Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

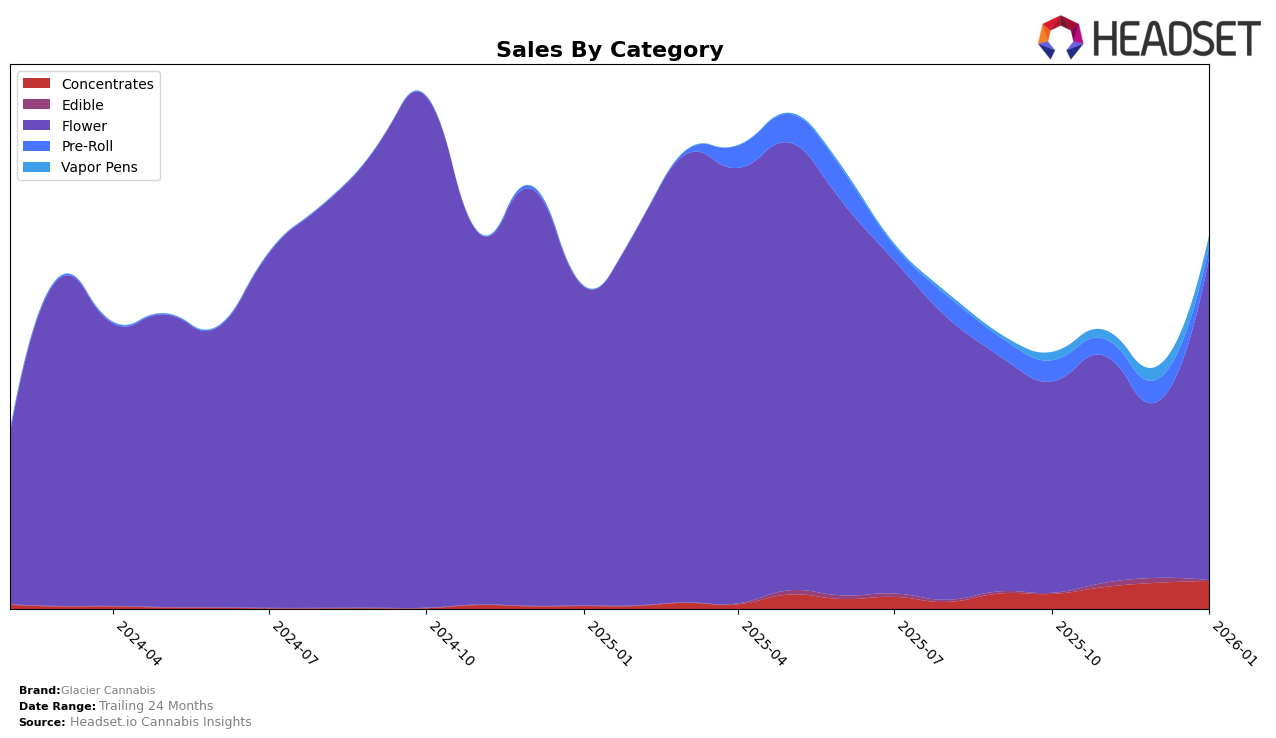

Glacier Cannabis has shown notable progress in the Michigan market, particularly in the Concentrates category. Over the span from October 2025 to January 2026, the brand climbed from being ranked 76th to 43rd. This upward trajectory is indicative of a positive reception and increased consumer demand for their concentrates products. The sales figures mirror this trend, with a consistent increase in sales each month, culminating in a notable January performance. However, in the Vapor Pens category, Glacier Cannabis was absent from the top 30 rankings until January 2026, where they entered at the 99th position, suggesting room for growth and an opportunity to capture more market share in this category.

In the Flower category, Glacier Cannabis has experienced fluctuations in its ranking within Michigan. The brand maintained a steady 38th position in October and November 2025 but faced a setback in December, dropping to 50th. Interestingly, by January 2026, they made a significant leap to the 19th position, which reflects a strong recovery and possibly strategic adjustments in their offerings or distribution. The sales data supports this improvement, marking a substantial increase in January. Despite these gains, the absence of Glacier Cannabis from the top 30 in certain months highlights areas where the brand could enhance its competitive edge and market penetration.

Competitive Landscape

In the competitive landscape of the Michigan flower category, Glacier Cannabis has experienced notable fluctuations in its ranking and sales over the past few months. Starting from a rank of 38 in October 2025, Glacier Cannabis maintained this position in November, but dropped to 50 in December, indicating a period of struggle. However, by January 2026, the brand made a significant leap to rank 19, suggesting a strong recovery and potential strategic adjustments. In contrast, competitors like Heavyweight Heads and Muha Meds consistently held higher ranks, with Muha Meds maintaining a top 20 position throughout the period. Despite this, Glacier Cannabis's January sales surged, surpassing those of Heavyweight Heads and nearing the figures of Zones, which suggests a positive trend and growing consumer interest. This dynamic shift highlights the importance of strategic marketing and product differentiation for Glacier Cannabis to sustain its upward momentum in the competitive Michigan market.

Notable Products

In January 2026, Glacier Cannabis saw its top-performing product being Blast Chiller (Bulk) from the Flower category, achieving the highest sales with 8016 units sold. Following closely, Freezer Jam (3.5g) and Freezer Jam (1g), both also from the Flower category, secured the second and third ranks respectively. Glacier Breath (Bulk) maintained a strong presence by ranking fourth, while Ice Runtz Live Resin (1g) was the top-performing concentrate, landing in fifth place. Compared to previous months, these products have consistently climbed the ranks, indicating a growing consumer preference for these particular Flower and Concentrate products. This upward trend suggests a successful market penetration and increasing brand loyalty for these offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.