Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

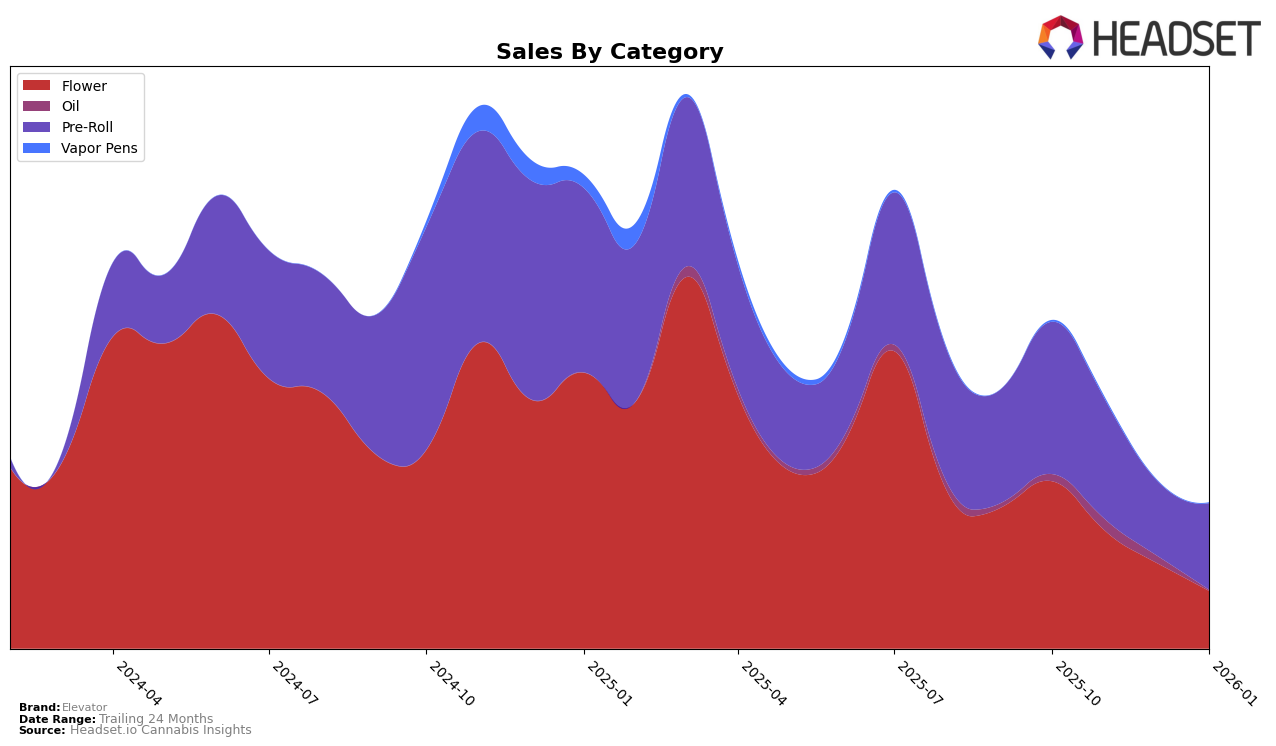

Elevator's performance in the Saskatchewan market has shown varied results across different product categories. In the Flower category, the brand has seen a steady decline in its ranking, moving from 8th place in October 2025 to 22nd place by January 2026. This downward trend is mirrored by a decrease in sales, which indicates a potential challenge in maintaining its competitive edge in this category. On the other hand, Elevator's presence in the Oil category is notable, as it entered the rankings in November 2025 at 6th place, demonstrating a strong initial presence despite not being in the top 30 in the preceding months. This suggests a strategic focus or successful campaign that has resonated with consumers in that category.

The Pre-Roll category presents a more dynamic picture for Elevator in Saskatchewan. While the brand maintained its 9th position from October to November 2025, it experienced a dip to 16th in December before rebounding to 10th in January 2026. This fluctuation could be indicative of seasonal demand shifts or competitive pressures within the market. Despite these ranking changes, the sales figures for Pre-Rolls show a recovery in January, suggesting that Elevator might be regaining traction or adjusting its strategies effectively. The brand's ability to bounce back in this category could be a positive sign for its adaptability and resilience in the face of market challenges.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Saskatchewan, Elevator has experienced notable fluctuations in its market position from October 2025 to January 2026. Initially ranked 9th in October and November 2025, Elevator saw a dip to 16th place in December, before rebounding to 10th in January 2026. This volatility contrasts with the more stable performance of competitors like Ritual Green / Ritual Gold, which consistently maintained a top 8 position throughout the same period. Meanwhile, Jackpot demonstrated a significant upward trajectory, climbing from 32nd in October to 11th by January, indicating a potential threat to Elevator's market share. Additionally, Rogue Botanicals showed resilience, maintaining a top 10 rank in three out of the four months. Despite the challenges, Elevator's rebound in January suggests a recovery in sales momentum, though it remains crucial for the brand to address the factors contributing to its December decline to sustain competitive positioning.

Notable Products

In January 2026, the top-performing product for Elevator was the Sativa Pre-Roll (0.5g) in the Pre-Roll category, reclaiming its position as number one with sales reaching 1466 units. The Fives Pre-Roll 5-Pack (2.5g) closely followed, dropping to second place from its previous top spot in December, with notable sales of 1138 units. The Indica Pre-Roll (0.5g) made a comeback to the rankings, securing the third position, showing a significant improvement from its absence in the previous two months. Pink Diesel Blunts Pre-Roll 5-Pack (2.5g) slipped to fourth place from its consistent second-place ranking in November and December. Finally, the Indica Pre-Roll 5-Pack (2.5g) maintained its presence in the top five, albeit at the fifth position, showing a gradual decline in its ranking over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.