Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

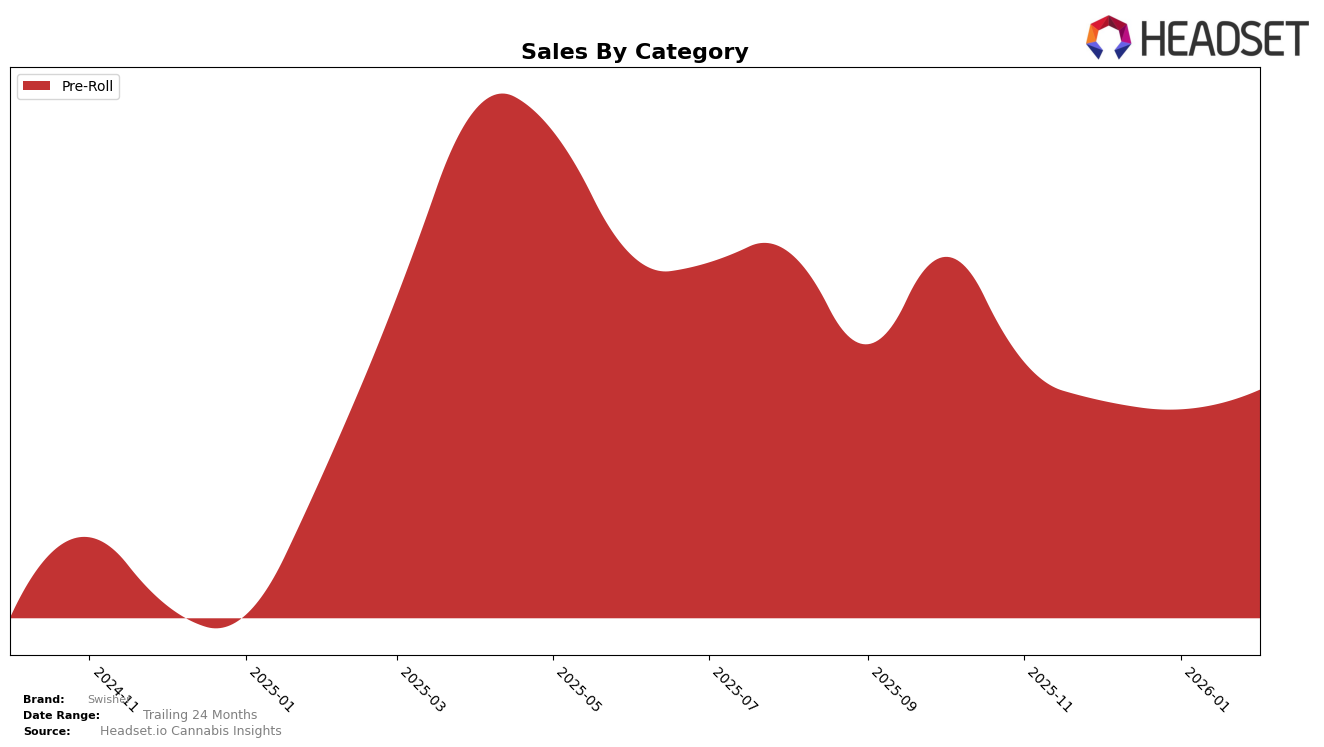

Swisher has shown a notable upward trend in the pre-roll category in Michigan. Over the span from November 2025 to February 2026, Swisher improved its ranking from 18th to 14th. This steady climb suggests a growing preference for Swisher's offerings in this category, despite a slight dip in sales during December 2025 and January 2026. The February rebound in sales indicates a potential recovery or strategic adjustment that resonated well with consumers. This movement within the top 20 highlights Swisher's resilience and ability to capture market share in a competitive landscape.

In contrast, the absence of Swisher from the top 30 brands in other states or categories during the same period could be seen as a challenge. While the brand is making headway in Michigan, it appears that similar traction has not been achieved elsewhere. This disparity may point to regional preferences or strategic focus areas that are yet to be optimized. Understanding these dynamics is crucial for Swisher as it seeks to expand its footprint and enhance its brand presence across different markets.

```Competitive Landscape

In the competitive landscape of the Pre-Roll category in Michigan, Swisher has shown a steady improvement in its ranking, moving from 18th in November 2025 to 14th by February 2026. This upward trend indicates a positive reception in the market, despite facing stiff competition. Notably, Mischief consistently outperformed Swisher, maintaining a strong position at 12th place in both January and February 2026, with a significant sales increase during this period. Meanwhile, Seed Junky Genetics also improved its standing, climbing from 20th to 15th, yet Swisher managed to surpass them by February. Play Cannabis held a stable position slightly above Swisher, indicating a competitive but achievable target for Swisher to aim for in the coming months. The data suggests that while Swisher is gaining ground, there is still room for growth to catch up with the leading brands in Michigan's Pre-Roll market.

Notable Products

For February 2026, Swisher's top-performing product was the Classic Grape Infused Blunt (1.5g), maintaining its position as the number one ranked product from the previous month with sales reaching 2773 units. The Peach Mango Infused Blunt (1.5g) held steady at the second position, despite a decrease in sales from January. The Strawberry Kiss Infused Blunt (1.5g) emerged as a notable contender, securing the third rank for the first time. Blueberry Pie Infused Blunt (1.5g) dropped to fourth place after leading in January, while the Irish Cream Infused Blunt (1.5g) entered the rankings at fifth place. These shifts indicate a dynamic market where consumer preferences continue to evolve.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.