Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

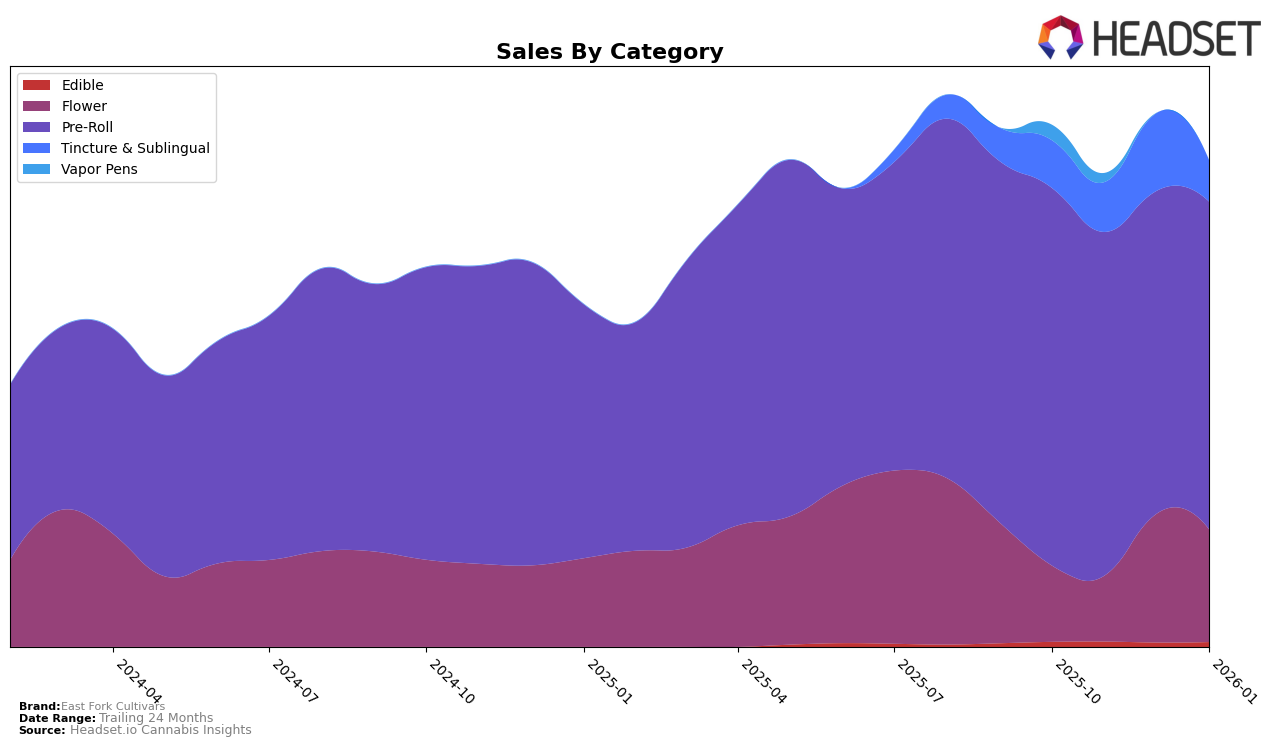

East Fork Cultivars has shown varied performance across its product categories and geographical markets. In the Oregon market, their Pre-Roll category has consistently hovered around the top 30 rankings, peaking at 31st in January 2026 after a slight dip to 36th in December 2025. This suggests a stable but competitive position in the Pre-Roll segment, reflecting potential opportunities for growth if they can break into the top 30 consistently. The Tincture & Sublingual category, however, has seen more fluctuation, with a notable peak at 7th place in December 2025, indicating a significant, albeit temporary, surge in popularity. Such movements highlight the brand's ability to capture market interest, particularly during the holiday season, but also underscore the challenges in maintaining a steady top-tier position.

It's worth noting that East Fork Cultivars did not appear in the top 30 for Pre-Rolls in some months, which could be interpreted as a competitive challenge or a strategic pivot in focus. Meanwhile, the Tincture & Sublingual category saw a dramatic drop to 14th place in January 2026 after its December peak, suggesting volatility that may be linked to seasonal demand or supply chain factors. Despite these fluctuations, the brand's presence in both categories points to a diversified strategy that could be leveraged to capitalize on emerging trends. For those interested in deeper insights, examining the underlying factors driving these ranking changes could provide valuable lessons in brand positioning and market adaptation.

Competitive Landscape

In the competitive landscape of Oregon's pre-roll category, East Fork Cultivars has shown a dynamic performance over the past few months. Starting from a rank of 33 in October 2025, East Fork Cultivars improved to 32 in November, dipped to 36 in December, and then climbed to 31 by January 2026. This fluctuation in rank reflects a competitive market environment where brands like Eugreen Farms and SugarTop Buddery also experienced rank changes, with Eugreen Farms consistently ranking higher than East Fork Cultivars, despite a downward trend in sales. Meanwhile, Mother Magnolia Medicinals showed a gradual improvement in rank, potentially posing a competitive threat. Notably, Cascade Valley Cannabis maintained a stronger position, consistently ranking higher than East Fork Cultivars, although their sales have been on a decline. This competitive analysis highlights the need for East Fork Cultivars to strategize effectively to maintain and improve its market position amidst fluctuating ranks and sales trends.

Notable Products

In January 2026, the top-performing product for East Fork Cultivars was the Sour Lemon Kush Pre-Roll (0.5g), which climbed to the number one rank despite a slight decrease in sales to 1661 units. The Relax - Pineapple Kush Pre-Roll (0.5g) slipped to second place after maintaining the top spot for the previous three months. Sour Lemon Kush (Bulk) maintained its third-place position from December 2025, showing a consistent performance in the Flower category. The Create - CBD/THC 1:1 Sour Lemon Kush Pre-Roll 7-Pack (3.5g) entered the rankings in January at fourth place, signaling a strong market entry. CBD/THC 1:1 Blueberry Balance (Bulk) debuted in the rankings at fifth place, suggesting potential for growth in the Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.