Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

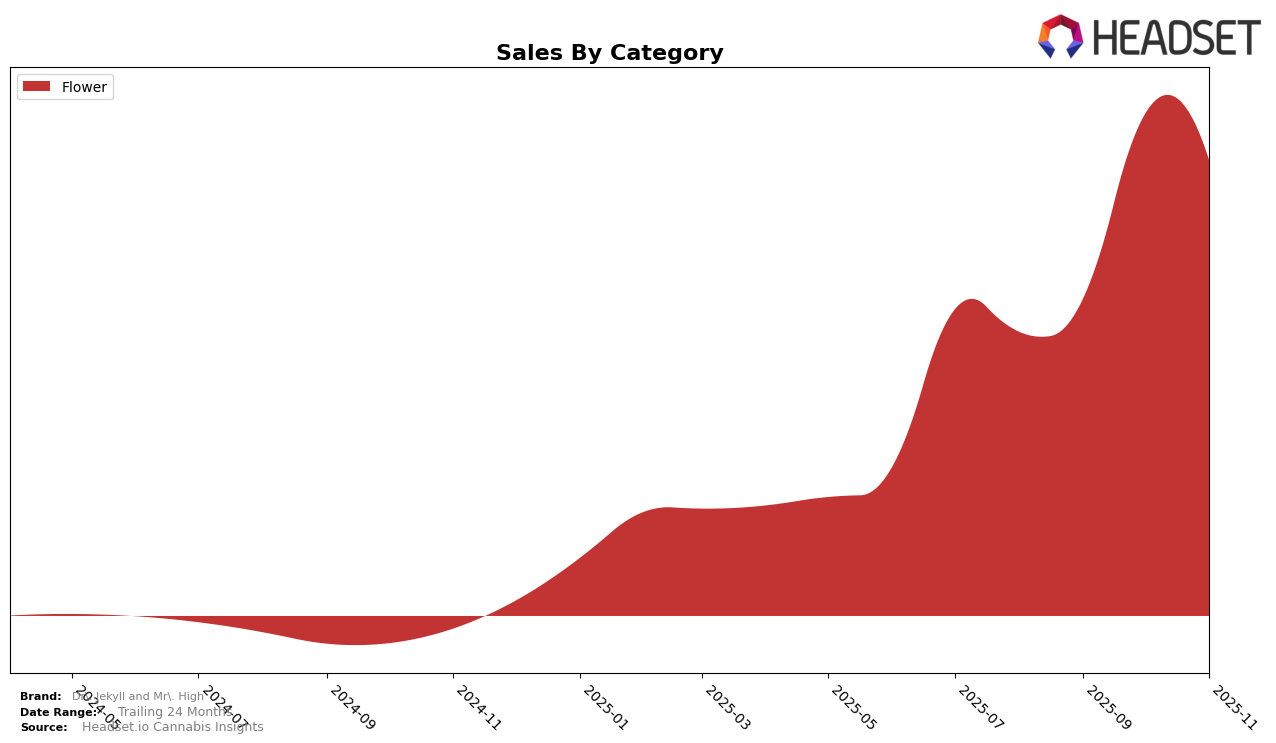

Dr. Jekyll and Mr. High has shown a notable upward trajectory in the New York market, particularly in the Flower category. In August 2025, the brand was ranked 47th, but it managed to climb into the top 30 by October, reaching the 29th position. This upward movement indicates a growing consumer interest and acceptance, which is further supported by a significant increase in sales from August to October. However, there was a slight dip in November, with the brand slipping to the 30th position. Despite this small decline, maintaining a top 30 position suggests sustained consumer interest and market presence.

While Dr. Jekyll and Mr. High has made strides in New York, the absence of rankings in other states or provinces indicates potential areas for growth and expansion. The brand's ability to break into the top 30 in New York's competitive Flower category is a positive sign, but the lack of similar rankings elsewhere highlights the need for strategic market penetration. This could be an opportunity for the brand to evaluate its current strategies and explore new markets or categories where it could replicate its success in New York. The brand's performance in New York could serve as a model for expansion efforts in other regions.

Competitive Landscape

In the competitive landscape of the Flower category in New York, Dr. Jekyll and Mr. High has shown a notable upward trajectory in its market position. Starting from a rank of 47 in August 2025, the brand improved significantly to reach rank 29 by October, before slightly dropping to 30 in November. This upward movement is indicative of a robust growth strategy, especially when compared to competitors such as Heady Tree, which maintained a relatively stable but lower rank, hovering around 32 to 34 during the same period. Meanwhile, Spacebuds Moonrocks consistently outperformed Dr. Jekyll and Mr. High, maintaining a rank in the mid to high 20s, suggesting a strong brand presence. However, the significant sales increase for Dr. Jekyll and Mr. High from September to October indicates a successful campaign or product launch that could potentially challenge these competitors if sustained. Brands like Hepworth, which saw a decline in rank from 20 to 28 in November, highlight the volatility and competitive nature of the market, emphasizing the importance of strategic positioning for Dr. Jekyll and Mr. High to capitalize on its recent momentum.

Notable Products

In November 2025, Gorilla Glue (3.5g) retained its position as the top-performing product for Dr. Jekyll and Mr. High, with sales reaching 1571 units, maintaining its lead from October. Ice Cream Swirl (3.5g) held steady at the second rank, showing consistent performance since its entry in September. Blueberry Swirl (3.5g) emerged as a strong contender, securing the third spot in November. White Widow (3.5g), which was the top performer in September, fell to fourth place in November, indicating a slight decline in its sales momentum. Mango Kush (3.5g) rounded out the top five, dropping one rank from October, highlighting a competitive market within the Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.