Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

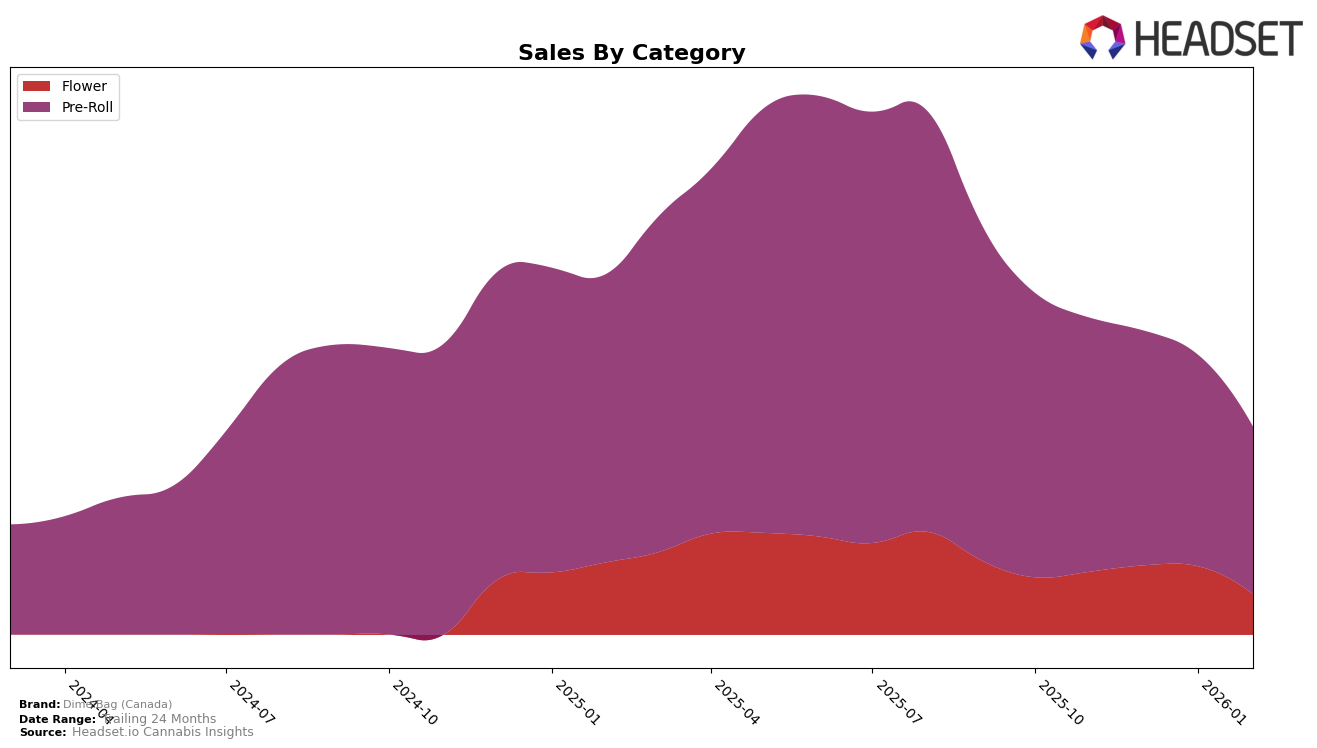

Dime Bag (Canada) has shown varied performance across different provinces and categories. In British Columbia, their Pre-Roll category saw a notable upward trend from November 2025 to January 2026, moving from 84th to 66th place, before slipping slightly to 75th in February 2026. This indicates a competitive presence in the pre-roll market in British Columbia, despite not breaking into the top 30. Conversely, in Alberta, Dime Bag (Canada) did not make it into the top 30 for the Flower category, which could suggest either a stronger competition or a need for strategic adjustments in this market.

In Ontario, Dime Bag (Canada) maintained a stable presence in the Pre-Roll category, consistently holding the 12th position from November 2025 through January 2026, only dropping slightly to 13th in February 2026. This stability highlights their strong foothold in the pre-roll market within Ontario. However, in the Flower category, their ranking fluctuated, starting at 40th in November 2025, improving slightly in December, but then experiencing a decline to 46th by February 2026. This fluctuation might reflect changing consumer preferences or competitive pressures in Ontario's flower market.

Competitive Landscape

In the competitive landscape of Ontario's Pre-Roll category, Dime Bag (Canada) has shown resilience amidst fluctuating market dynamics. Despite a slight dip in rank from 12th to 13th position by February 2026, Dime Bag (Canada) remains a strong contender, consistently outperforming brands like Spinach and Pure Sunfarms, which have seen more volatility in their rankings. Notably, FIGR has maintained a stable position slightly ahead of Dime Bag (Canada), indicating a competitive edge in sales performance. Meanwhile, 1Spliff has experienced a similar rank trajectory, suggesting a close rivalry. The overall trend for Dime Bag (Canada) indicates a need for strategic initiatives to regain and surpass its previous standings, as the brand navigates a market where competitors are both gaining and losing ground.

Notable Products

In February 2026, the top-performing product from Dime Bag (Canada) was the Diesel Pocket Puffs Pre-Roll 4-Pack (2g) in the Pre-Roll category, maintaining its number one rank consistently from November 2025 with sales of 37,742 units. The Tropical Pocket Puffs Pre-Roll 4-Pack (2g) held the second position throughout the same period, followed by the Sweet Pocket Puffs Pre-Roll 4-Pack (2g) in third place. Funky Pocket Puffs Pre-Roll 4-Pack (2g) and Spicy Pocket Puffs Pre-Roll 4-Pack (2g) consistently ranked fourth and fifth, respectively. Notably, all these products have retained their rankings from previous months, although the sales figures have seen a gradual decline across the board since November 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.