Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

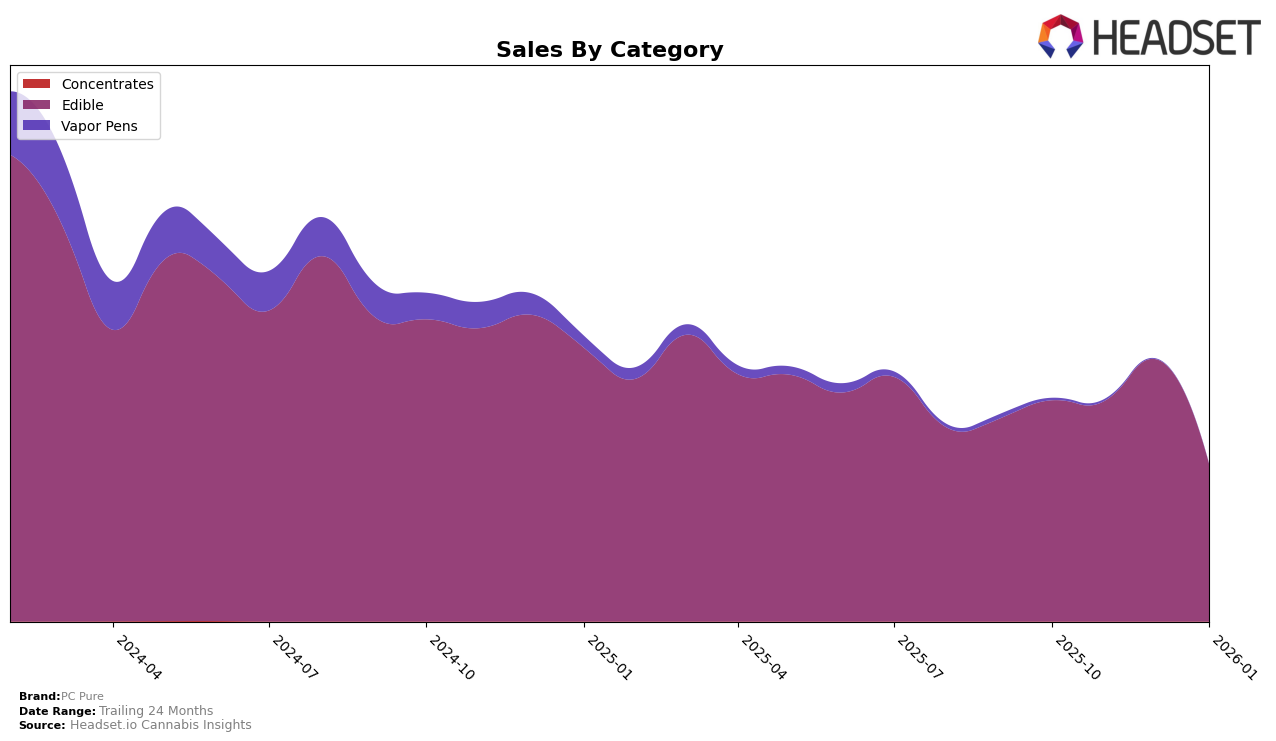

In the state of Michigan, PC Pure has shown a fluctuating performance in the Edible category over the recent months. Starting in October 2025, the brand was ranked 21st, showing a slight improvement to 20th in November. By December, PC Pure climbed further up the ranks to 18th, indicating a positive trend in consumer preference or market penetration. However, this upward trajectory took a downturn in January 2026, when the brand fell to the 26th position, suggesting potential challenges in maintaining market share or responding to competitive pressures. This decline is particularly noteworthy as it indicates that PC Pure did not maintain its position within the top 20, highlighting a significant shift in market dynamics or internal brand strategy during this period.

Sales figures for PC Pure in Michigan reflect these ranking changes, with a notable peak in December 2025. Although specific sales numbers are not disclosed for all months, the December peak suggests a successful marketing campaign or seasonal demand that was not sustained into January. The drop in rank and sales in January could be due to various factors, such as increased competition or changes in consumer preferences post-holiday season. It is crucial for PC Pure to analyze these trends and adapt accordingly to regain its position and continue its growth in the Edible category. Observing these movements provides valuable insights into the brand's performance and strategic opportunities within the Michigan market.

Competitive Landscape

In the competitive landscape of the Michigan edible cannabis market, PC Pure has experienced notable fluctuations in its rank and sales performance over the past few months. Starting in October 2025, PC Pure held the 21st position, improving to 18th by December, before dropping to 26th in January 2026. This trajectory indicates a temporary surge in popularity during the holiday season, followed by a decline. In contrast, Dixie Elixirs maintained a consistent presence in the top 20 until January, when it fell out of the top rankings, suggesting a similar seasonal impact. Meanwhile, Platinum Vape and Magic Edibles have shown steady performance, with Platinum Vape consistently improving its rank from 30th to 25th, and Magic Edibles maintaining a stable position around the mid-20s. Petra also saw a decline, moving from 22nd to 28th, which mirrors the trend seen with PC Pure. These dynamics highlight the competitive pressures and the importance of strategic marketing efforts to sustain and improve PC Pure's market position in Michigan's edible category.

Notable Products

In January 2026, PC Pure's top-performing product was Tropical Breeze Gummies 10-Pack (200mg), which climbed to the number one spot from fourth place in December 2025, with notable sales of 4,432 units. Michigan Cherry Gummies 20-Pack (200mg) maintained its second-place ranking, though experiencing a decline in sales from December. Sativa Strawberry Kiwi Vegan Gummies 10-Pack (200mg) dropped from first place in December to third place in January, indicating a shift in consumer preference. Hybrid Strawberry Lemonade Gummies 20-Pack (200mg) made its debut on the rankings, securing the fourth position. Blueberry Cheesecake RSO Gummies 10-Pack (200mg) followed closely behind in fifth place, showing a strong entry into the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.