Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

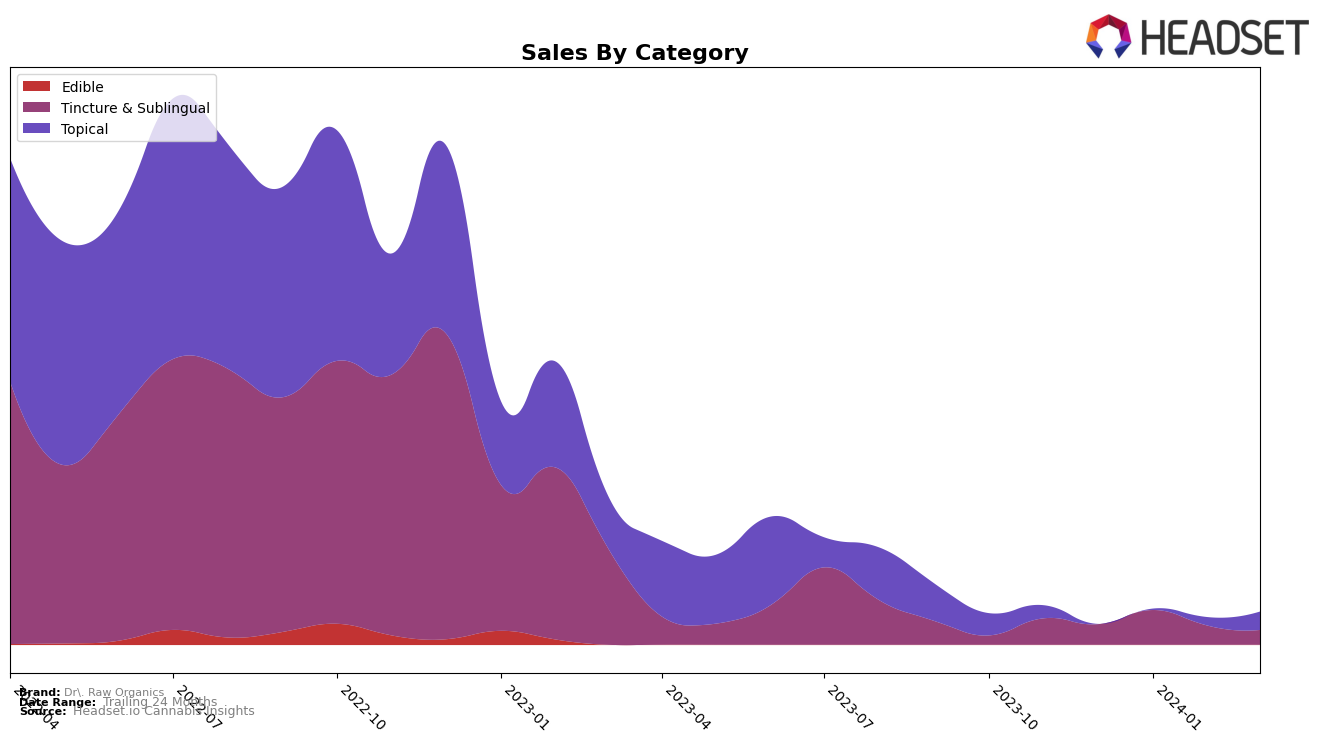

In the competitive landscape of California's cannabis market, Dr. Raw Organics has shown varied performance across different product categories. In the Tincture & Sublingual category, their ranking has seen slight fluctuations from December 2023 to March 2024, moving from the 43rd position in December to 36th in January, then slightly down to 38th in February, and settling at 37th in March. This indicates a struggle to break into the top 30 brands within this category, despite a notable sales jump from December to January. This fluctuation in ranking, coupled with the inability to consistently improve or maintain a higher position, suggests a challenging environment for Dr. Raw Organics in the highly competitive Tincture & Sublingual market segment in California.

On the other hand, the Topical category tells a different story for Dr. Raw Organics, showcasing a positive trajectory in the California market. The brand was not ranked within the top 30 in December 2023, which indicates a lack of significant presence in this category at that time. However, starting January 2024, they made a notable entrance at 24th position and maintained this rank in February, before achieving a slight improvement to 22nd position by March. This upward movement, especially the significant sales increase from 124 units in January to 1947 units in March, highlights a growing consumer interest and acceptance in their Topical products. The entry and subsequent rise in rankings within just a few months reflect a successful strategic push or increased market demand for their offerings in this category.

Competitive Landscape

In the competitive landscape of the topical cannabis category in California, Dr. Raw Organics has shown a notable upward trajectory in terms of rank and sales from January 2024 to March 2024, moving from not being in the top 20 in December 2023 to securing the 22nd position by March 2024. This growth is significant when compared to competitors such as Breez, which did not rank in the top 20 during the same period, and Kind Medicine, which experienced a decline, dropping from the 20th to the 23rd position. Meanwhile, Jade Nectar and Mother Humboldt's have shown fluctuations in their rankings but remained within the top 21, indicating a more stable but less dynamic market presence compared to Dr. Raw Organics. The significant increase in sales for Dr. Raw Organics from January to March 2024 suggests a growing consumer interest and market share within the topical category, positioning it as a brand to watch in the evolving California cannabis market.

Notable Products

In March 2024, Dr. Raw Organics saw the "CBD/THC 1:1 Balance Twist-Up Topical Balm (50mg CBD, 50mg THC, 1.5oz)" from the Topical category rise to the top spot, marking a notable increase in its ranking from third in January to first, with sales hitting 75 units. The "CBD:THC 1:1 Balance Formula Tincture (250mg CBD, 250mg THC,30ml)" from the Tincture & Sublingual category, which consistently held a top position from December 2023 through February 2024, shared the top rank in March, also with 75 units sold. Meanwhile, the "CBD:THC 1:1 Balance Formula Tincture (500mg CBD, 500mg THC, 30ml)" experienced a decline, moving from the leading position in January to second place in March, indicating a change in consumer preference or possibly inventory levels affecting sales. These shifts highlight the dynamic nature of product popularity within Dr. Raw Organics, with the Tincture & Sublingual category showing significant consumer interest. The data suggests a growing demand for balanced CBD:THC formulations, reflecting broader market trends towards products offering a mix of therapeutic benefits.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.