Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

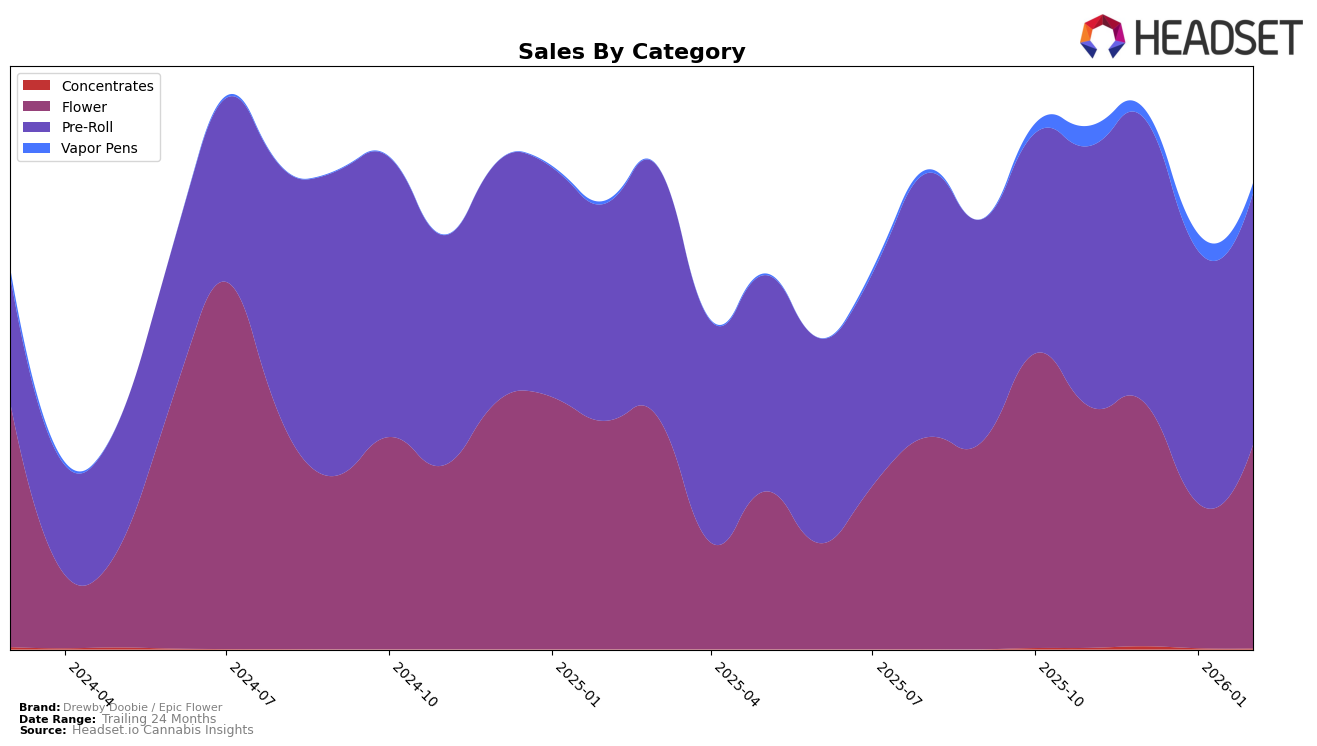

In the Oregon market, Drewby Doobie / Epic Flower has shown varied performance across different product categories. In the Flower category, the brand's ranking has fluctuated, starting at 33rd in November 2025, dropping out of the top 30 in January 2026, and then recovering back to 33rd by February 2026. This suggests some volatility in their Flower sales, possibly due to seasonal demand or competitive pressures. In contrast, the brand has maintained a relatively stable presence in the Pre-Roll category, consistently ranking in the top 20, with a slight improvement from 18th in November 2025 to 16th in February 2026. This stability in Pre-Rolls indicates a strong market position and consumer preference for their products in this category.

The performance of Drewby Doobie / Epic Flower in the Vapor Pens category in Oregon appears to be less robust. The brand was ranked 81st in November 2025 and 86th in January 2026, with no ranking in December 2025 and February 2026, indicating they fell out of the top 30 during these months. This could point to challenges in capturing market share in the Vapor Pens segment, which might be due to increased competition or a need for product innovation. Despite these challenges, the overall sales trends in other categories suggest that Drewby Doobie / Epic Flower has a diverse product portfolio that helps maintain its market presence, although there is room for growth in certain areas.

Competitive Landscape

In the competitive landscape of the Oregon pre-roll category, Drewby Doobie / Epic Flower has shown resilience and adaptability despite fluctuating ranks over recent months. From November 2025 to February 2026, Drewby Doobie / Epic Flower's rank improved from 18th to 16th, indicating a positive trend amidst fierce competition. Notably, Cabana consistently outperformed Drewby Doobie / Epic Flower, maintaining a higher rank and experiencing robust sales, particularly in December 2025. Meanwhile, Entourage Cannabis / CBDiscovery experienced a decline in February 2026, dropping to 15th, which may present an opportunity for Drewby Doobie / Epic Flower to capture additional market share. Although Feel Goods also saw a decline, Drewby Doobie / Epic Flower's steady sales figures suggest a stable customer base that could be leveraged to improve its competitive position further. Overall, while Drewby Doobie / Epic Flower faces strong competition, its upward trajectory in rank suggests potential for growth in the Oregon pre-roll market.

Notable Products

In February 2026, Drewby Doobie / Epic Flower's top-performing product was Cherry Dosi Pre-Roll 10-Pack (5g), which rose to the number one spot with impressive sales of 1620 units, marking a significant leap from its fourth-place ranking in November 2025. Supreme Lee Hi Pre-Roll 10-Pack (5g) maintained a strong presence, holding steady at the second position, consistent with its ranking from December 2025. Tropicanna Cherries Pre-Roll 10-Pack (5g) entered the rankings at third place, highlighting its growing popularity. Lizard Burger Pre-Roll 10-Pack (5g) debuted in fourth place, showing a promising start. Cherry Dosi (Bulk) rounded out the top five, indicating a solid demand for bulk flower products from Drewby Doobie / Epic Flower.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.