Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

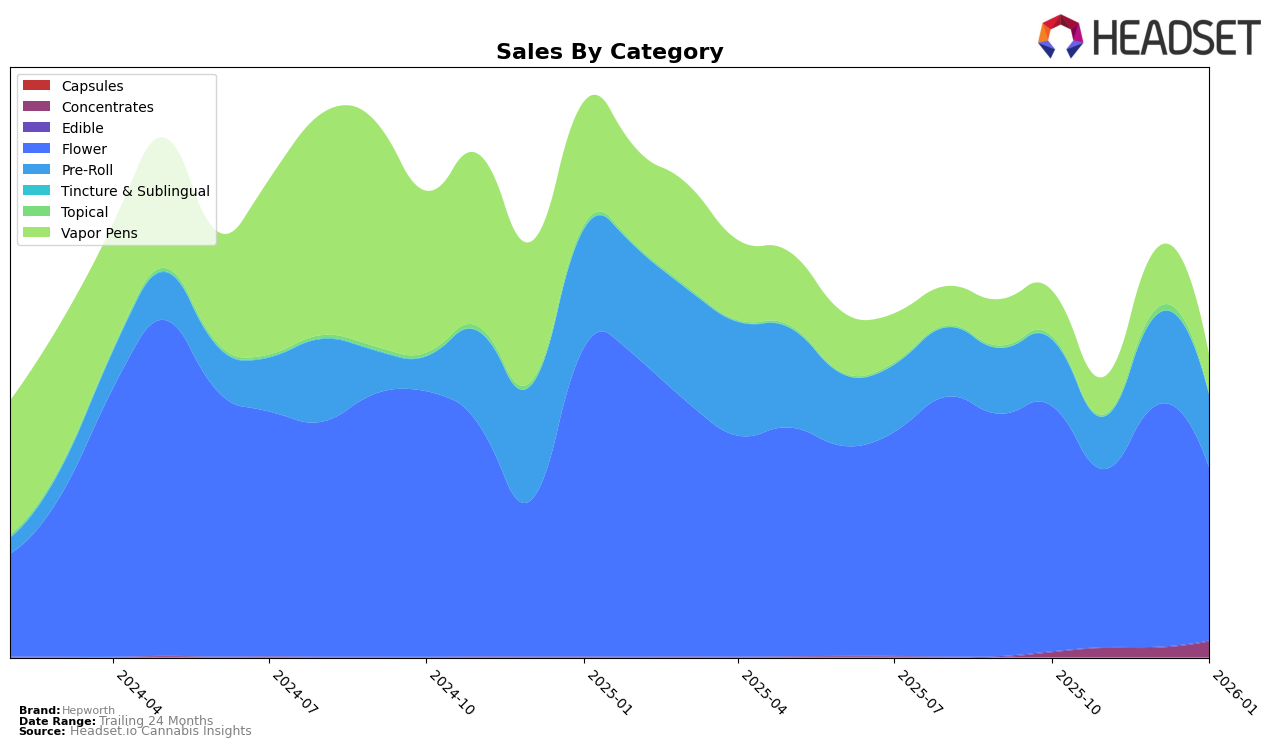

In New York, Hepworth's performance across various cannabis categories has shown notable fluctuations. In the Concentrates category, the brand made a significant jump from not being in the top 30 in October 2025 to securing the 25th position by January 2026. This upward trajectory indicates a growing consumer interest or strategic shifts that have paid off. However, the Flower category tells a different story, where Hepworth's rank slipped from 19th in October 2025 to 33rd by January 2026, suggesting potential challenges in maintaining its competitive edge or changes in market dynamics.

Hepworth's presence in the Pre-Roll category in New York has been relatively stable, with a modest improvement from 48th in October 2025 to 39th in January 2026. This steady climb might reflect a consistent demand or effective marketing strategies. Conversely, in the Vapor Pens category, the brand's ranking remained largely unchanged, hovering around the 50s, which could imply a saturated market or strong competition. Notably, Hepworth's sales in the Flower category saw a decline from October to January, which may be a point of concern for the brand moving forward.

Competitive Landscape

In the competitive landscape of the New York flower category, Hepworth has experienced notable fluctuations in its rank and sales over the past few months. Starting strong in October 2025 with a rank of 19, Hepworth saw a decline to 27 in November before recovering slightly to 22 in December, only to drop again to 33 by January 2026. This volatility is mirrored in its sales, which peaked in October and December but dipped in November and January. In comparison, Jetpacks maintained a more stable presence, consistently ranking in the low 20s before slipping to 32 in January, indicating a potential threat to Hepworth's market share. Meanwhile, 7 SEAZ showed a remarkable recovery from a rank of 60 in December to 30 in January, suggesting a growing competitive edge. Additionally, Old Pal and Dragonfly Cannabis both demonstrated significant rank improvements in January, which could signal increasing competition for Hepworth in the coming months. These dynamics underscore the importance for Hepworth to strategize effectively to maintain and enhance its position in this competitive market.

Notable Products

In January 2026, the top-performing product from Hepworth was Terp Poison (3.5g) in the Flower category, climbing to the number one rank with sales of 2099 units. Durban Poison x Soap (3.5g), also in the Flower category, held steady at the second position despite a notable decrease in sales compared to December 2025. Kush Mintz x Gelato 41 Pre-Roll 5-Pack (2.5g) entered the rankings at the third position, indicating a strong debut. Sour Apple x Lemon Cherry Gelato Ground (7g) and Super Sour Diesel Sauce Cartridge (1g) secured the fourth and fifth positions, respectively, showcasing a diverse range of products in the top five. These rankings reflect a dynamic shift from previous months, with Terp Poison's rise to the top being the most significant change.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.