Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

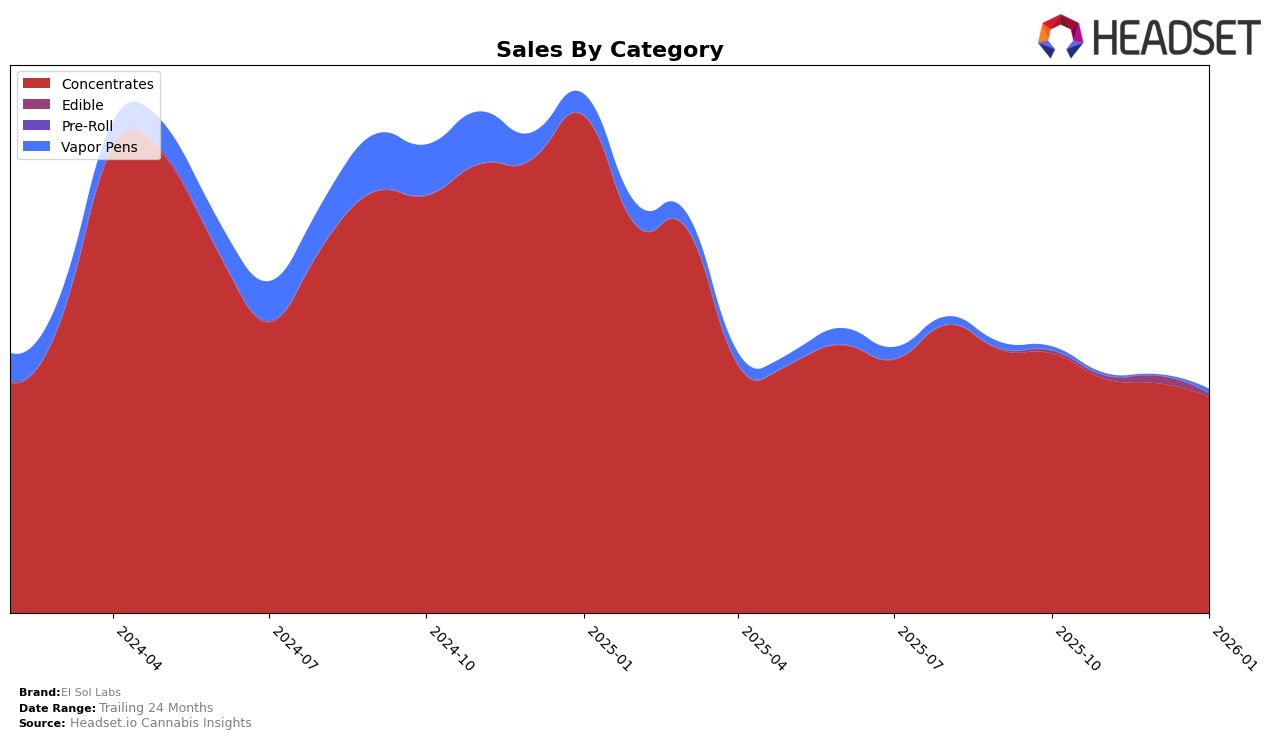

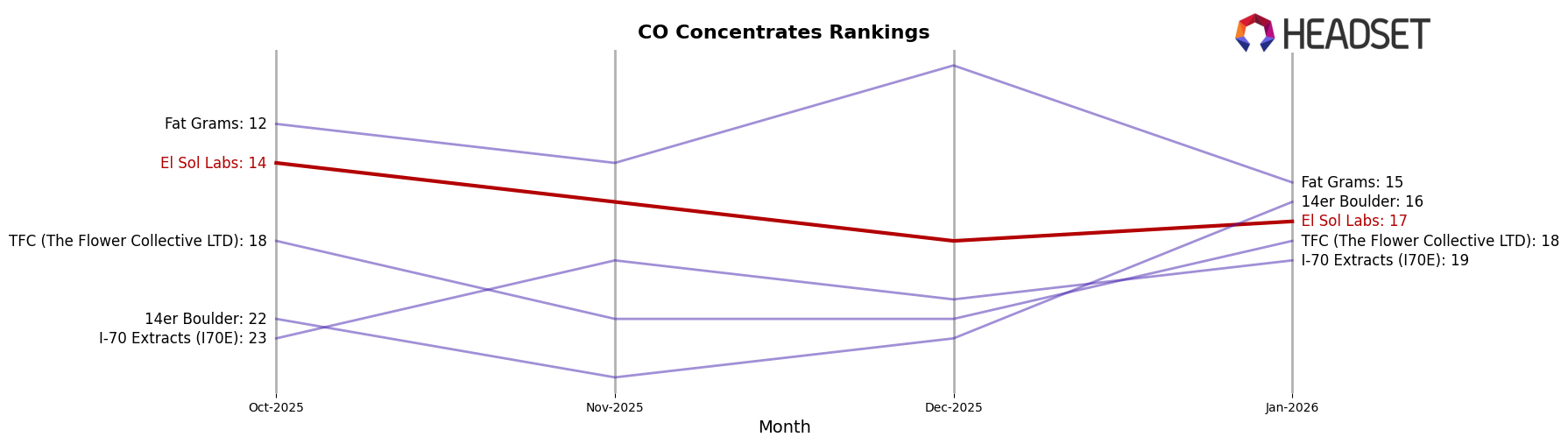

El Sol Labs has shown a consistent presence in the Colorado concentrates market over the past few months. Starting in October 2025, the brand was ranked 14th, but it experienced a slight decline in subsequent months, dropping to 16th in November and 18th in December, before slightly improving to 17th in January 2026. This movement suggests a competitive landscape in the concentrates category, where El Sol Labs is maintaining its position within the top 20 but facing challenges to climb higher. The steady decline in sales from October to January, with a notable decrease from $168,674 in October to $140,120 in January, could indicate a need for strategic adjustments to regain momentum.

In other states and categories, El Sol Labs did not make it to the top 30 brands, which could be seen as a potential area for growth or a reflection of their strategic focus on the Colorado market. The absence of rankings in other regions highlights an opportunity for the brand to explore market expansion or diversification strategies. Understanding the dynamics of these markets could provide valuable insights into potential areas of investment or reallocation of resources to enhance their competitive edge in the concentrates category. As the brand navigates these challenges, monitoring their performance in existing and new markets will be crucial for sustained growth.

Competitive Landscape

In the competitive landscape of the Colorado concentrates market, El Sol Labs has experienced notable fluctuations in its ranking over the past few months. As of October 2025, El Sol Labs held the 14th position, but it saw a decline to 16th in November and further to 18th in December, before slightly improving to 17th by January 2026. This downward trend in rank correlates with a decrease in sales, suggesting a challenging period for the brand. In contrast, Fat Grams demonstrated a strong performance, climbing to 9th place in December, although it dropped to 15th in January. Meanwhile, 14er Boulder showed a significant improvement in January, jumping from 23rd to 16th, indicating a potential rise in consumer preference. TFC (The Flower Collective LTD) and I-70 Extracts (I70E) maintained relatively stable positions, with TFC returning to its October rank by January. These dynamics highlight the competitive pressures El Sol Labs faces, emphasizing the need for strategic adjustments to regain and enhance its market position.

Notable Products

In January 2026, the top-performing product from El Sol Labs was ZZ Sangria Wax (1g) in the Concentrates category, which secured the first rank with sales of 509 units. Biscotti Chaos Wax (1g) climbed to the second position from its previous third place in November 2025. Dino Dreams Wax (1g) maintained a steady performance, holding the third rank for both December 2025 and January 2026. Peaceful Puppy Wax (1g) also showed consistent sales, ranking fourth in both December and January. Notably, Polar Plunge Wax (1g) entered the top five for the first time in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.