Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

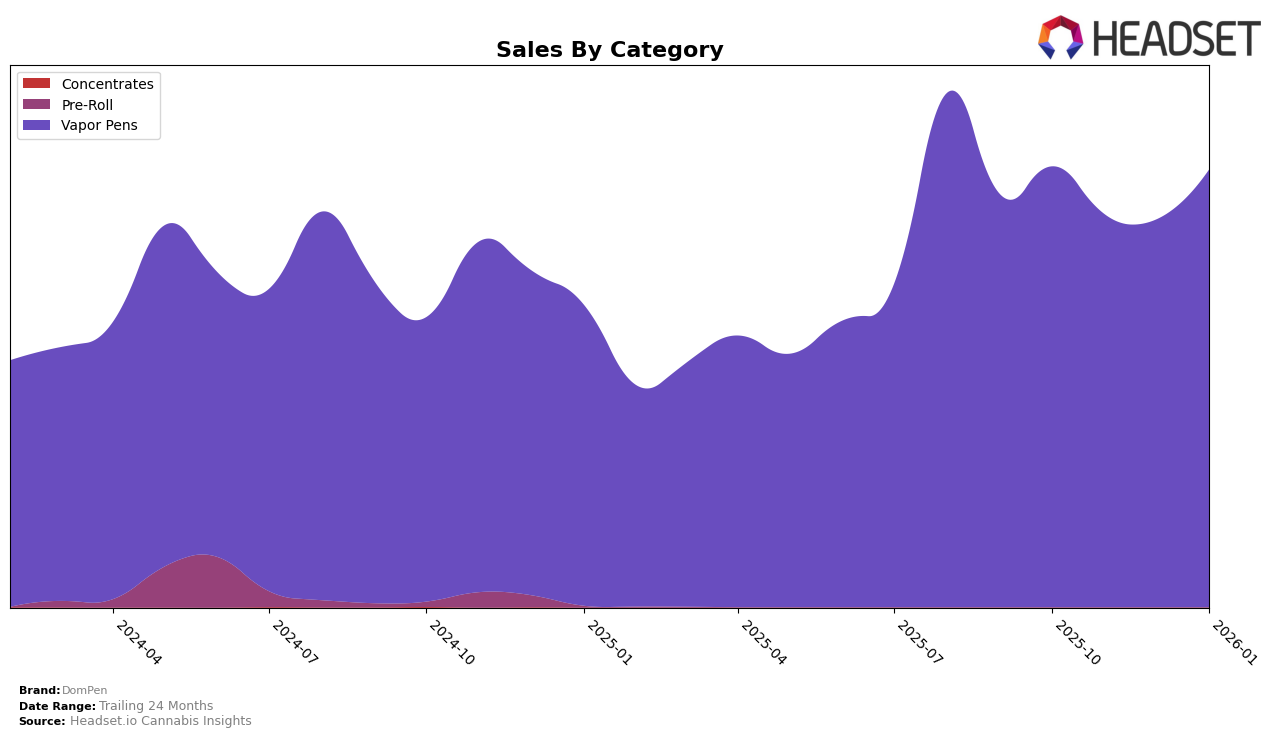

DomPen has shown varied performance across different states and categories, particularly in the Vapor Pens category. In California, the brand has seen a gradual improvement in its ranking, moving from 57th in October 2025 to 48th by January 2026. This upward trend is accompanied by a noticeable increase in sales, indicating a strengthening presence in the market. Conversely, in Massachusetts, DomPen's rankings have plummeted, falling out of the top 30 by January 2026 after being ranked 74th in October 2025. This decline suggests challenges in maintaining market share in Massachusetts, despite the overall growth in other states.

In Maryland, DomPen has maintained a relatively stable position, fluctuating slightly but remaining within the top 30 throughout the observed period. Their consistent ranking, coupled with steady sales figures, reflects a stable foothold in this market. Meanwhile, in New York, DomPen entered the rankings at 77th in January 2026, indicating a new or renewed effort to capture market share in this state. In Ohio, the brand has experienced some volatility, with rankings oscillating between 51st and 61st, suggesting a competitive landscape. The data reveals both opportunities and challenges for DomPen, with certain states showing promising growth while others highlight areas for potential improvement.

Competitive Landscape

In the competitive landscape of vapor pens in California, DomPen has shown a promising upward trajectory in recent months. From October 2025 to January 2026, DomPen improved its rank from 57th to 48th, indicating a positive shift in market presence. This rise is particularly noteworthy when compared to competitors like 710 Labs, which consistently ranked lower, and Eureka, which maintained a steady but lower rank. DomPen's sales also reflect this upward trend, with a significant increase from October to January, surpassing the sales of Kushy Punch in the latter months. Meanwhile, Boutiq has also been a strong contender, showing a rise in rank and sales, but DomPen's consistent improvement in rank suggests a strengthening brand position in the California vapor pen market.

Notable Products

For January 2026, DomPen's top-performing product is the Classic King Louis XIII Live Resin Disposable (1g) in the Vapor Pens category, which rose to the first rank with notable sales of 1214 units. The California Citrus Distillate Disposable (1g) followed closely, climbing to the second position from fifth in December 2025. Pineapple Coast Distillate Cartridge (1g) secured the third rank, showing a consistent presence in the top ranks after previously holding the second spot in November 2025. Pineapple Coast Distillate Disposable (1g) experienced a drop to fourth place from its previous top rank in December 2025. Blue Dream Live Resin Disposable (1g) rounded out the top five, having slipped from a third-place ranking in the previous month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.