Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

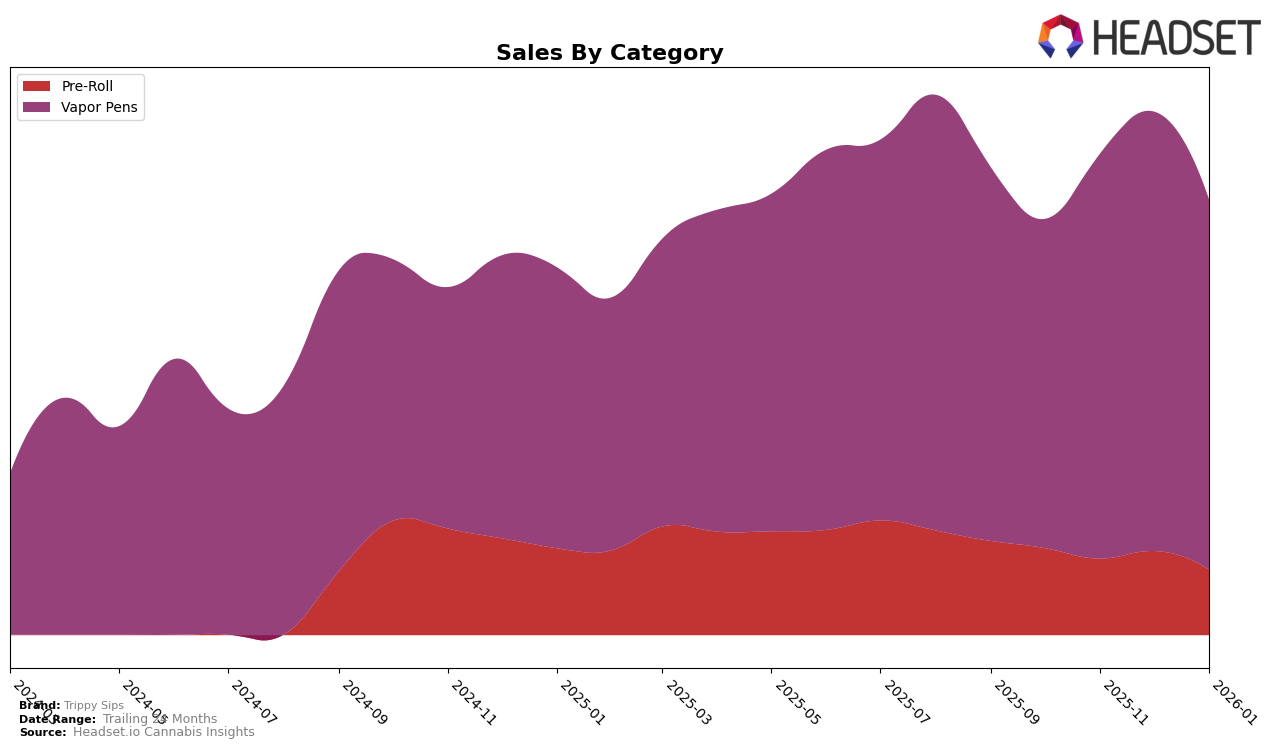

Trippy Sips has shown varied performance across different states and categories, indicating a dynamic market presence. In Alberta, the brand has seen a consistent rise in the Pre-Roll category, moving from 61st in October 2025 to 45th by January 2026, suggesting a strengthening foothold. However, in the Vapor Pens category within the same province, there was a slight decline from 8th to 11th position, which could indicate competitive pressures or shifting consumer preferences. Meanwhile, in British Columbia, Trippy Sips improved its standing in Vapor Pens significantly, climbing from 27th to 11th place over the same period, reflecting a successful strategy or increased brand recognition.

In contrast, the brand's performance in Ontario shows a downward trend in the Pre-Roll category, slipping from 77th to 95th, which may suggest challenges in maintaining market share or consumer interest. The Vapor Pens category in Ontario saw a slight fluctuation, with rankings moving between 38th and 42nd, indicating a relatively stable but competitive market position. In the U.S., specifically in Illinois, Trippy Sips remained outside the top 50 for Vapor Pens, highlighting potential market entry challenges or the need for strategic adjustments. Notably, in New Jersey, the brand did not make it to the top 30 in January 2026, which could be a point of concern for maintaining brand visibility in that region.

Competitive Landscape

In the competitive landscape of vapor pens in Alberta, Trippy Sips has experienced some fluctuations in its market position from October 2025 to January 2026. Initially ranked 8th in October 2025, Trippy Sips saw a slight dip to 9th in November before rebounding to 8th in December. However, by January 2026, the brand had slipped to 11th, falling out of the top 10. This decline in rank is notable given the performance of competitors like 1964 Supply Co, which improved its rank from 16th to 10th over the same period, and Kolab, which maintained a relatively stable position, ending January in 9th place. Despite these challenges, Trippy Sips achieved its highest sales in December, indicating strong consumer interest, although sales dropped significantly by January. This suggests that while Trippy Sips has a strong product offering, it faces intense competition and may need strategic adjustments to regain and maintain a higher rank in the Alberta vapor pen market.

Notable Products

In January 2026, Blue Lemonade Liquid Diamond Cartridge maintained its top position in the Vapor Pens category for Trippy Sips, with sales reaching 6077 units. Caribbean Crush Liquid Diamond Cartridge secured the second position, showing consistent performance from the previous month. Guava Kiwitopia Liquid Diamonds Cartridge ranked third, swapping places with Caribbean Crush compared to December 2025. Kool Cherry Liquid Diamonds Cartridge held steady in fourth place, continuing its upward sales trend. Notably, Kool Grape Jammer Distillate Cartridge entered the rankings in fifth place, marking its debut appearance in the dataset.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.