Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

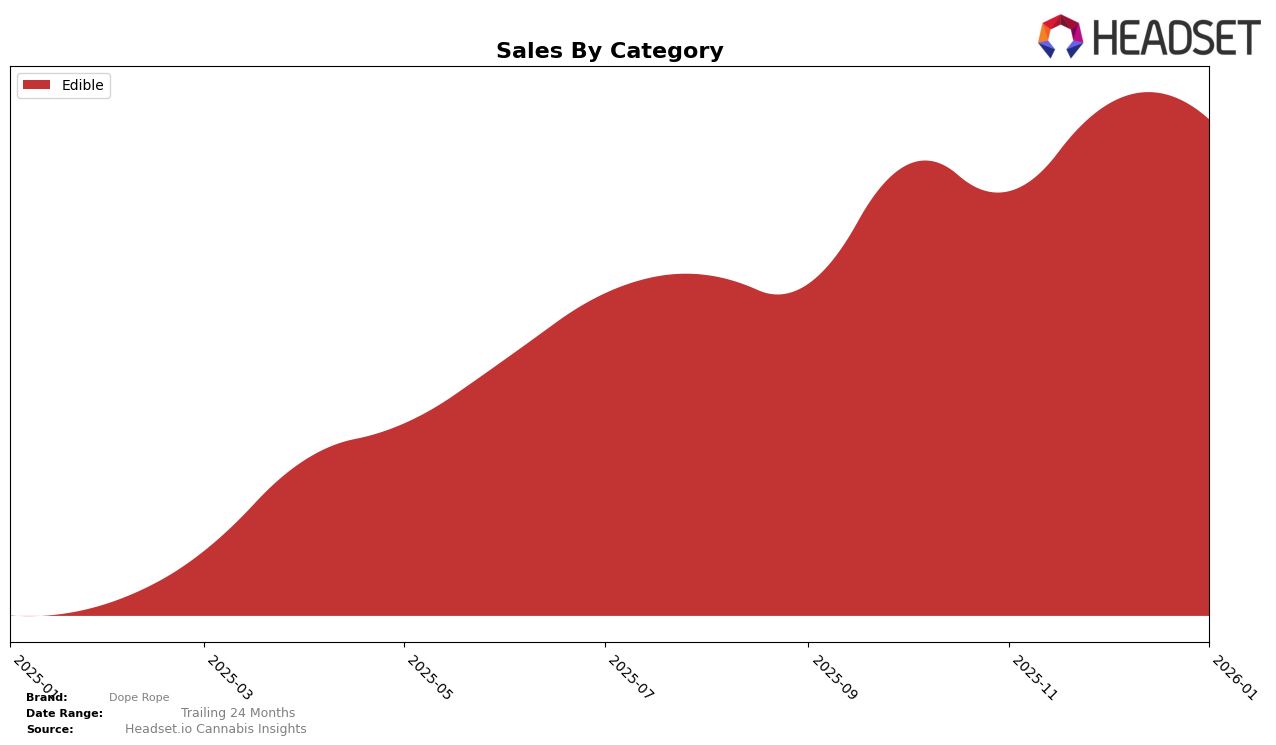

In the state of Michigan, Dope Rope has shown a steady upward trend in the Edible category rankings over the past few months. Starting from a rank of 17 in October 2025, the brand has climbed to 13 by January 2026. This consistent improvement indicates a growing popularity and possibly an effective strategy in capturing market share within Michigan's competitive edibles market. The sales trajectory also supports this upward movement, with a notable increase from November to December, followed by a slight decrease in January, which still kept them in a strong position.

However, it's interesting to note that Dope Rope's presence in other states or provinces is not highlighted, suggesting that their impact might be limited to specific regions or categories. The absence of rankings in other states can be interpreted as a potential area of growth or an indication of challenges they face outside of Michigan. This information can be crucial for stakeholders looking to understand the brand's regional strengths and potential areas for expansion or improvement. The data suggests that while Dope Rope is making significant strides in Michigan, there is room for growth in other markets.

Competitive Landscape

In the Michigan edibles market, Dope Rope has shown a promising upward trajectory in rankings from October 2025 to January 2026, moving from 17th to 13th place. This improvement is noteworthy, especially when compared to competitors like Cannalicious Labs, which saw a decline from 12th to 15th place, and Banned Cannabis Edible Co., which fluctuated but ended up at 14th. Meanwhile, Rocket (MI) consistently outperformed Dope Rope, maintaining a higher rank, peaking at 12th in January 2026. Despite this, Dope Rope's sales have shown resilience, with a notable increase in December 2025, indicating a potential for further growth. This upward trend in rank and sales suggests that Dope Rope is gaining traction in the competitive Michigan edibles market, positioning itself as a brand to watch.

Notable Products

In January 2026, Totally Razz Gummy Rope (200mg) maintained its position as the top-performing product for Dope Rope, with sales reaching 26,877 units. Cherry Fizz Gummy Rope (200mg) consistently held the second spot, although its sales slightly decreased from December 2025. Maui Mango Gummy Rope (200mg) remained steady in third place throughout the observed months, showing consistent performance. Sour Apple Smash Gummy Rope (200mg) improved its ranking to fourth place from fifth in the previous months, indicating a growing popularity. Meanwhile, Grape Trip Gummy Rope (200mg) experienced a drop in sales, resulting in a decrease in its rank from fourth to fifth place in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.