Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

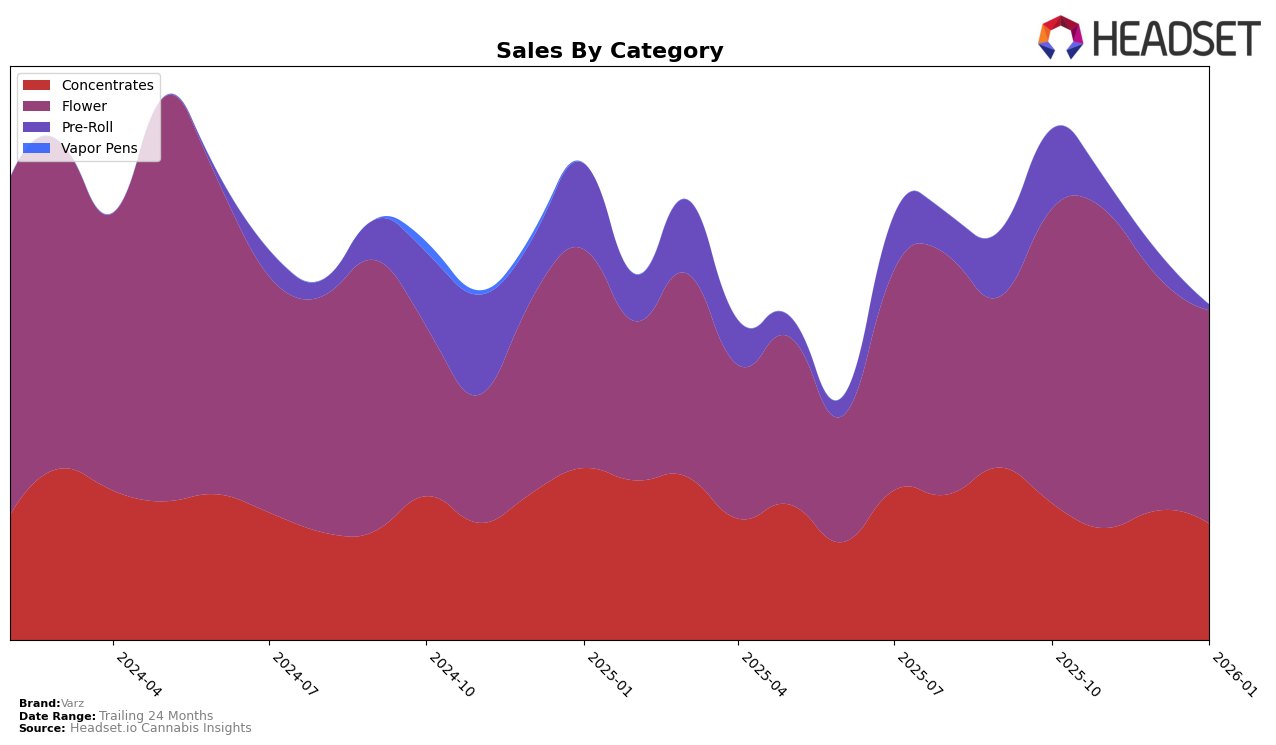

In Arizona, Varz has shown a consistent presence in the Concentrates category, maintaining a position within the top 30 brands. Despite some fluctuations in their rankings, moving from 25th in October 2025 to 28th in November and December, and back to 25th in January 2026, Varz has managed to sustain its market presence. This suggests a stable demand for their products in this category, even though sales figures show a slight dip in November before recovering in December. In contrast, Varz's performance in the Flower category has not been as strong, failing to break into the top 30, which indicates potential challenges or opportunities for growth in this segment.

Interestingly, Varz's performance in the Pre-Roll category in Arizona highlights a different story. The brand ranked 57th in October 2025 but did not appear in the top 30 in subsequent months, which may point to a decline in consumer interest or increased competition. This absence from the rankings could be a concern, as it suggests that Varz might need to reassess its strategy or offerings in the Pre-Roll market to regain traction. Overall, while Varz has maintained a foothold in the Concentrates category, its performance in other categories like Flower and Pre-Roll indicates areas where the brand could potentially improve or innovate to enhance its market position.

Competitive Landscape

In the competitive landscape of the Arizona flower category, Varz has maintained a relatively stable position, though it faces significant competition from brands like Vortex Cannabis Inc. and Tyson 2.0. Varz's rank fluctuated slightly from 47th in October 2025 to 42nd in November 2025, before settling back to 47th by January 2026. Despite these fluctuations, Varz's sales have shown a downward trend, contrasting with the more volatile sales patterns of its competitors. For instance, Vortex Cannabis Inc. experienced a significant drop in sales from October 2025 to January 2026, which might provide Varz with an opportunity to capture market share if it can stabilize and increase its sales. Meanwhile, Tyson 2.0 entered the top 50 in December 2025 and saw a decline in sales by January 2026, suggesting potential vulnerabilities that Varz could exploit to improve its market position.

Notable Products

In January 2026, Glitter Bomb (3.5g) emerged as the top-performing product for Varz, taking the number one spot in the Flower category with sales reaching 471 units. Gorilla Dosha (3.5g) followed closely in second place, showing strong demand. Trop Cherry (3.5g) secured the third position, maintaining a steady presence in the top ranks. Notably, Glitter Bomb rose from third place in December 2025 to claim the top spot in January 2026, indicating a significant increase in popularity. This upward shift in rankings showcases the dynamic consumer preferences within the Flower category for Varz products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.