Sep-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

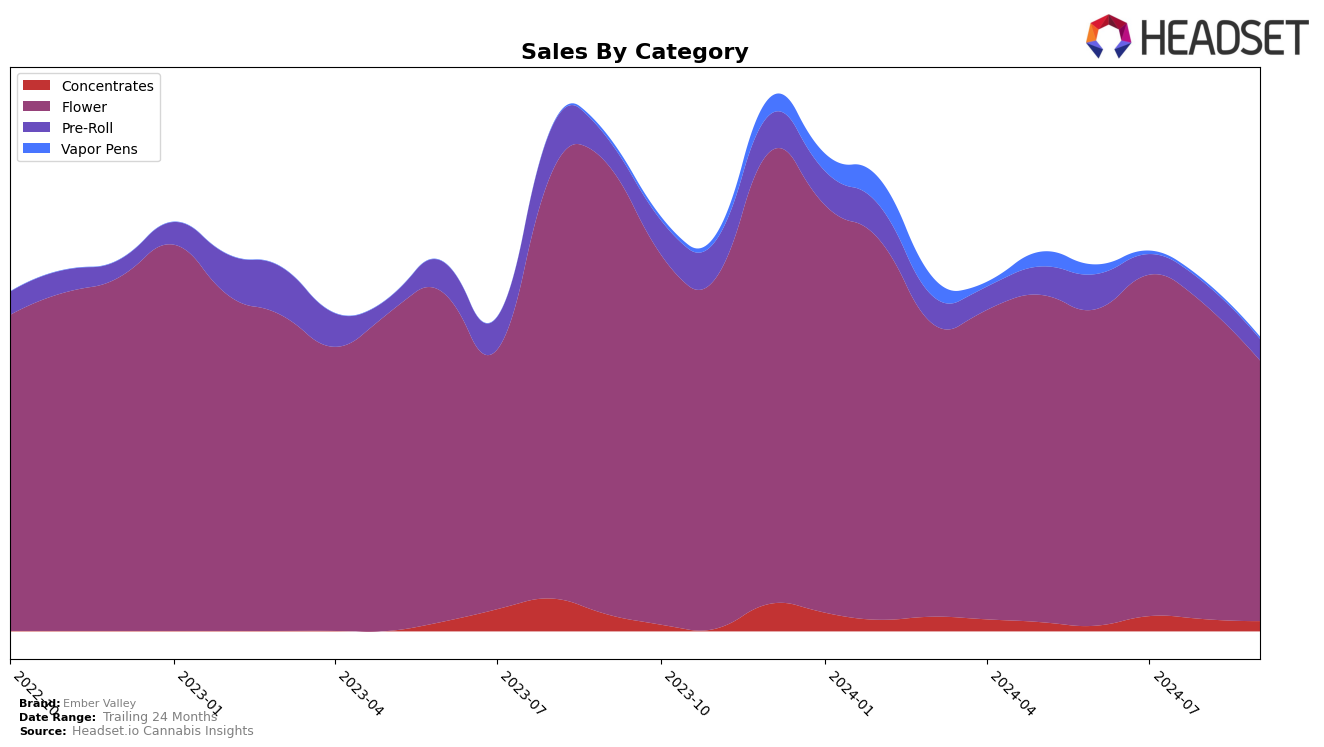

Ember Valley's performance across various categories in California shows a mixed trajectory. In the Flower category, Ember Valley maintained a relatively stable presence, holding the 24th position in both July and August 2024, before dropping slightly to the 27th position in September. This suggests a consistent demand for their Flower products, with only a small dip in sales towards the end of the period. However, in the Concentrates category, Ember Valley did not make it to the top 30 brands throughout the observed months, which indicates a challenging competitive landscape or perhaps a need for strategic adjustments in their Concentrates offerings. The absence from the top 30 in June and subsequent lower rankings in the following months highlight the need for potential growth strategies in this segment.

In the Pre-Roll category, Ember Valley appeared in the rankings only in June and September 2024, with positions of 82nd and 93rd, respectively, which indicates an inconsistent presence in the market. This fluctuation might point to seasonal demand variations or marketing efforts that did not sustain momentum. The significant drop in sales from June to September suggests that there might be untapped potential or areas for improvement in product visibility or distribution strategies. Overall, while Ember Valley shows strength in the Flower category, the brand faces challenges in maintaining a competitive edge in Concentrates and Pre-Rolls, which could be pivotal areas for future growth and development.

Competitive Landscape

In the competitive California flower market, Ember Valley has experienced fluctuations in its rank, indicating a dynamic competitive landscape. Notably, Ember Valley maintained a stable rank of 24th in July and August 2024, but saw a decline to 27th by September 2024. This drop coincided with a decrease in sales, suggesting potential challenges in maintaining market share. In contrast, A Golden State showed a positive trend, improving its rank from 32nd in June to 25th by August and maintaining that position in September, with sales surpassing Ember Valley's in the latter month. Similarly, West Coast Treez improved its rank to 26th by September, also overtaking Ember Valley in sales. These shifts highlight the competitive pressures Ember Valley faces from brands like A Golden State and West Coast Treez, which are gaining traction in the market. For Ember Valley, these insights underscore the need for strategic adjustments to regain its competitive edge in California's flower category.

Notable Products

In September 2024, Ember Valley's top-performing product was Tiger King (3.5g) in the Flower category, which climbed to the number one spot with sales of 3027 units. LA Runtz (3.5g) held the second position, dropping from its peak in August when it was ranked first. Melon Fizz (3.5g) made its debut in the rankings at third place, showing strong initial sales. Northern Fire (3.5g) maintained its fourth-place ranking from August, indicating consistent performance. Dirty Banana (3.5g) entered the rankings at fifth place, rounding out the top products for the month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.