Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

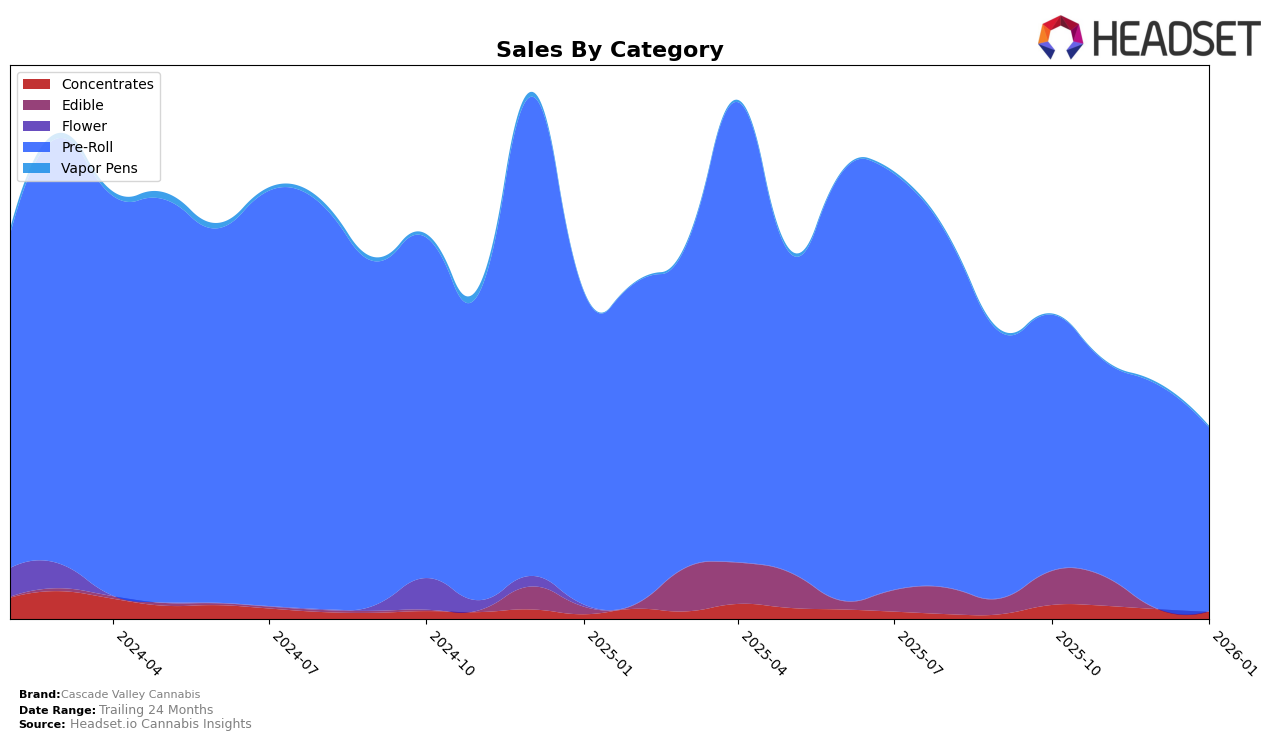

In the Oregon market, Cascade Valley Cannabis has shown varying performance across different product categories. In the Edible category, the brand maintained a presence in the top 30 as of October 2025, ranking 29th, but dropped out of the top 30 in November 2025. This decline suggests a potential area for improvement or increased competition in the Edible space. Meanwhile, the Pre-Roll category has displayed more consistent performance, with Cascade Valley Cannabis maintaining a presence within the top 30 across all months from October 2025 to January 2026, although there is a noticeable downward trend from 25th in October and November to 30th by January. This indicates a need for strategic adjustments to regain higher rankings.

Analyzing sales trends provides additional insights into the brand's performance. The Pre-Roll category, for instance, experienced a decline in sales from October 2025 to January 2026, which aligns with the drop in rankings. This may reflect broader market dynamics or changes in consumer preferences within Oregon. However, it's worth noting that despite these fluctuations, Cascade Valley Cannabis has managed to sustain a presence in the competitive Pre-Roll market, which could indicate a strong brand foundation that can be leveraged for future growth. The absence of ranking data for the Edible category in December and January underscores the challenges faced in maintaining a competitive edge in this segment.

Competitive Landscape

In the competitive landscape of Oregon's Pre-Roll category, Cascade Valley Cannabis has experienced notable fluctuations in its market positioning over the past few months. As of January 2026, Cascade Valley Cannabis has seen a decline in its ranking from 25th in October 2025 to 30th, indicating a potential challenge in maintaining its competitive edge. This downward trend in rank is mirrored by a decrease in sales, which have dropped consistently over the same period. In contrast, competitors such as East Fork Cultivars and Gud Gardens have shown more stability, with East Fork Cultivars improving its rank to 31st in January 2026, while Gud Gardens climbed to 28th. Meanwhile, SugarTop Buddery demonstrated resilience by rebounding to 29th place after a dip in November and December. These dynamics suggest that Cascade Valley Cannabis may need to reassess its strategies to regain its footing in the competitive Oregon Pre-Roll market.

Notable Products

In January 2026, the top-performing product for Cascade Valley Cannabis was Cascade Critical Pre-Roll (1g), which rose to the number one spot from third place in December 2025, achieving notable sales of 3,470 units. Runtz Pre-Roll (1g) maintained its strong performance, holding steady at the second position with 2,504 units sold. Scorpion Tears Pre-Roll (1g) improved its ranking from fourth to third place, while Grapes & Cream Pre-Roll (1g) experienced a decline, dropping from first place in December to fourth in January. Ice Cream Cake Pre-Roll (1g) entered the rankings at fifth place, marking its debut in the top five. These shifts indicate a dynamic competitive landscape among the pre-roll category for Cascade Valley Cannabis.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.