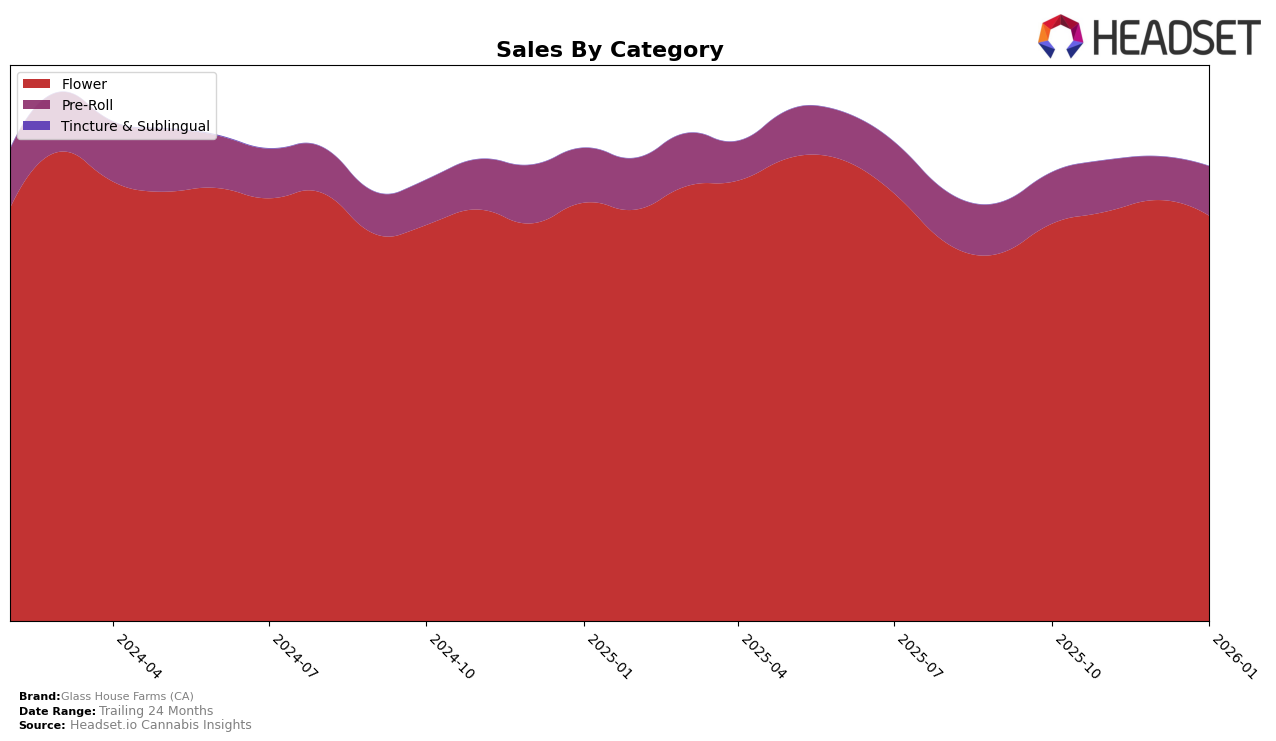

Glass House Farms (CA) has shown a consistent performance in the California market, particularly in the Flower category. Over the observed months, the brand has maintained a strong presence with rankings improving from 16th in October 2025 to 14th by January 2026. This upward trend is supported by a steady increase in sales, peaking in December 2025. Such movement indicates a positive reception and growing demand for their Flower products among consumers in California. The consistent rise in rankings suggests that Glass House Farms is effectively navigating the competitive landscape of the Flower category.

In contrast, the performance of Glass House Farms in the Pre-Roll category within California presents a more volatile picture. The brand's ranking fluctuated, dropping to 65th in December 2025 before rebounding to 54th in January 2026. Despite the fluctuations, the sales figures reflect a certain resilience, as they managed to recover from the dip in December. The brand's absence from the top 30 in this category during this period highlights the challenges faced in gaining a stronger foothold. However, the recovery in January could indicate potential strategies or market adjustments that may bolster their standing in the coming months.

Competitive Landscape

In the competitive landscape of California's flower category, Glass House Farms (CA) has shown a steady improvement in its ranking, moving from 16th place in October 2025 to 14th place by January 2026. This upward trend in rank is indicative of a positive momentum in sales performance, even as competitors like Dime Bag (CA) and Pacific Stone maintain strong positions. Notably, Quiet Kings experienced a significant drop from 11th to 16th place, which may have contributed to Glass House Farms' ability to climb the ranks. Meanwhile, West Coast Treez saw a substantial rise from 18th to 13th place, suggesting a competitive push in the market. Despite these shifts, Glass House Farms' consistent sales growth underscores its resilience and potential to further enhance its market position in the coming months.

Notable Products

In January 2026, Gelato #41 x Animal Mints (1g) from Glass House Farms (CA) emerged as the top-performing product, achieving the number one rank with impressive sales of 6,454 units. Donny Burger #5 Pre-Roll (1g) followed closely, securing the second position, with a notable increase from its third-place ranking in December 2025. Super Silver Haze (3.5g) climbed to the third spot, showing a consistent upward trend from its previous fourth and fifth positions in November and October 2025, respectively. Garlic Starship (3.5g) and Lilac Diesel (7g) rounded out the top five in fourth and fifth places, respectively, marking their debut in the rankings. Overall, the data indicates a strong performance from the Flower category, with a significant reshuffling of product rankings from previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.