Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

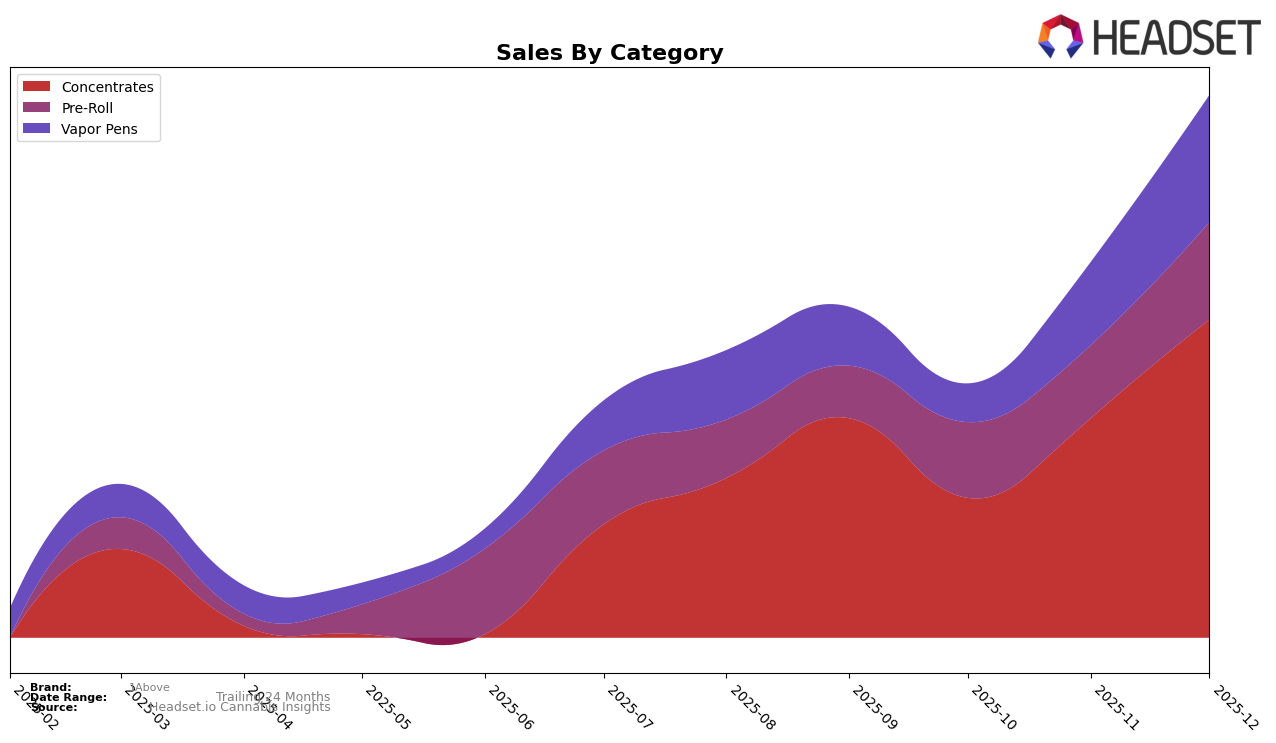

Market Insights Snapshot

In the Ontario market, 1Above has shown a notable performance in the Concentrates category. Over the last four months of 2025, the brand has demonstrated a positive trend, climbing from the 26th position in September to 21st by December. This upward movement indicates a strengthening presence in the market, with December sales reaching a peak of 120,689 units. The fluctuation in rankings, particularly the dip to 33rd in October, suggests a competitive landscape, yet the recovery and improvement in subsequent months highlight 1Above's resilience and potential growth in this category.

In the Vapor Pens category within Ontario, 1Above's performance reveals both opportunities and challenges. The brand was not ranked in the top 30 in October, which may indicate a period of struggle or market adjustment. However, the recovery to the 67th position by December, along with a significant increase in sales from September to December, suggests a rebound and potential for further improvement. The absence from the top 30 in October highlights the competitive nature of this category, but the subsequent rise in rankings and sales could signal a strategic pivot or successful adaptation by 1Above in their market approach.

Competitive Landscape

In the Ontario concentrates market, 1Above has shown a dynamic shift in its competitive positioning over the last few months of 2025. Starting from a rank of 26 in September, 1Above experienced a dip to 33 in October, indicating a temporary decline in market presence. However, the brand quickly rebounded, climbing to 25 in November and further improving to 21 in December. This recovery suggests a strong resilience and potential strategic adjustments that have positively impacted its market standing. In contrast, competitors like GREAZY maintained a more stable trajectory, consistently improving from 25 in September to 19 by December, while Sauce Rosin Labs saw a decline from 15 in October to 20 in December. Meanwhile, Sheeesh! showed a significant rise from 30 in September to 22 in December, closely trailing 1Above. These movements highlight the competitive volatility within the Ontario concentrates market, emphasizing the importance for 1Above to sustain its upward momentum to secure a stronger foothold against its rivals.

Notable Products

In December 2025, 1Above's top-performing product was the 73u Live Rosin (1g) from the Concentrates category, maintaining its first-place rank for the fourth consecutive month with notable sales of 1809 units. The Hybrid Juice Bar Rosin Disposable (0.5g) in the Vapor Pens category held its second-place position from November, showing a strong sales increase. The Hybrid Hash Hole Rosin Infused Pre-Roll 2-Pack (2g) rose to third place from fifth, indicating a growing popularity in the Pre-Roll category. Zoap 73u Live Rosin (1g) dropped to fourth place despite a strong performance in November, while the Hybrid Hash Hole Infused Pre-Roll (2g) fell to fifth, showing a downward trend. Overall, the sales dynamics in December reflect a consistent demand for concentrates and vapor pens from 1Above.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.