Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

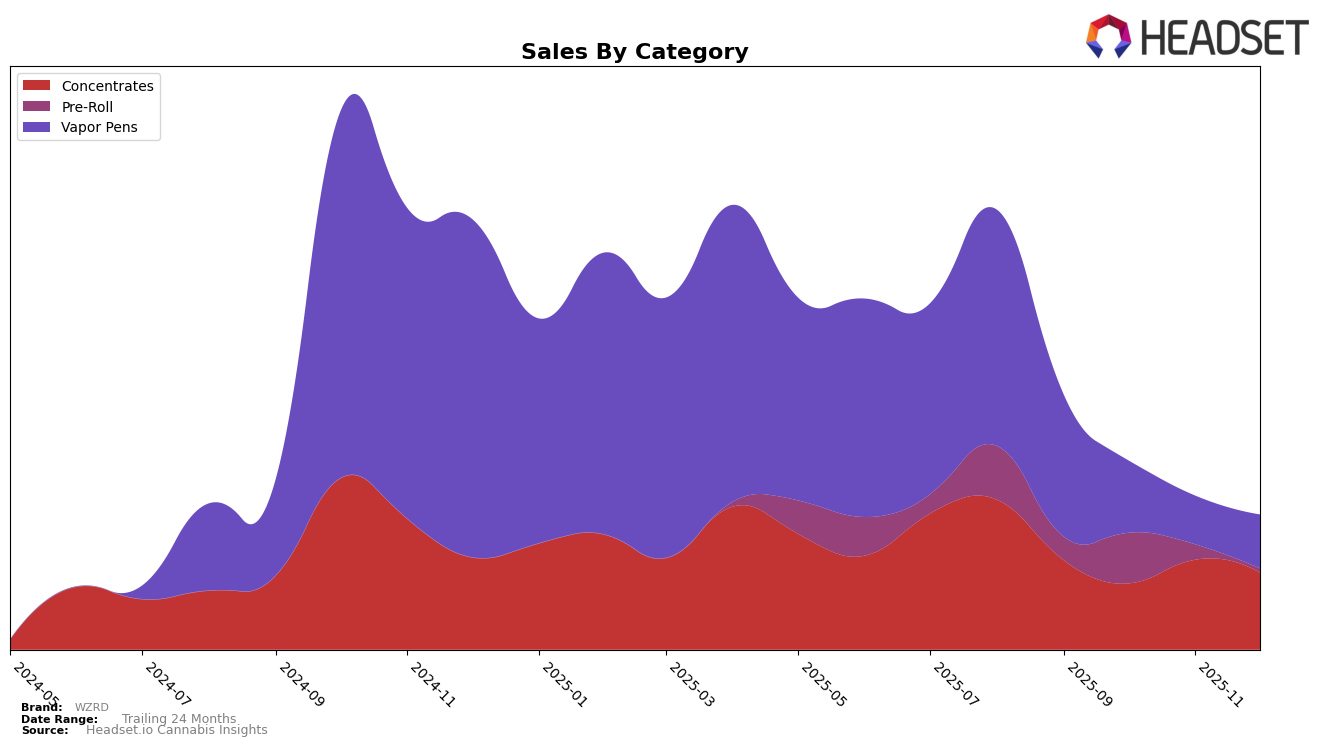

WZRD's performance in Arizona across various categories shows a mix of stability and fluctuations. In the Concentrates category, WZRD maintained a presence within the top 30 rankings throughout the last quarter of 2025, although their position varied. They started at rank 21 in September, dipped to 28 in October, climbed back to 23 in November, and settled at 26 in December. This indicates a competitive but somewhat volatile performance, with sales peaking in November at 42,679 units. Meanwhile, their Vapor Pens category experienced a downward trend, dropping from rank 39 in September to 49 by December, suggesting a need for strategic adjustments in this segment to regain market share.

In contrast, WZRD's performance in the Pre-Roll category in Arizona showed an upward movement, although they did not break into the top 30 rankings during the period analyzed. Starting at rank 70 in September and improving to 56 in October, this suggests growing consumer interest and potential for further growth if the trend continues. However, the absence of rankings for November and December indicates that WZRD was unable to sustain this upward trajectory into the top 30, highlighting a potential area for improvement. This mixed performance across categories underscores the need for WZRD to focus on strategic enhancements to solidify their market presence in Arizona.

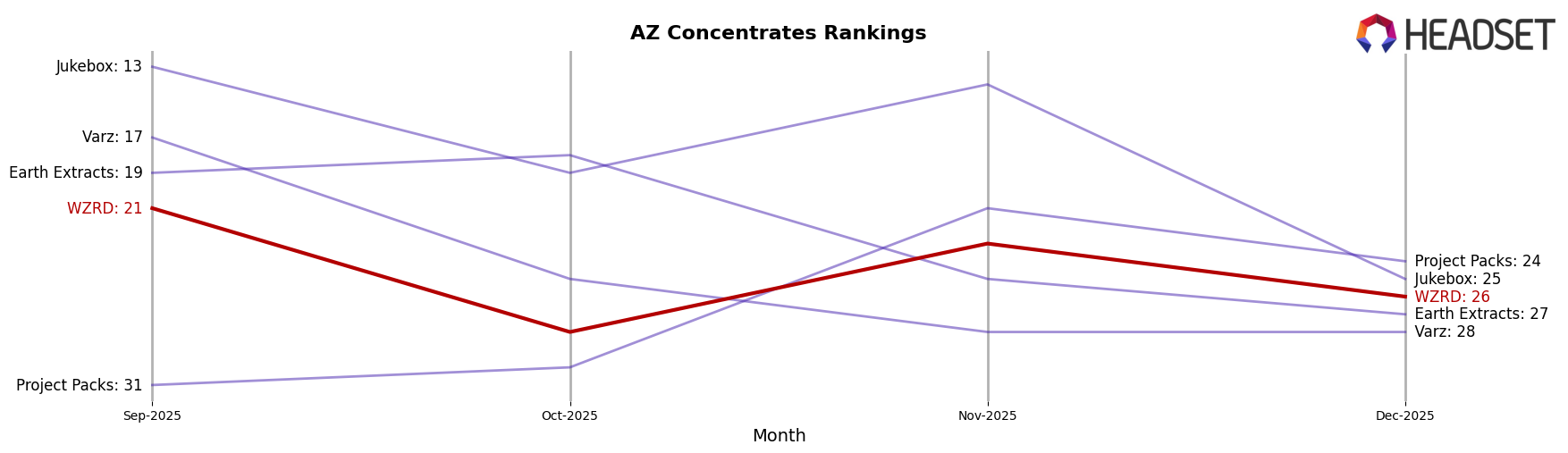

Competitive Landscape

In the competitive landscape of the concentrates category in Arizona, WZRD has experienced notable fluctuations in its rankings, which reflect broader market dynamics. From September to December 2025, WZRD's rank shifted from 21st to 26th, indicating a competitive pressure from other brands. For instance, Jukebox saw a decline from 13th to 25th, suggesting a potential loss of market share that could have been captured by WZRD. Meanwhile, Earth Extracts maintained a relatively stable position, slightly dropping from 18th to 27th, which might have contributed to the competitive tension. Varz consistently ranked lower, from 17th to 28th, potentially opening opportunities for WZRD to improve its standing. Interestingly, Project Packs showed upward mobility, moving from 31st to 24th, which could be a sign of increasing competition for WZRD. These movements highlight the dynamic nature of the concentrates market in Arizona, where WZRD's strategic adjustments could capitalize on competitors' declining trends and bolster its market position.

Notable Products

In December 2025, the top-performing product for WZRD was Snowdrop Berry Burst Distillate Cartridge (1g) in the Vapor Pens category, which ascended to the first rank with sales of 266. Bluejitsu Shatter (1g) in the Concentrates category debuted impressively at the second position. Tiger's Blood Distillate Cartridge (1g) also in Vapor Pens, improved from the fifth position in November to third in December. Sunshine 4 Badder (1g) in Concentrates secured the fourth rank, entering the rankings for the first time. Guava Jelly Shatter (1g) dropped from first place in November to fifth in December, indicating a shift in consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.