Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

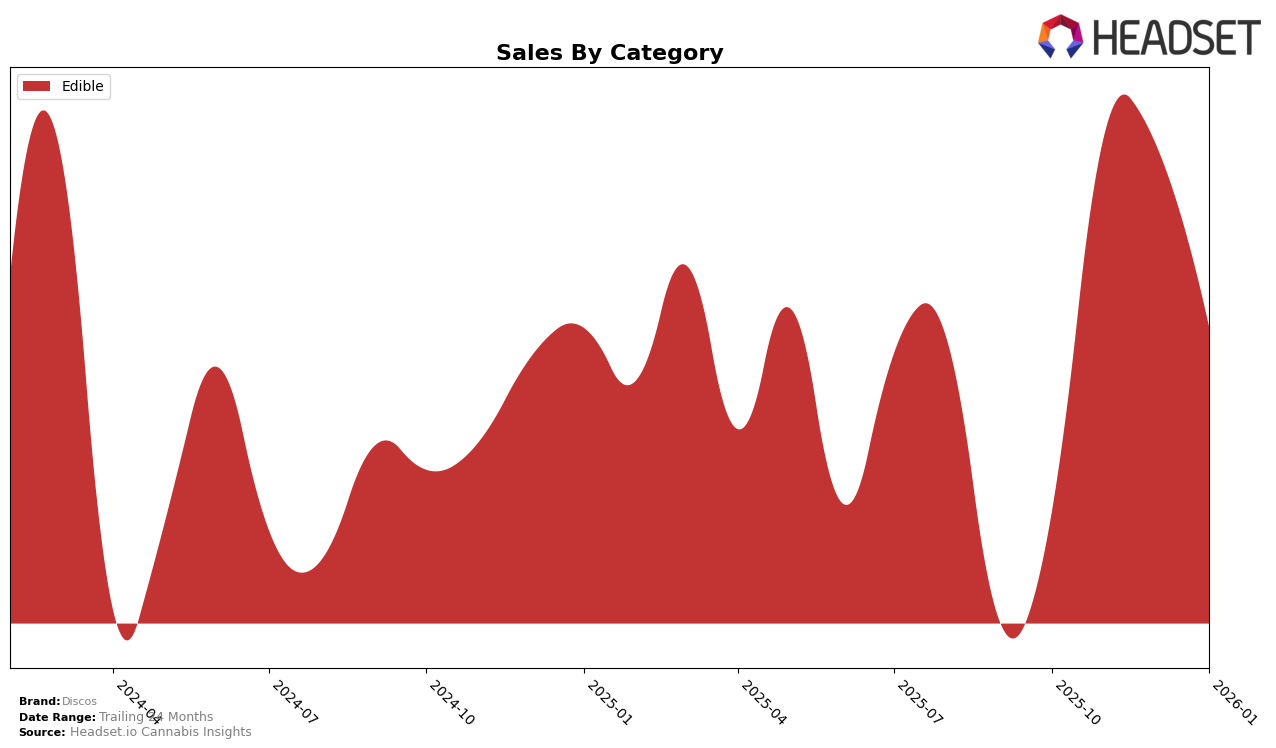

Discos has shown a consistent presence in the Maryland edible category over the past few months. Starting from October 2025, the brand was ranked 22nd, and by January 2026, it had improved its position to 18th. This upward trend indicates a strengthening market presence in Maryland, particularly within the edible category. While the sales figures saw a dip in January 2026 compared to previous months, the brand's ability to maintain a top 30 ranking consistently suggests a solid customer base and potential for growth.

Notably, Discos' absence from the top 30 rankings in other states or categories could be seen as a missed opportunity or a strategic focus on the Maryland market. The lack of presence in other regions might indicate either a targeted strategy or areas where the brand could expand its efforts. Understanding the dynamics of Discos' performance in Maryland could provide insights into potential strategies for entering or improving in other markets. This selective performance across states and categories highlights the importance of regional strategies in the cannabis industry.

Competitive Landscape

In the Maryland edible cannabis market, Discos has experienced notable fluctuations in its competitive positioning, reflecting both challenges and opportunities. From October 2025 to January 2026, Discos' rank oscillated between 18th and 22nd, indicating a struggle to consistently maintain a top-tier position. Despite a promising improvement from 22nd in October to 18th in November, Discos faced a setback in December, dropping to 21st before recovering to 18th in January. This volatility is contrasted by the steady performance of competitors like Evermore Cannabis Company, which consistently held a higher rank, peaking at 16th in December and January. Meanwhile, AiroPro displayed resilience, maintaining a rank between 17th and 19th, while Beezle Extracts showed a similar pattern of fluctuation, yet managed to secure a spot within the top 20 by January. These dynamics suggest that while Discos is competitive, it faces pressure from brands like Evermore Cannabis Company, which not only achieved higher rankings but also demonstrated stronger sales growth over the same period. For Discos to enhance its market position, focusing on strategies that stabilize and boost its rank and sales could be crucial in the coming months.

Notable Products

In January 2026, the top-performing product from Discos was the CBD/THC/CBN 5:1:1 Wild Cherries Gummies 10-Pack, maintaining its number one rank despite a decrease in sales to 1014 units. Peppermint Dark Chocolate Bites 10-Pack climbed to the second position, reflecting a consistent rise in popularity over the previous months. Sours Pink Lemonade Live Resin Gummies 10-Pack also improved its ranking, moving up to third place. White Chocolate With Cookies & Cream Topping 10-Pack, which was unranked in December, re-entered the list at fourth place. Radzberry Live Resin Gummies 10-Pack held steady in fifth position, showing consistent performance across the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.