Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

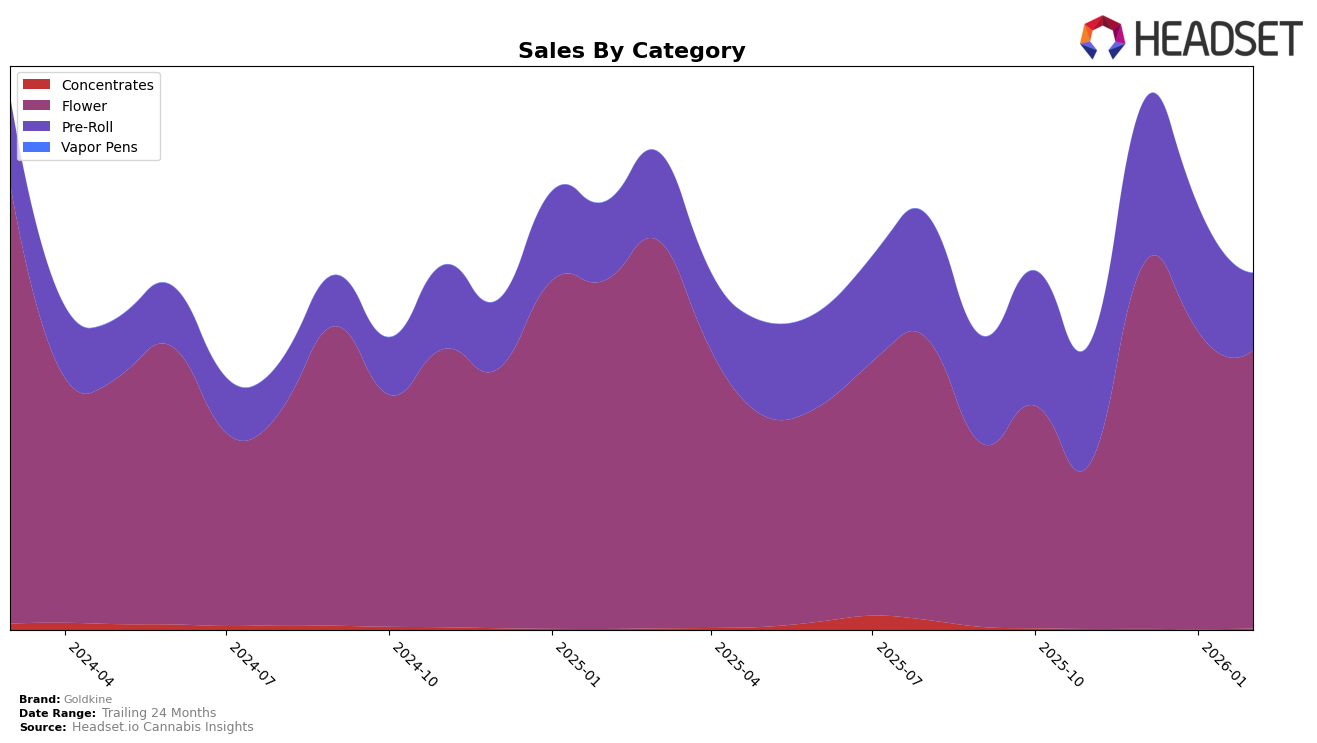

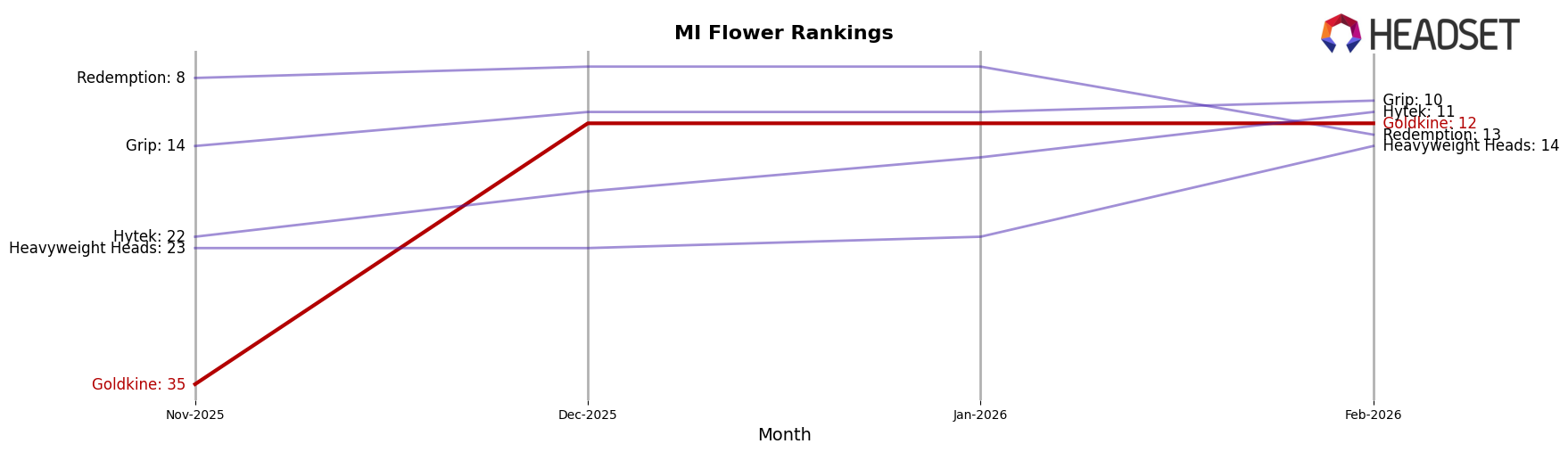

Goldkine's performance in the Michigan market has shown notable movements across different product categories. In the Flower category, Goldkine made a significant leap from a rank of 35 in November 2025 to consistently holding the 12th position from December 2025 through February 2026. This indicates a strong market presence and growing consumer preference for their Flower products. The jump in rank suggests an effective strategy or possibly an increase in product quality or availability. However, the absence of a ranking in the top 30 prior to November 2025 might have been a concern for stakeholders, but the subsequent rise demonstrates a positive turnaround.

In contrast, the Pre-Roll category presents a more fluctuating scenario for Goldkine in Michigan. Starting at rank 16 in November 2025, Goldkine improved slightly to 13th in December, but then experienced a decline to 19th by February 2026. This downward trend could be attributed to increased competition or changes in consumer preferences within the Pre-Roll segment. Despite these challenges, the fact that Goldkine maintained a presence in the top 20 throughout this period is indicative of a resilient brand, though it highlights areas for potential improvement in maintaining or enhancing their market share in this category.

Competitive Landscape

In the competitive landscape of the Michigan flower category, Goldkine has demonstrated a remarkable upward trajectory in recent months. Initially ranked 35th in November 2025, Goldkine made a significant leap to 12th place by December 2025, maintaining this position through February 2026. This ascent is particularly notable when compared to competitors like Redemption, which experienced a decline from 7th to 13th place over the same period. Meanwhile, Hytek showed a steady climb, reaching 11th place by February 2026, just one spot ahead of Goldkine. Despite this, Goldkine's consistent rank at 12th suggests a stabilization in their market presence, contrasting with Heavyweight Heads, which fluctuated but ultimately improved to 14th place. Grip remained a strong competitor, advancing to 10th place. Goldkine's strategic positioning and sales momentum indicate a promising potential to further challenge these established brands in the Michigan flower market.

Notable Products

In February 2026, Rock N Rye Gelato Smalls (14g) emerged as the top-performing product for Goldkine, climbing from the fifth position in January to first place with sales reaching 3,635 units. Jah Magic (3.5g) secured the second spot, marking its first appearance in the rankings. Pear-Fection Live Resin Infused Pre-Roll (1g) debuted at the third position, showcasing strong performance in the Pre-Roll category. Orange Creamsicle Infused Pre-Roll (1g) moved up to fourth place from its previous absence in January, while Lemon Headz Smalls (14g) rounded out the top five, dropping from its third-place ranking in December. These shifts highlight a dynamic change in consumer preferences within Goldkine's product lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.