Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

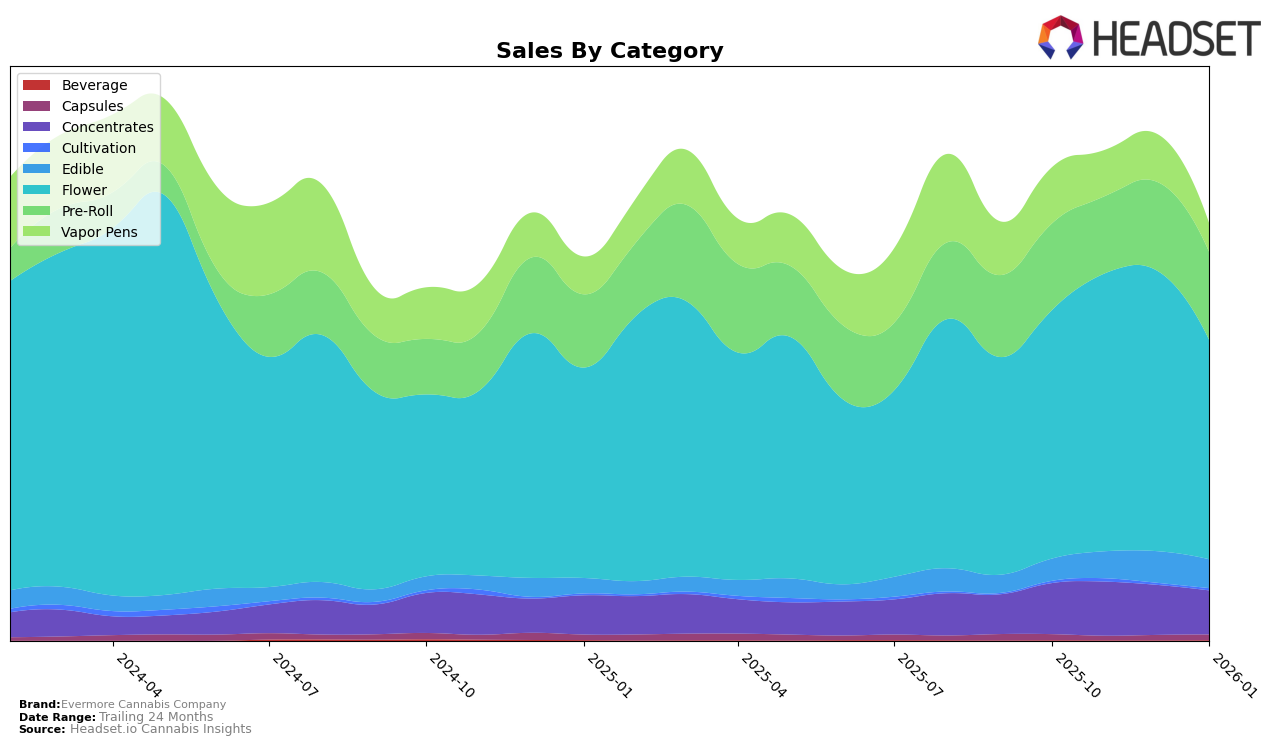

Evermore Cannabis Company has shown varied performance across different product categories in Maryland. Notably, their Concentrates category maintained a strong presence, starting at rank 2 in October 2025 and gradually moving to rank 4 by January 2026. This indicates a slight decline but still reflects a competitive stance within the top ranks. In contrast, the Vapor Pens category saw a more significant drop, from rank 15 in October to rank 20 by January, suggesting increased competition or a shift in consumer preference. Despite this, the Pre-Roll category remained consistent, holding the 5th position in both December and January, which might indicate a stable demand for their offerings in this segment.

In terms of Edibles, Evermore Cannabis Company experienced a positive trend, improving their rank from 19 in October to 16 by December and maintaining that position into January. This upward movement suggests that their edible products are gaining traction among consumers in Maryland. However, the Flower category saw a decline from rank 5 in December to rank 10 in January, which could be concerning given the typically high sales volume associated with flower products. This decline might suggest either a seasonal variation or an increased competitive landscape. The absence of Evermore Cannabis Company from the top 30 brands in any state outside of Maryland highlights a potential area for growth and expansion.

Competitive Landscape

In the competitive landscape of the flower category in Maryland, Evermore Cannabis Company has experienced notable fluctuations in its ranking and sales performance from October 2025 to January 2026. Initially ranked 7th in October 2025, Evermore climbed to 5th place in both November and December, before dropping to 10th in January 2026. This decline in rank coincided with a decrease in sales from December to January, suggesting a potential challenge in maintaining market momentum. Competitors such as Kind Tree Cannabis and Grow West Cannabis Company have shown resilience, with Kind Tree Cannabis improving its rank from 12th in November to 8th in both December and January, while Grow West Cannabis Company consistently hovered around the 9th position. Meanwhile, Curio Wellness experienced a rank drop from 8th in November to 11th in January, indicating a competitive and dynamic market environment. These shifts highlight the importance for Evermore Cannabis Company to strategize effectively to regain and sustain its competitive edge in the Maryland flower market.

Notable Products

In January 2026, the top-performing product from Evermore Cannabis Company was Gumi #6 (3.5g) in the Flower category, which rose to the first position with sales reaching 7,254 units. Happy J's - Funky Guava Pre-Roll 2-Pack (1g) secured the second spot, experiencing a drop from its previous top position in December 2025. Sunset Octane (3.5g) climbed to third place, showing a consistent presence within the top five over the past months. Orange Drizzle (3.5g), which held the first position in November 2025, fell to fourth place. Funky Guava (3.5g) rounded out the top five, maintaining its steady ranking despite a slight decrease in sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.