Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

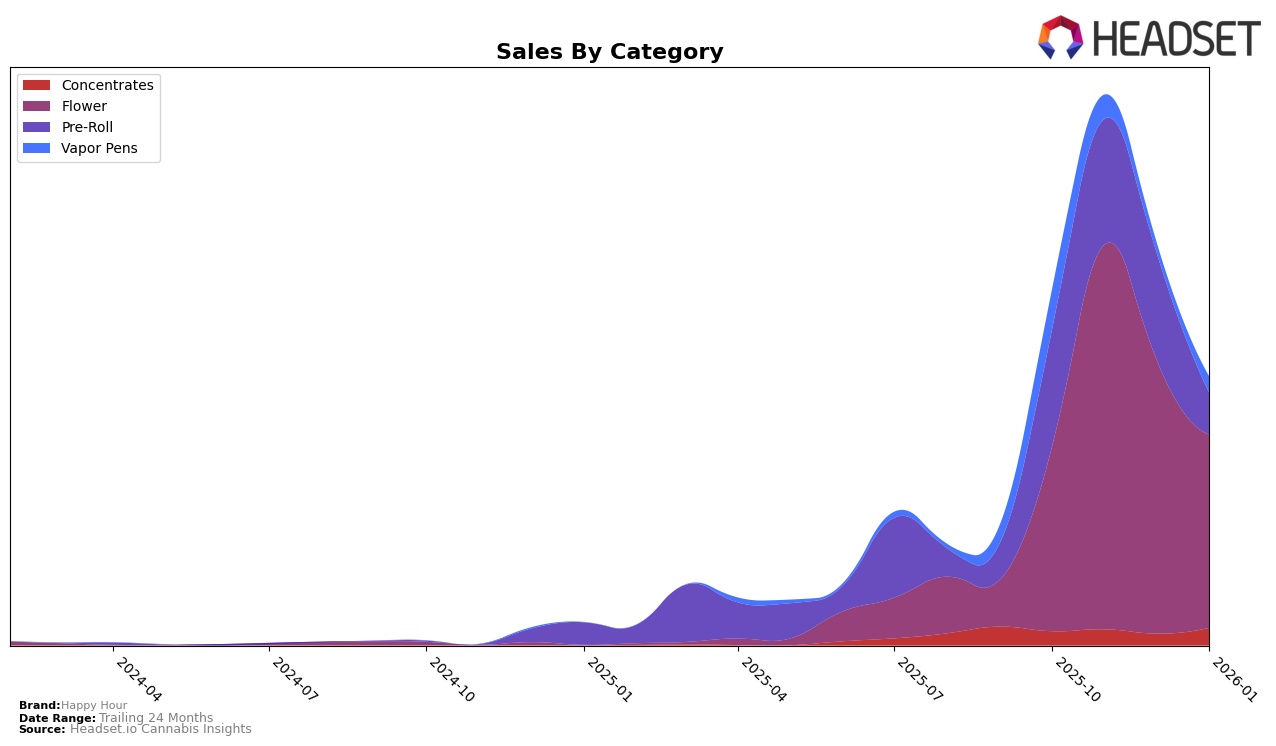

In British Columbia, Happy Hour has shown varied performance across different cannabis categories. The brand's presence in the Concentrates category has been somewhat stable, maintaining a position just outside the top 30 for most months, with a notable return to the 29th spot in January 2026. This indicates a potential resurgence or stabilization in consumer interest. Meanwhile, in the Flower category, Happy Hour has experienced a downward trend in rankings from October 2025 to January 2026, dropping from 12th to 21st. Despite this decline, the Flower category remains a stronghold for the brand, suggesting that it continues to be a significant player in this segment.

The Pre-Roll and Vapor Pens categories tell a different story for Happy Hour. In Pre-Rolls, the brand's rank has plummeted from 20th to 81st over the four-month period, which could be a cause for concern regarding its market share and consumer preference in this category. Similarly, the Vapor Pens category has seen Happy Hour fall out of the top 30 entirely by November 2025, indicating a substantial decline in performance or market competition. These shifts highlight the challenges Happy Hour faces in maintaining its standing across various product lines, and it will be interesting to see how they strategize to address these trends in the coming months.

Competitive Landscape

In the competitive landscape of the Flower category in British Columbia, Happy Hour has experienced a notable decline in its ranking from October 2025 to January 2026, dropping from 12th to 21st position. This downward trend is contrasted by competitors such as Tweed, which maintained a steady rank around 19th, and FIGR, which made a significant leap from being unranked in October to securing the 20th spot by January. Additionally, Homestead Cannabis Supply showed remarkable improvement, climbing from 88th to 22nd place. Despite Happy Hour's initial strong sales in October, the brand's sales figures have seen a decline, which may be contributing to its drop in rank. This suggests that while Happy Hour was once a leading contender, it now faces increasing pressure from both established and emerging brands in the market.

Notable Products

In January 2026, Ice Cream Cake (7g) topped the sales chart for Happy Hour, marking its debut at the top position with sales of 1027 units. Harmony Haze Pre-Roll (0.5g) climbed to the second position from fourth place in October 2025, despite a slight drop in sales to 913 units. Pineapple OG Pre-Roll 10-Pack (5g) maintained a strong presence, moving up to third place after ranking fourth in November 2025. Lift Ticket (28g) experienced a decline, dropping from second place in November 2025 to fourth in January 2026. Hybrid THCA Topper (1g) entered the top five for the first time, securing the fifth spot.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.