Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

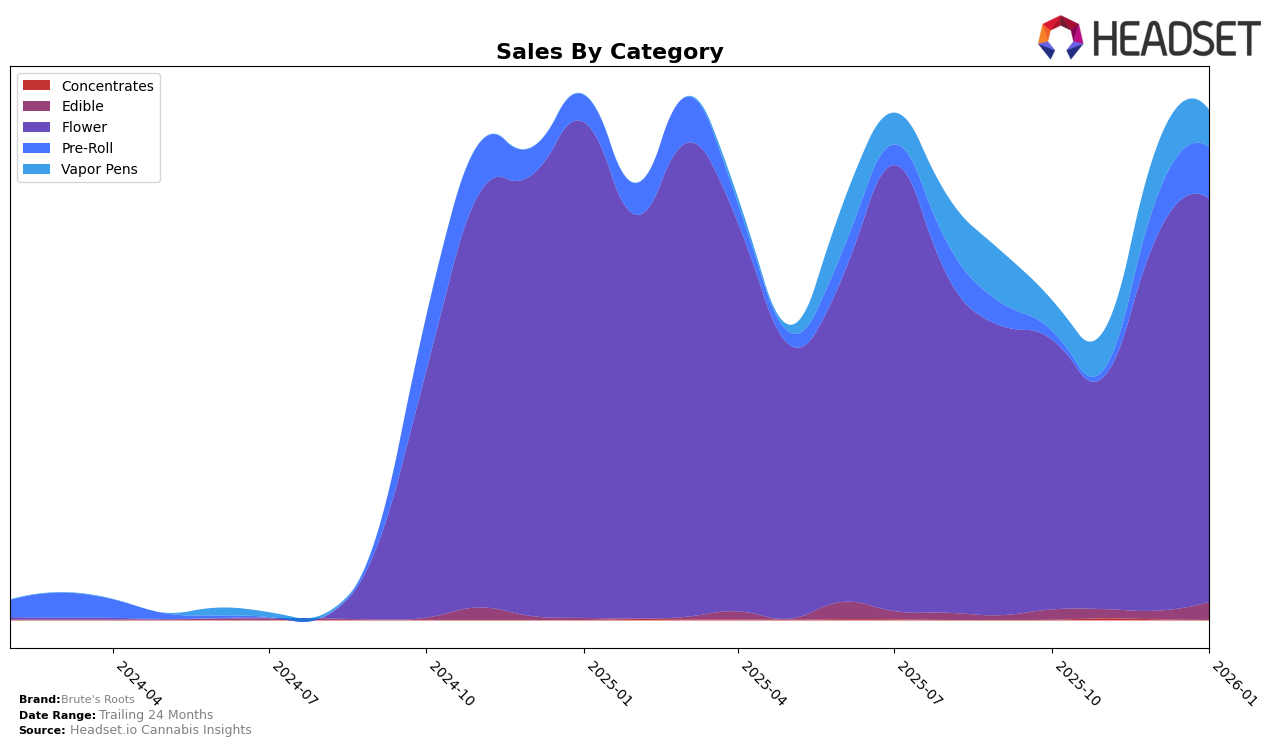

Brute's Roots has shown a varied performance across different product categories in New Jersey. In the Edible category, the brand struggled to break into the top 30, with rankings consistently above 50 until January 2026, when they improved to 42nd place. This upward movement is notable given their previous standings, suggesting a potential strategic shift or increased consumer demand. In contrast, their Flower category has seen a more favorable trajectory, climbing from 29th in October 2025 to a commendable 19th place by January 2026. This rise indicates a strong consumer preference or effective marketing strategies that have bolstered their presence in this competitive category.

On the downside, the Pre-Roll category has been inconsistent, with Brute's Roots not even making it into the top 30 in November 2025. However, the brand rebounded to 47th in December and further improved to 36th by January 2026, which might hint at a recovery or a successful promotional campaign. Vapor Pens, another critical category, saw some fluctuations, with a peak at 44th place in November 2025, though it dipped slightly to 51st by January 2026. Despite these fluctuations, the brand's sales figures suggest a robust market presence, particularly in Flower, where they reported significant sales growth from October 2025 to January 2026, reflecting a strong market position in New Jersey.

Competitive Landscape

In the competitive landscape of the New Jersey Flower category, Brute's Roots has shown a remarkable upward trajectory in recent months. Initially ranked 29th in October 2025, Brute's Roots climbed to 19th by January 2026, indicating a significant improvement in market presence and consumer preference. This upward movement is particularly notable when compared to competitors like Old Pal, which fluctuated between 18th and 28th place, and Triple Seven (777), which saw a decline from 12th to 21st. Meanwhile, Fresh Cannabis and Legend maintained relatively stable ranks, with Fresh Cannabis ending at 17th and Legend consistently around 18th. Despite starting outside the top 20, Brute's Roots' sales growth has outpaced several competitors, suggesting a strong potential for continued advancement in rank and market share.

Notable Products

In January 2026, Brute's Roots saw Brute's Blend Pre-Roll (1g) maintain its top rank as the best-selling product, achieving sales of 15,033 units. Glue (3.5g) remained steady in second place for two consecutive months with significant growth in sales. Neon Runtz (3.5g) entered the rankings at third place, showing a resurgence after being unranked in December 2025. Honey Badger (3.5g) debuted in the rankings at fourth place, suggesting a strong market entry. Sugar Factory Popcorn (3.5g) also made its first appearance, securing the fifth spot, indicating expanding consumer interest in this category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.