Sep-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

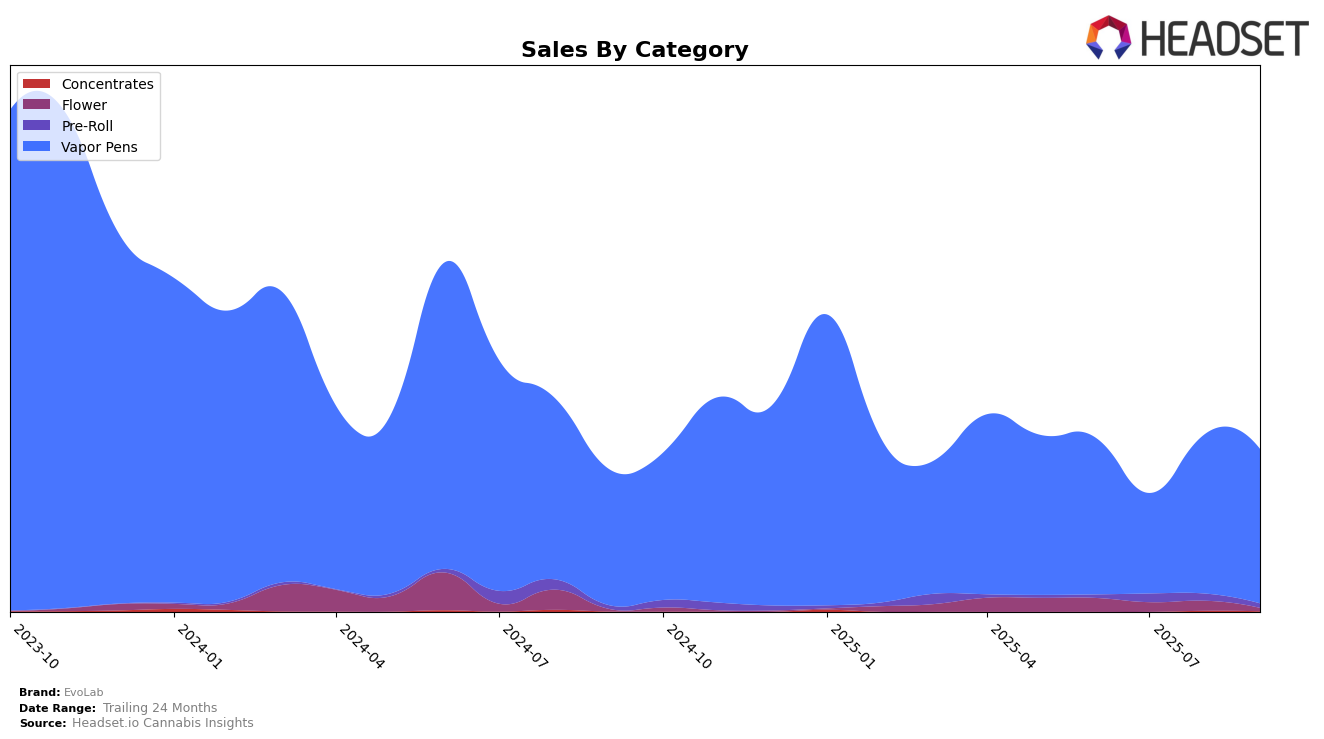

In the state of Colorado, EvoLab has shown a notable upward trend in the Vapor Pens category. After slipping slightly in July 2025 to rank 35th, the brand rebounded to break back into the top 30 by August 2025, reaching the 30th position. By September 2025, EvoLab had improved its standing further to 29th. This movement is indicative of a positive trajectory, suggesting that EvoLab's strategies in this category might be gaining traction with consumers. Despite a dip in sales from June to July, the brand experienced a recovery in August, maintaining a consistent performance into September.

Conversely, EvoLab's performance in the Nevada Flower category paints a different picture. The brand has consistently ranked outside the top 90, with its highest position being 92nd in June 2025. By September 2025, EvoLab did not make it into the top 30, indicating challenges in gaining a foothold in this competitive market. The absence of a ranking in September suggests that EvoLab may need to reassess its approach in Nevada's Flower category. This contrast between the two states highlights the varying market dynamics and consumer preferences that EvoLab faces across different regions.

Competitive Landscape

In the competitive landscape of Vapor Pens in Colorado, EvoLab has shown a steady improvement in its ranking over the past few months, moving from 31st place in June 2025 to 29th in September 2025. Despite this positive trend, EvoLab still faces stiff competition from brands like Billo and Binske, which have consistently ranked higher, with Billo peaking at 22nd place in August before dropping to 32nd in September. Meanwhile, Sunshine Extracts has also maintained a competitive edge, ranking as high as 25th in August. Although EvoLab's sales have fluctuated, with a notable dip in July, the brand's upward movement in rank suggests a potential for increased market share if it continues to capitalize on its recent gains. However, to further enhance its position, EvoLab must address the competitive pressure from brands like Lazercat Cannabis, which closely trails EvoLab, and focus on strategies that could boost its sales and rank further in the upcoming months.

Notable Products

In September 2025, the top-performing product for EvoLab was Colors - Cherry Lime Distillate Disposable (1g) in the Vapor Pens category, which ascended to the first rank with notable sales of 1116 units. Following closely, Colors - Blueberry CO2 Disposable (1g) secured the second position, maintaining a strong presence after climbing from the fifth position in July. Colors - White Cherry Co2 Disposable (1g) held steady in the third rank, consistently performing well throughout the months. Colors - Blackberry Distillate Disposable (1g) also showed a stable performance, retaining the fourth position from August. Lastly, Colors - Malibu Blast Live Resin Disposable (1g) re-entered the top five, marking a comeback after being absent from the rankings in July and August.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.