Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

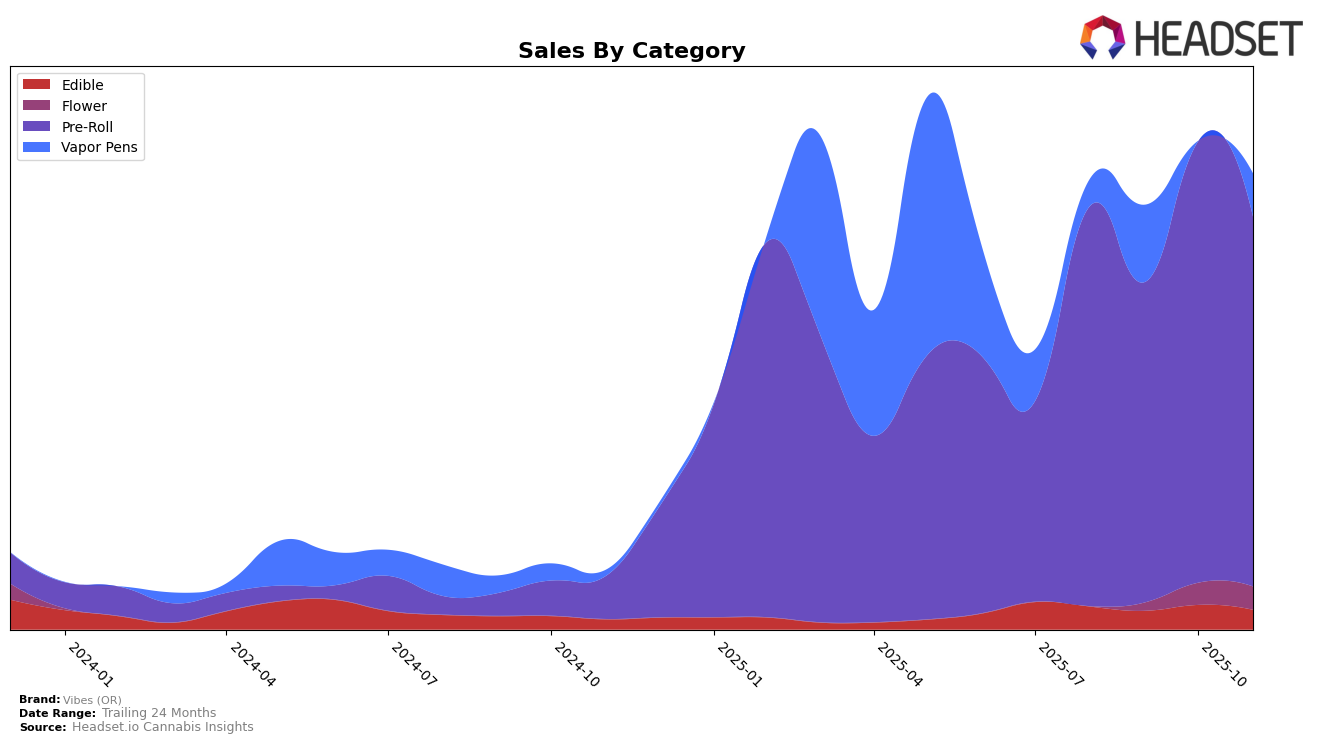

In the Oregon market, Vibes (OR) has demonstrated notable shifts in its performance across different product categories. In the Pre-Roll category, the brand experienced a dynamic movement in rankings, starting at 30th place in August 2025, climbing to 22nd in October, before settling at 27th in November. This fluctuation suggests a competitive landscape but also indicates potential for growth as evidenced by the brand's ability to break into the top 30, which it failed to maintain in September. The sales figures support this narrative, with a peak in October, hinting at a possible seasonal or promotional influence during that month.

Conversely, in the Vapor Pens category, Vibes (OR) did not feature in the top 30 rankings during August and October, and only appeared in September and November at 65th and 77th positions, respectively. This inconsistency in rankings suggests a struggle to establish a strong foothold in this category within the Oregon market. The sales data, with a notable drop from August to November, further emphasizes the challenges faced in this segment. However, the presence in the rankings during two months indicates there might be untapped potential or a niche market that could be capitalized on with strategic adjustments.

Competitive Landscape

In the competitive landscape of the Oregon pre-roll category, Vibes (OR) has experienced notable fluctuations in its ranking over the past few months, reflecting the dynamic nature of the market. In August 2025, Vibes (OR) held the 30th position, which dropped to 35th in September, before climbing to 22nd in October, and then slightly declining to 27th in November. This pattern indicates a volatile yet promising trajectory, with a significant peak in October. Comparatively, Mule Extracts consistently maintained a higher rank, although it experienced a drop from 20th in October to 26th in November, suggesting potential vulnerability. Meanwhile, Dog House showed a steady performance, improving from 34th in August to 25th by November, which could pose a competitive challenge to Vibes (OR). Eugreen Farms and East Fork Cultivars also displayed competitive movements, with Eugreen Farms making a notable jump from 45th in September to 28th in November. These shifts highlight the importance for Vibes (OR) to capitalize on its October momentum and strategize against competitors' advancements to enhance its market position.

Notable Products

In November 2025, the top-performing product for Vibes (OR) was God's Breath Pre-Roll (1g) in the Pre-Roll category, securing the number one rank with notable sales of 1,403 units. Grapehead Pre-Roll (1g) maintained its position at rank two from the previous month, albeit with a decrease in sales to 1,192 units. Coconut Milk Pre-Roll (1g) entered the rankings at position three, while Gary's Pineapple Pre-Roll (1g) dropped one spot to fourth place. Rainbow Zangria Pre-Roll (1g) improved its position, climbing from fourth to fifth with an increase in sales. Overall, the rankings indicate a competitive market with slight shifts in product popularity from October to November.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.