Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

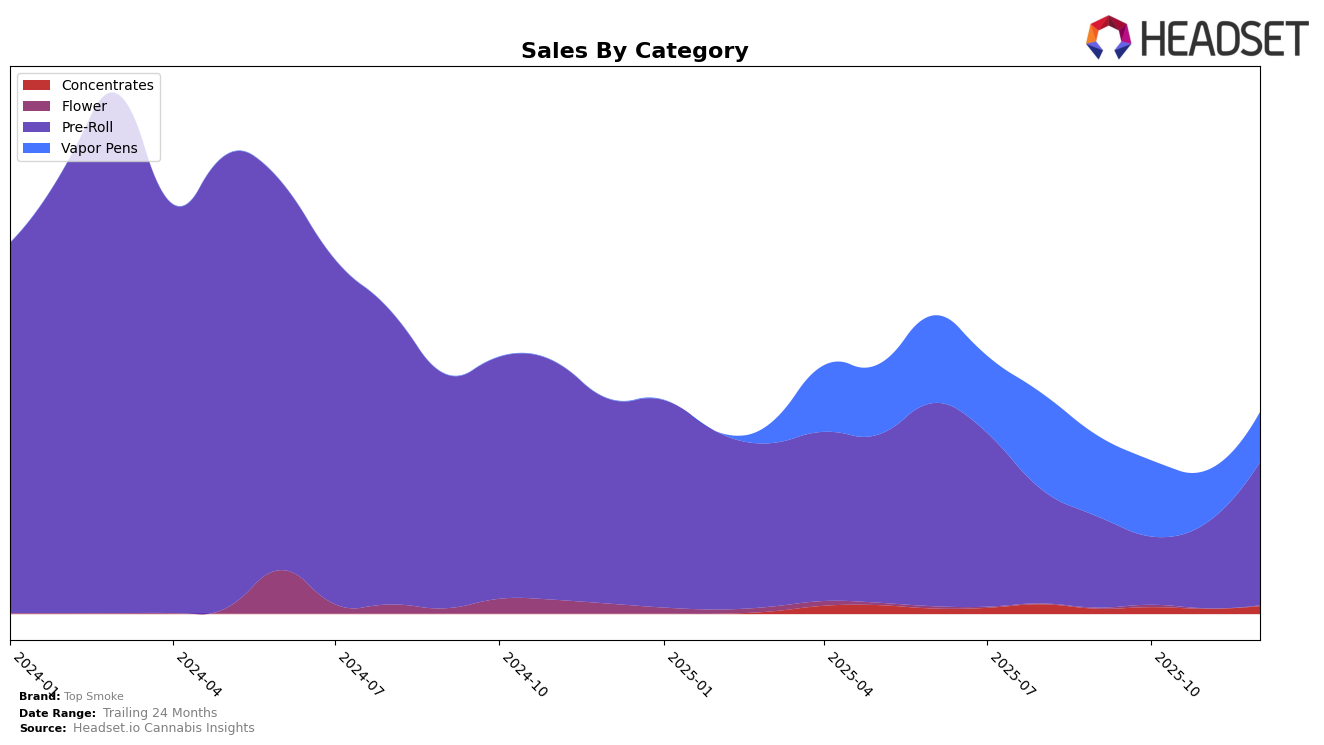

In the state of Michigan, Top Smoke has shown a notable improvement in the Pre-Roll category. Starting from a rank of 50 in September 2025, the brand climbed to 29th place by December 2025. This upward trajectory is indicative of a strong performance in this category, especially considering the significant sales increase from October to December, where sales nearly doubled. However, the Vapor Pens category tells a different story. Top Smoke's rank in this category dropped from 46 in September to 65 by December, indicating a decline in competitive standing. This suggests that while Top Smoke is gaining traction in Pre-Rolls, it faces challenges in maintaining its position in the Vapor Pens market.

Top Smoke's varied performance across categories in Michigan highlights the dynamic nature of the cannabis market. The brand's absence from the top 30 in the Vapor Pens category, despite being present in Pre-Rolls, could be seen as a strategic gap or an area for potential growth. The disparity in rankings suggests that Top Smoke may need to reassess its approach in the Vapor Pens segment to enhance its market presence. Conversely, the improvement in Pre-Rolls could be leveraged as a strength to bolster overall brand visibility and consumer loyalty within the state.

Competitive Landscape

In the competitive landscape of the Michigan pre-roll market, Top Smoke has demonstrated a notable recovery in its rank from September to December 2025. Initially positioned at 50th in September and slipping to 64th in October, Top Smoke made a significant leap to 29th by December. This recovery is particularly impressive given the consistent performance of competitors such as Road Trip, which maintained a top 20 position until December, when it dropped to 30th. Meanwhile, Peninsula Cannabis and Redemption experienced fluctuations, with Peninsula Cannabis peaking at 24th in November before falling to 27th in December, and Redemption dropping from 22nd in September to 28th by December. Giggles maintained a relatively stable position, ending the year at 31st. Despite lower sales figures compared to these competitors, Top Smoke's upward trajectory in rank suggests effective strategic adjustments, potentially positioning it for further growth in the coming months.

Notable Products

In December 2025, Top Smoke's top-performing product was Go Kartz - Gelato 33 Distillate Cartridge (1g) in the Vapor Pens category, which climbed to the number one rank with sales of 3,446 units. The Go Kartz - Guava Distillate Cartridge (1g) held steady at the second position, showing a slight decrease in sales compared to previous months. Go Kartz - Tropicana Cookies Distillate Cartridge (1g) dropped to third place after leading in November. Zkittles Pre-Roll (1g) moved up to the fourth rank, indicating a consistent demand in the Pre-Roll category. Go Kartz - OG Kush Distillate Cartridge (1g) re-entered the top five, showcasing a resurgence in popularity despite fluctuating rankings in previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.