Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

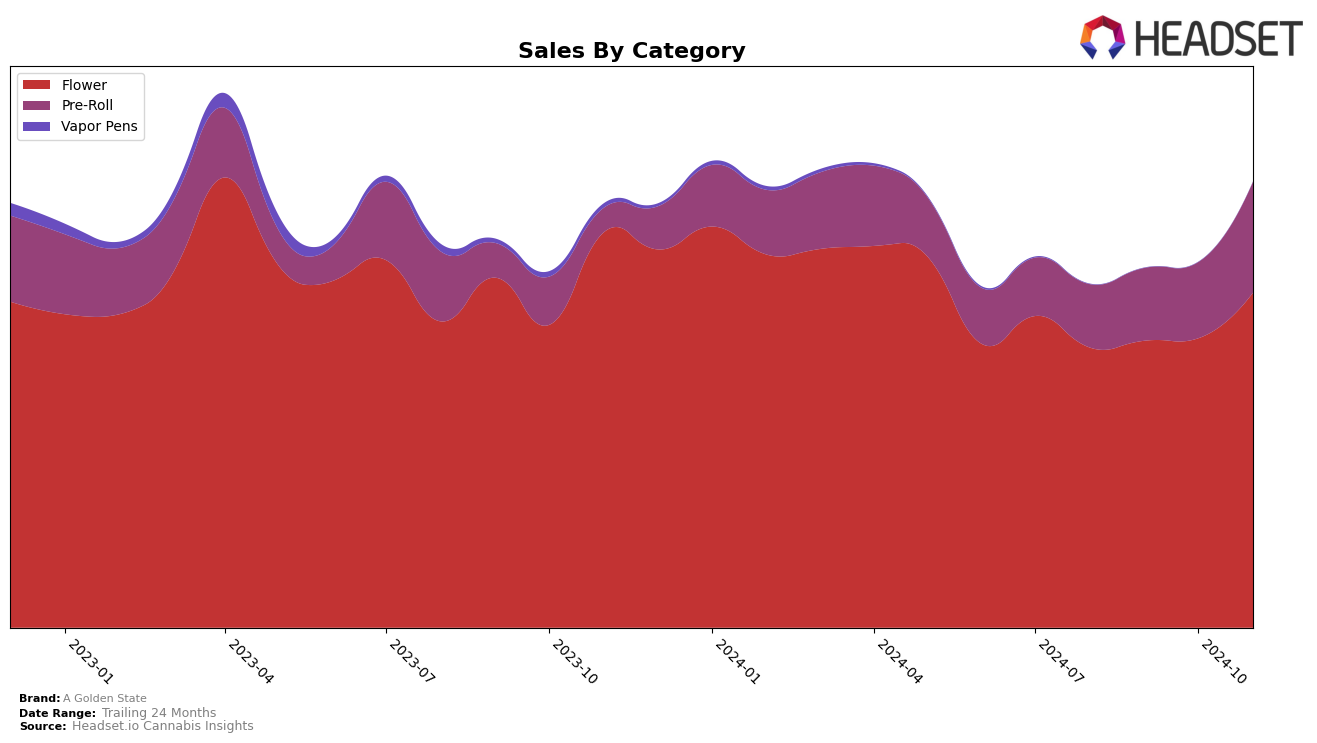

A Golden State has shown a notable performance in the California market, particularly in the Flower category. Over the past few months, the brand has oscillated around the 30th position, experiencing a slight dip in October 2024 before reclaiming the 29th spot in November 2024. This movement suggests a resilient presence in a highly competitive market. The brand's sales in this category have seen a steady increase, with a significant jump in November, indicating a positive reception from consumers and possibly an effective marketing strategy or product launch that month.

In the Pre-Roll category, A Golden State has demonstrated a more dynamic trajectory within California. The brand was not ranked in the top 30 in August 2024, but it made a remarkable climb to the 37th position by November 2024. This upward trend suggests an increasing consumer interest or a strategic shift that has paid off, as evidenced by the substantial growth in sales figures. While the brand hasn't broken into the top 30 yet, its rapid ascent is a positive indicator of its potential to further penetrate the market. However, the specific strategies or factors contributing to this growth remain to be explored.

Competitive Landscape

In the competitive landscape of the California flower category, A Golden State has shown a consistent performance, maintaining its rank at 29th in both September and November 2024, despite a slight dip to 33rd in October. This stability in rank is noteworthy, especially when compared to competitors like Maven Genetics, which climbed from 40th in August to 24th in October, indicating a significant upward trend. Meanwhile, West Coast Treez experienced fluctuations, dropping from 23rd in October to 28th in November, suggesting potential volatility. A Golden State's sales trajectory also reflects a positive trend, with a notable increase from September to November, surpassing the sales of Henry's Original consistently, while remaining competitive with Mr. Zips, which saw a slight decline in November. This analysis highlights A Golden State's resilience and steady growth in a dynamic market, positioning it as a reliable choice for consumers seeking quality flower products in California.

Notable Products

In November 2024, A Golden State's top-performing product was Lava (3.5g) in the Flower category, maintaining its first-place ranking for four consecutive months with a notable sales figure of 5327. Sweet Flower Pre-Roll 5-Pack (1.5g) secured the second position, marking its debut in the rankings this month. Alpine Sunrise (3.5g), also in the Flower category, dropped to third place from its consistent second-place ranking over the previous months. Caramel Apple Pre-Roll 5-Pack (1.5g) and Alpine Sunrise Pre-Roll 5-Pack (1.5g) entered the rankings in fourth and fifth positions, respectively. This shift suggests a growing popularity in pre-roll products alongside the consistent demand for flower products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.