Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

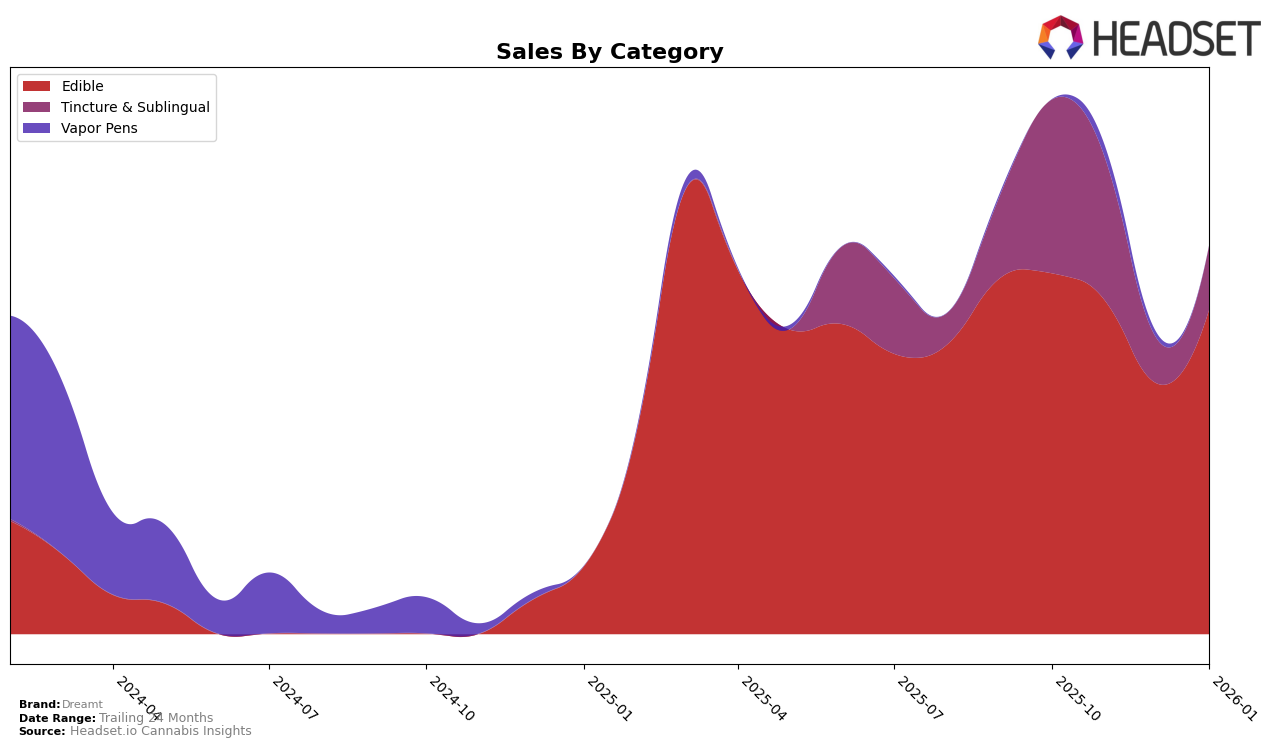

Dreamt's performance in the New Jersey market highlights some intriguing trends over the recent months. In the Edible category, Dreamt hovered around the mid-50s in rankings, with a slight dip in December 2025, where it ranked 58th, before returning to 56th in January 2026. This pattern suggests a relatively stable presence in the market, albeit not breaking into the top 30, which indicates room for growth. Despite the fluctuations, the sales figures show a noticeable increase from October to November, followed by a decrease in December, and a subsequent rise in January, suggesting a potential seasonal influence or promotional impact affecting sales.

In contrast, Dreamt's performance in the Tincture & Sublingual category in New Jersey is more promising, as evidenced by its strong ranking at 5th place in October 2025. However, the absence of further rankings in the following months implies that the brand did not maintain this top-tier position, indicating a potential drop-off in visibility or competition from other brands. The initial sales figures for October were notable, positioning Dreamt as a significant player in this category, though the lack of subsequent data suggests challenges in sustaining that momentum. These insights point towards strategic opportunities for Dreamt to capitalize on its early success and address the factors hindering its sustained performance in this category.

Competitive Landscape

In the competitive landscape of the Edible category in New Jersey, Dreamt has shown a dynamic yet challenging performance trajectory. Over the months from October 2025 to January 2026, Dreamt's rank fluctuated between 53rd and 58th, indicating a struggle to break into the top tier of the market. Despite this, Dreamt's sales saw a notable increase from $14,926 in October to $18,530 in November, before experiencing a dip in December and a slight recovery in January. In contrast, competitors like AiroPro maintained a stable position at 18th, consistently outperforming Dreamt with significantly higher sales figures. Meanwhile, HAZE and Kore displayed more volatility in their rankings, with HAZE dropping from 39th to 56th and Kore fluctuating between 44th and 52nd, yet both managed to sustain higher sales than Dreamt. Notably, Rosin King of Jersey emerged in December with a 62nd rank, slightly trailing behind Dreamt but showing potential for growth. This competitive analysis highlights the need for Dreamt to strategize effectively to enhance its market position and capitalize on sales opportunities in the evolving New Jersey edible market.

Notable Products

In January 2026, the top-performing product from Dreamt was the CBD/CBN/THC 4:2:1 Midnight Berry Gummies, which maintained its number one rank from December 2025 with an impressive sales figure of 1253 units. The Honey Lemon Gummies 2-Pack climbed to the second position, improving from the third rank in December, with strong sales performance. The CBD/THC/CBN 2:5:1 Honey Lemon Gummies 20-Pack dropped to third place, despite being the top product in October 2025. The CBD/THC 2.5:1 Sleep Tincture remained consistent in fourth place, showing a notable decline in sales from its peak in November 2025. The Honey Lemon Soft Lozenge 20-Pack maintained its fifth rank throughout the period, indicating stable but modest sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.