Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

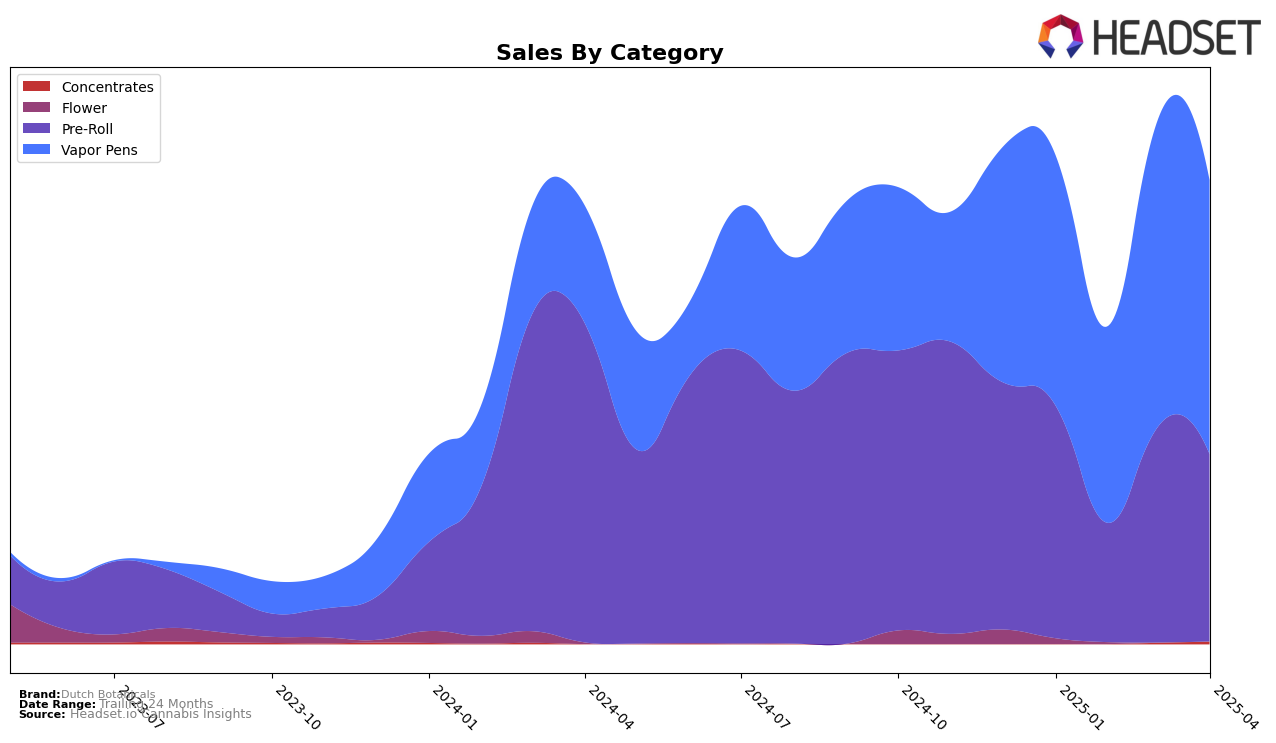

In the state of Colorado, Dutch Botanicals has shown fluctuating performance across different cannabis categories. In the Pre-Roll category, the brand maintained a strong presence, oscillating between ranks 9 and 17 from January to April 2025. Notably, despite a drop to rank 17 in February, Dutch Botanicals quickly regained momentum, climbing back to rank 9 by April. This suggests a resilient market demand for their pre-roll products, even amidst competitive pressures. In the Vapor Pens category, the brand exhibited a positive trajectory, improving its rank from 27 in January to 20 by April. This upward movement indicates a growing consumer preference for Dutch Botanicals' vapor pen offerings in the Colorado market.

However, it's important to note that Dutch Botanicals did not make it into the top 30 brands for Vapor Pens in February, which could be seen as a temporary setback. Nonetheless, the subsequent improvement in rankings demonstrates the brand's ability to recover and strengthen its market position. The sales figures corroborate these trends, with a noticeable increase in sales for both categories from February to March, highlighting a successful rebound. Such performance dynamics emphasize the brand's adaptability and potential for growth in a competitive environment, making it a noteworthy player in the Colorado cannabis market.

Competitive Landscape

In the competitive landscape of vapor pens in Colorado, Dutch Botanicals has shown a notable improvement in rank from January to April 2025, moving from 27th to 20th place. This upward trend indicates a positive reception in the market, especially when compared to competitors like EvoLab, which saw fluctuations and a drop out of the top 20 in March, and Olio, which experienced a decline from 13th to 19th place by April. Meanwhile, The Colorado Cannabis Co. maintained a relatively stable position, consistently ranking in the top 20, though Dutch Botanicals' sales growth suggests a narrowing gap. The competitive dynamics highlight Dutch Botanicals' potential to further climb the ranks, driven by its recent sales momentum and strategic positioning in the market.

Notable Products

In April 2025, Jenny's Pre-Roll (1g) emerged as the top-performing product for Dutch Botanicals, maintaining its number one rank from the previous month with notable sales of 29,283 units. Jenny's - NYC Kush Pre-Roll (1g) climbed to the second position, up from an absence in March, showcasing strong sales momentum. Jenny's - PB Cookies Pre-Roll (1g) made its first appearance in the rankings at third place. Dutch Botanicals x Jenny's - Superboof Pre-Roll (1g) slipped to fourth place, having previously occupied the fifth position in March. Blue Dream Pre-Roll (1g) rounded out the top five, experiencing a drop from third place in March to fifth in April.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.