Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

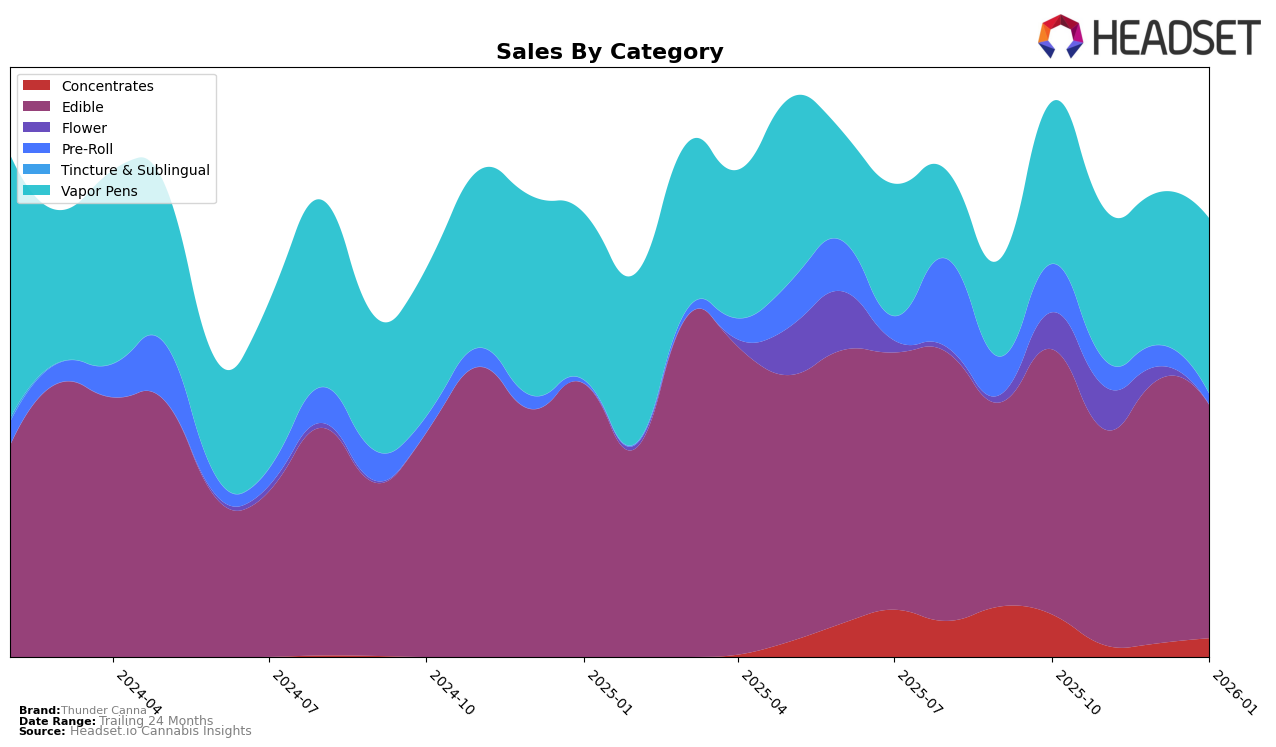

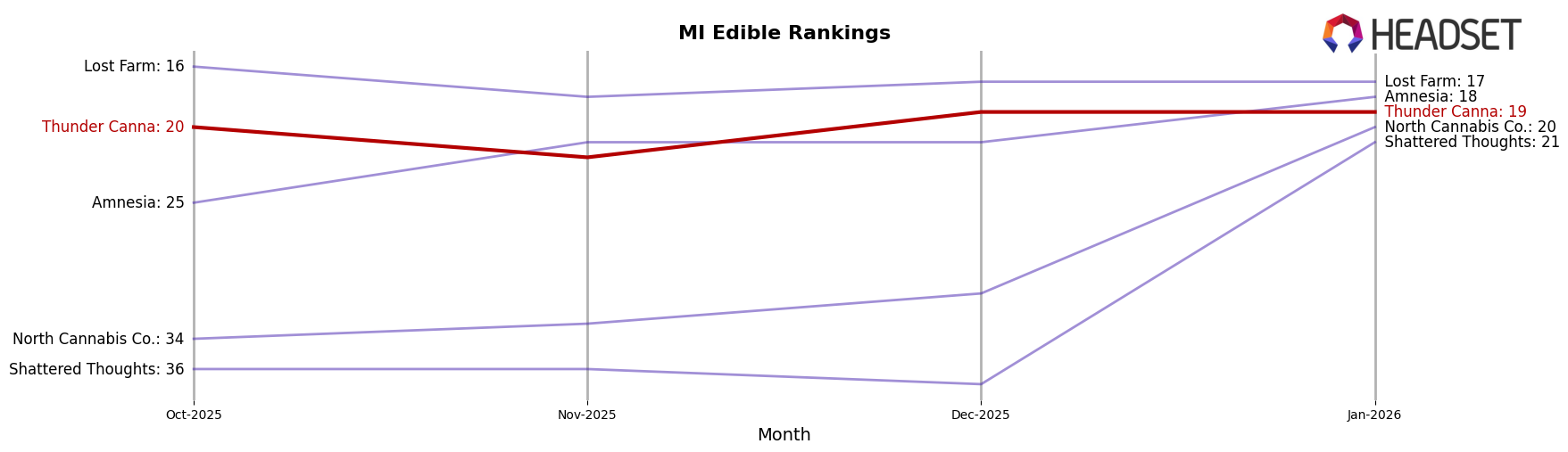

Thunder Canna's performance in the Michigan market presents a mixed bag across different product categories. In the Edibles category, Thunder Canna has maintained a relatively stable position, hovering around the 19th to 22nd rank from October 2025 to January 2026. This consistency suggests a solid consumer base and steady demand for their edible products. However, in the Concentrates category, Thunder Canna did not make it into the top 30 ranks for three consecutive months, only reappearing at rank 85 in January 2026, indicating potential challenges in gaining traction or increased competition in this segment.

In the Vapor Pens category, Thunder Canna shows a promising upward trend. Starting at the 40th position in October 2025, the brand improved its rank to 34th by January 2026. This movement could reflect a growing consumer preference for their vapor pen products or effective strategic adjustments in this category. Despite the positive trajectory in Vapor Pens, the absence from the top 30 in Concentrates suggests that Thunder Canna might need to reassess its strategies in certain areas to enhance its market presence and competitiveness across all categories.

Competitive Landscape

In the competitive landscape of Michigan's edible cannabis market, Thunder Canna has shown resilience, maintaining a consistent rank of 19th in December 2025 and January 2026, despite facing stiff competition. Notably, Amnesia has improved its position from 25th in October 2025 to 18th by January 2026, reflecting a positive sales trajectory that could pose a challenge to Thunder Canna's market share. Meanwhile, Lost Farm has held a steady rank at 17th, indicating stable performance, though its sales have seen a decline, which may provide an opportunity for Thunder Canna to close the gap. On the other hand, brands like North Cannabis Co. and Shattered Thoughts have made significant strides, moving into the top 20 by January 2026, suggesting an increasingly competitive environment. For Thunder Canna, maintaining its current position will require strategic marketing efforts to counteract the upward momentum of these emerging competitors.

Notable Products

In January 2026, Pink Grapefruit Gummies 4-Pack (200mg) emerged as the top-performing product for Thunder Canna, achieving the number one rank with sales of 24,186 units. Wonderful Watermelon Gummies 4-Pack (200mg) made a notable debut at the second position, indicating strong consumer interest. Classic Cherry Gummies 4-Pack (200mg) experienced a slight drop to the third position from being the top seller in December 2025. Magnificent Mango Gummies 4-Pack (200mg) maintained a consistent presence, ranking fourth, similar to its performance in October 2025. Indica Groovy Grape Gummies 4-Pack (200mg) saw a decline from its previous top positions, settling at fifth place in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.