Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

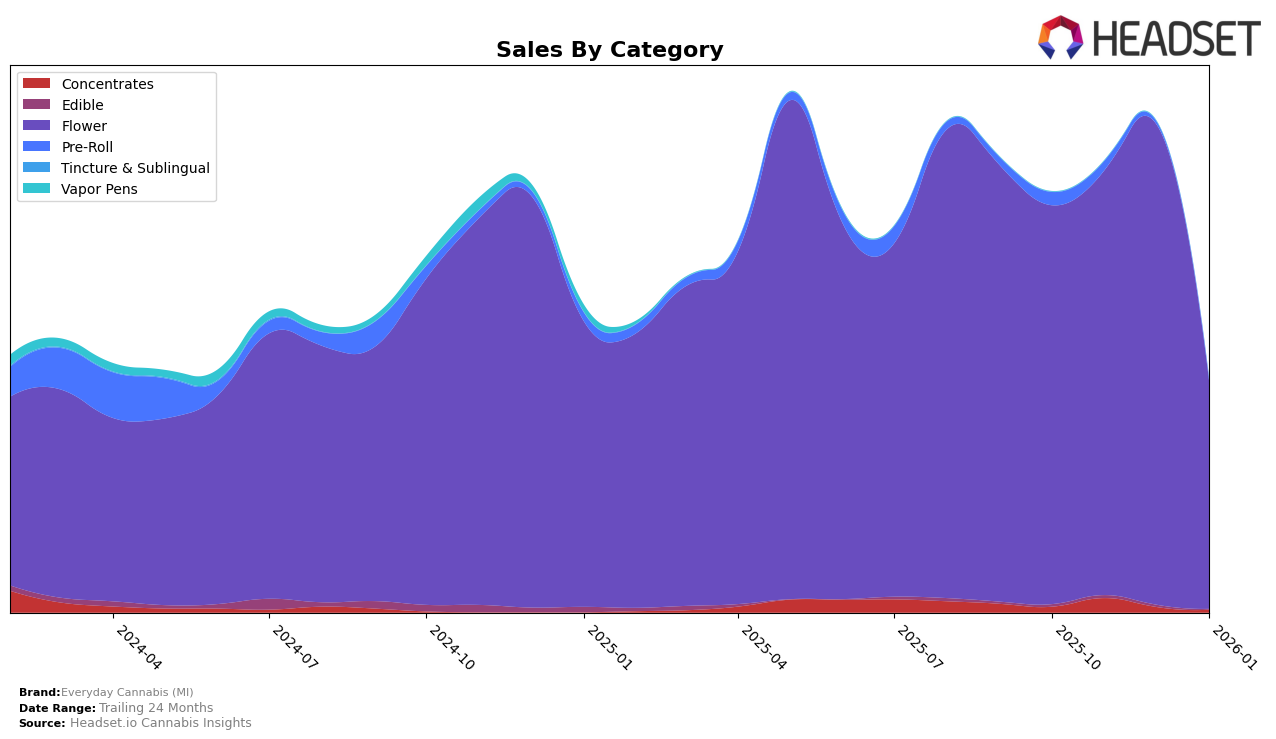

Everyday Cannabis (MI) has shown a dynamic performance in the Michigan market, particularly within the Flower category. The brand has experienced fluctuations in its ranking, starting at 11th in October 2025, slightly dropping to 12th in November, climbing to an impressive 8th place in December, before falling to 24th in January 2026. This indicates a strong but volatile presence in the Flower segment. The brand's sales figures reflect this volatility, with a notable peak in December 2025, suggesting effective strategies or market conditions that favored their products during this period. However, the drop in January suggests potential challenges or increased competition that may have impacted their ranking. The absence of a top 30 ranking in the Concentrates category could be seen as an area for potential growth or a need for strategic realignment.

In terms of category performance, Everyday Cannabis (MI) has not managed to break into the top 30 in the Concentrates category in Michigan from October 2025 to January 2026. This absence from the top rankings could indicate either a lack of focus on this category or strong competition from other brands. The lack of presence in the top 30 suggests that there may be untapped potential or a need for innovation within their Concentrates offerings. Meanwhile, the Flower category remains a stronghold for the brand, although the significant drop in January 2026 highlights the need for sustained marketing efforts and perhaps diversification to maintain and improve their standing. These insights could guide strategic decisions for Everyday Cannabis (MI) as they navigate the competitive landscape of the cannabis market.

Competitive Landscape

In the competitive landscape of the Michigan flower category, Everyday Cannabis (MI) has demonstrated notable fluctuations in rank and sales over the past few months. Starting strong in October 2025 with an 11th place rank, Everyday Cannabis (MI) saw an improvement to 8th place by December 2025, indicating a positive trajectory in sales performance. However, by January 2026, the brand experienced a significant drop to 24th place, suggesting a potential challenge in maintaining its earlier momentum. In comparison, Glorious Cannabis Co. maintained a relatively stable presence, peaking at 10th place in November 2025 before dropping to 25th in January 2026. Meanwhile, Skymint and Carbon both showed inconsistent rankings, with Skymint starting at 19th and ending at 23rd, and Carbon fluctuating between 18th and 26th. The data suggests that while Everyday Cannabis (MI) initially captured consumer interest, sustaining this growth amidst competitive pressures remains a challenge, especially as brands like Guerilla Grown also vie for market share with similar ranking volatility.

Notable Products

In January 2026, the top-performing product for Everyday Cannabis (MI) was Apple Fritter (3.5g) in the Flower category, leading with 4,381 sales. Following closely, Glue Cheese (3.5g) secured the second spot with significant sales, while Candy Cream Puffs (3.5g) ranked third. Purple Chem Cookies (3.5g) and What Up Doe (3.5g) completed the top five, maintaining strong positions with competitive sales figures. Notably, these products did not appear in the top rankings in the previous months of October, November, or December 2025, indicating a substantial rise in popularity for January 2026. This shift suggests a dynamic change in consumer preferences or successful marketing strategies by Everyday Cannabis (MI).

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.