Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

Dream Edibles has shown varying performance across different states and categories. In Arizona, the brand has managed to break into the top 30 rankings for the Edible category, with a consistent upward trajectory from September to December 2025, moving from the 33rd position to the 29th. This indicates a positive trend and growing consumer interest in their products within the state. The brand's sales in Arizona also reflect this upward movement, with a steady increase over the months, highlighting the brand's strengthening presence in the market.

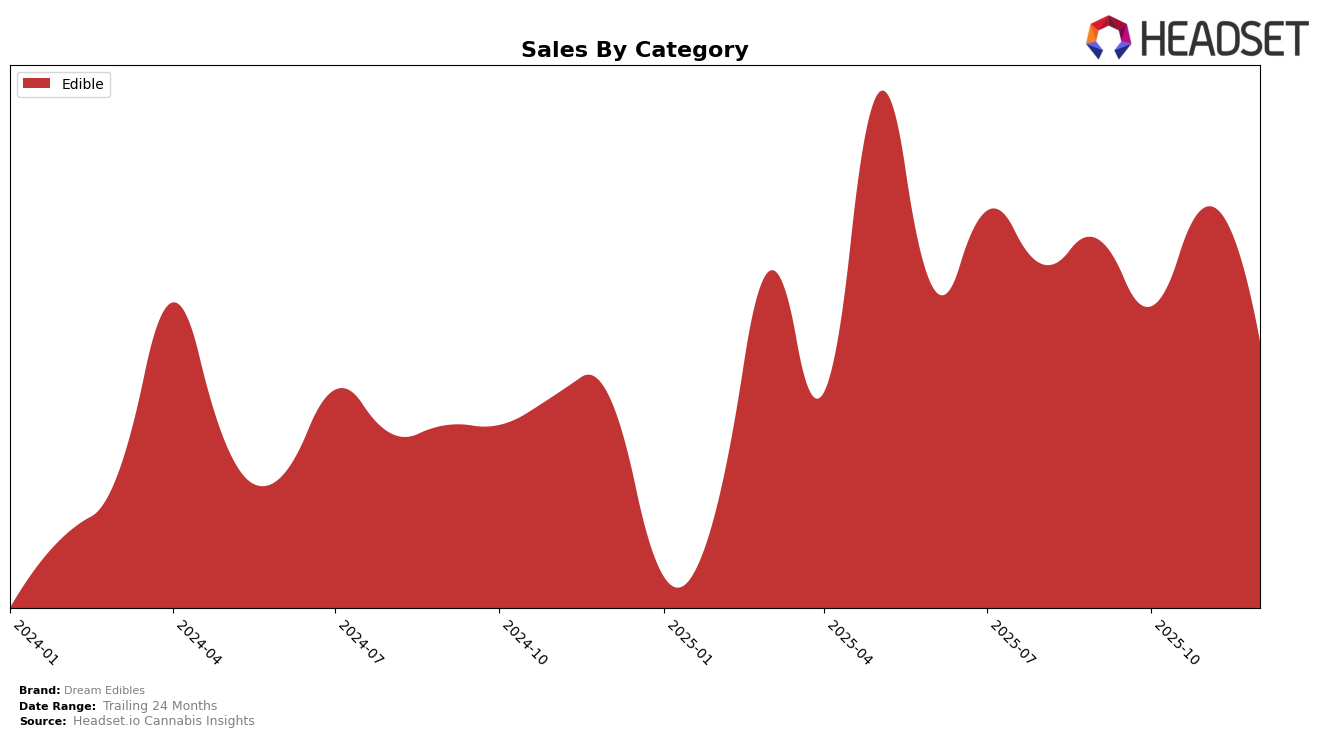

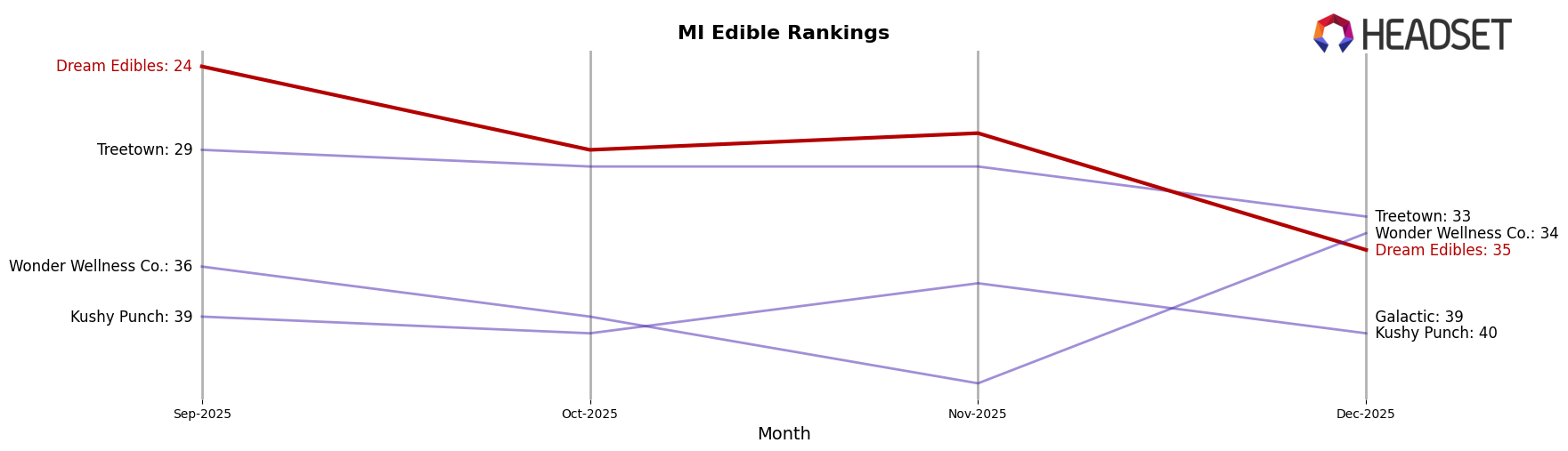

Conversely, in Michigan, Dream Edibles has experienced a slight decline in its ranking within the Edible category, dropping from 24th in September to 35th by December 2025. This downward shift suggests challenges in maintaining market share amidst competitive pressures. Despite this, the brand's sales in Michigan reveal fluctuations, with a notable dip in December, which could be attributed to several market dynamics. The brand's absence from the top 30 in December underscores the need for strategic adjustments to regain traction in the state.

Competitive Landscape

In the competitive landscape of the Michigan edibles market, Dream Edibles has experienced notable fluctuations in its ranking and sales performance from September to December 2025. Initially positioned at 24th in September, Dream Edibles saw a decline to 35th by December, indicating a downward trend in its market standing. This shift is particularly significant when compared to competitors like Treetown, which maintained a relatively stable position, only dropping from 29th to 33rd, and Wonder Wellness Co., which improved its rank from 43rd in November to 34th in December. Meanwhile, Kushy Punch remained consistently lower in the rankings, hovering around the 37th to 40th positions. Despite these challenges, Dream Edibles' sales figures, while declining from $237,478 in September to $190,917 in December, still surpassed those of Kushy Punch and Wonder Wellness Co., suggesting that while rank has dropped, the brand maintains a competitive edge in sales volume. This analysis highlights the importance for Dream Edibles to strategize effectively to regain its higher rank and capitalize on its sales strengths.

Notable Products

In December 2025, the top-performing product for Dream Edibles was Potpots - Dark Chocolate 100-Pack (100mg), which climbed to the number one rank with sales of 5927 units, marking a significant increase from its third-place position in November. Pot Pots - Milk Chocolates 100-Pack (100mg) maintained a strong presence, holding the second rank despite a decline in sales figures compared to previous months. Potdots - Milk Chocolate Bites 10-Pack (10mg) entered the rankings for the first time, securing the third spot. Potpots - Milk Chocolate Sugar Shelled 10-Pack (100mg) dropped from the top position in November to fourth place. Watermelon Pixils 20-Pack (200mg) remained consistently in the fifth position, showing steady performance over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.