Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

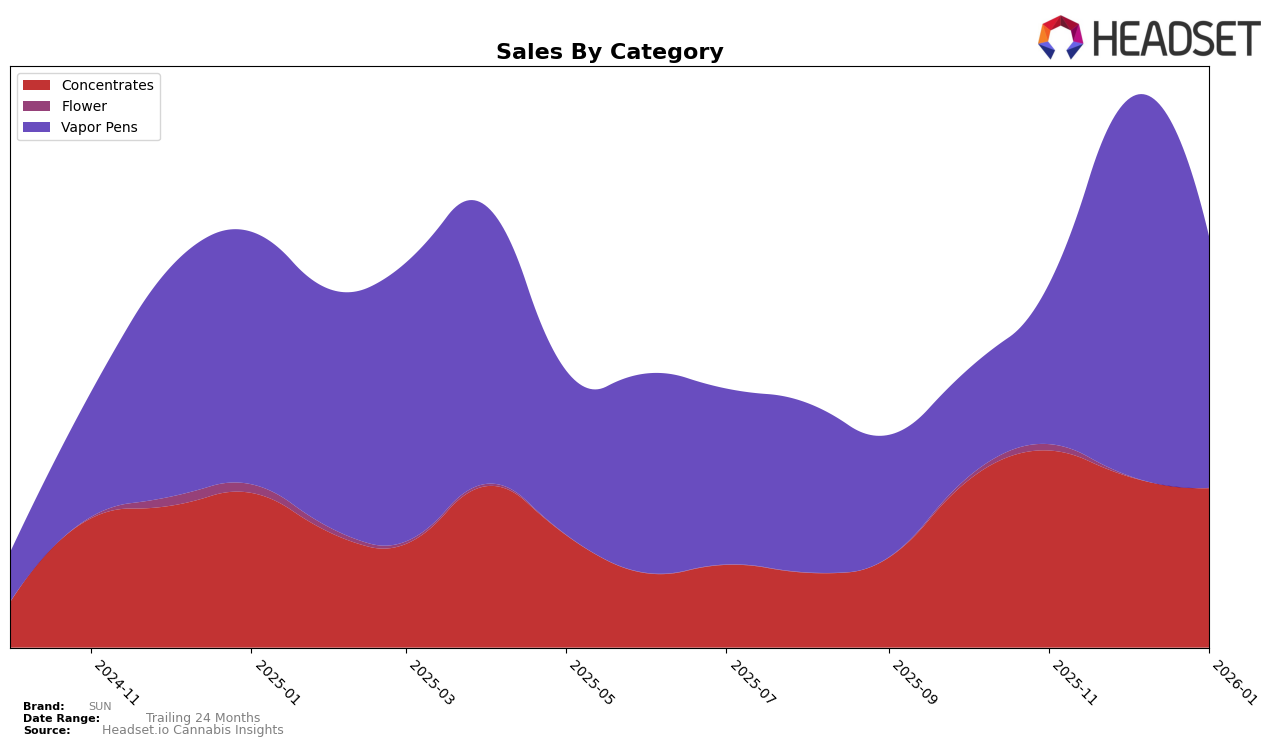

In the New Jersey market, SUN's performance in the Concentrates category has shown some fluctuations over the months from October 2025 to January 2026. Starting at a rank of 14 in October, SUN improved slightly to 12 in November, but then experienced a decline, ending at 15 in January. Despite these changes in rank, SUN maintained a consistent presence in the top 15, indicating a stable position in this category. However, the slight drop from December to January suggests potential competition or market shifts that SUN might need to address.

In contrast, SUN's presence in the Vapor Pens category in New Jersey has been more volatile, with a significant improvement from rank 60 in October to 31 in December, before slightly declining to 37 in January. This upward movement in November and December suggests that SUN capitalized on a growing demand or effectively adjusted its strategy in the Vapor Pens market. The absence from the top 30 in October highlights a previous lack of competitiveness, but the subsequent ranking improvements indicate a positive trend. This could point to successful marketing efforts or product innovations that resonated well with consumers during the holiday season.

Competitive Landscape

In the competitive landscape of vapor pens in New Jersey, SUN has demonstrated notable progress in its market positioning over recent months. From October 2025 to January 2026, SUN's rank improved significantly from 60th to 37th, marking a substantial leap in visibility and consumer preference. This upward trajectory is particularly impressive when compared to competitors such as ONYX (NJ) and Breakwater, which have shown more stable yet less dynamic rank changes, with ONYX (NJ) maintaining a rank around the mid-30s and Breakwater slipping slightly from 30th to 38th. Despite SUN's lower sales figures compared to brands like Jersey Sauce Boss, which consistently ranks in the top 35, SUN's sales have seen a remarkable increase, particularly in December 2025, where they surpassed the sales of some higher-ranked competitors. This suggests a growing consumer interest and potential for SUN to continue climbing the ranks if the trend persists.

Notable Products

In January 2026, SUN's top-performing product was the Ice Wookie Cured Resin Cartridge (1g) in the Vapor Pens category, maintaining its number one rank from December 2025 with sales of $322. Black Cherry Gelato Live Resin Badder (1g) in the Concentrates category climbed from fifth to second place, showcasing a notable increase in demand. Yikes Cured Resin Sugar (1g) entered the rankings at third place, indicating a strong debut. Permanent Chimera Live Resin Cartridge (1g), also in the Vapor Pens category, secured the fourth position, marking its first appearance in the rankings. Meanwhile, Cereal Milk Cured Resin Cartridge (1g) dropped from fourth to fifth place, suggesting a slight decline in popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.