Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

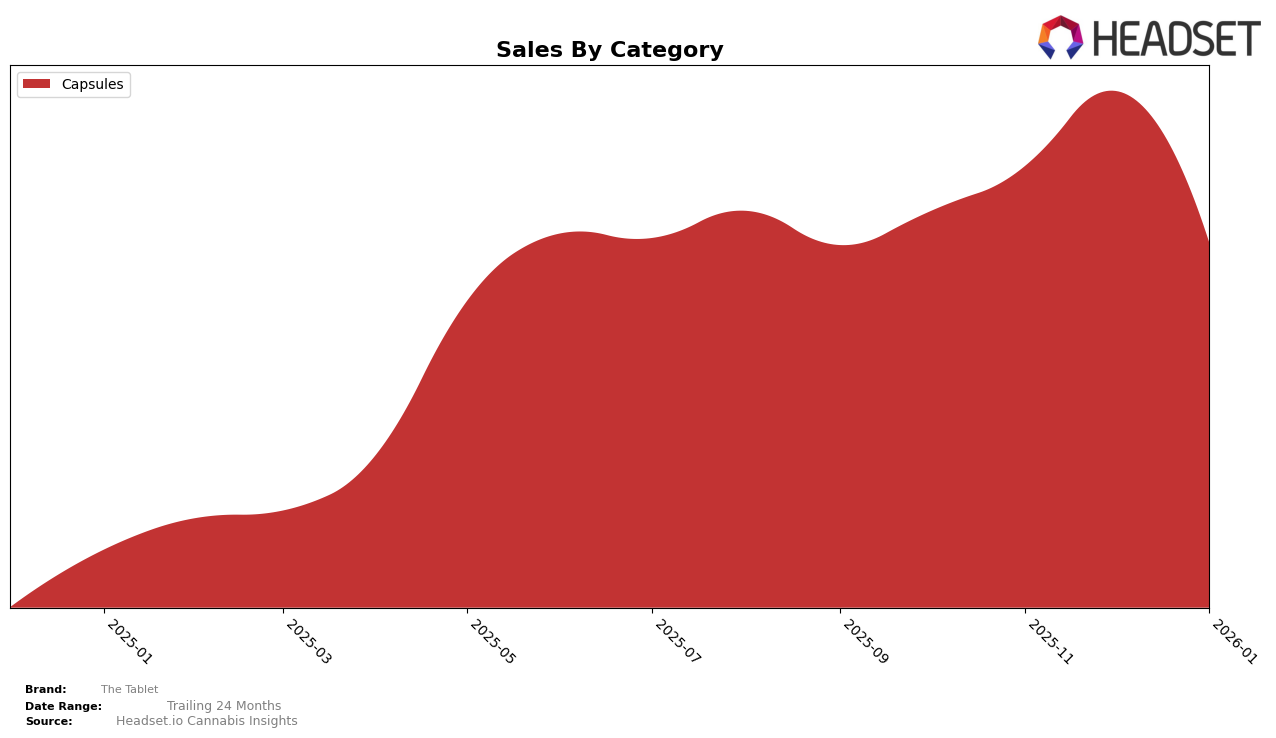

The Tablet has shown consistent performance in the Capsules category within California, maintaining a steady rank of 7th place from October 2025 through January 2026. This stability in ranking indicates a strong market presence and consumer loyalty in the state. Notably, the sales figures for The Tablet saw a peak in December 2025, suggesting a possible seasonal boost or successful promotional activities during that period. However, the subsequent dip in January 2026 sales may hint at post-holiday market adjustments or increased competition.

While The Tablet's performance in California's Capsules category is commendable, the absence of rankings in other states or categories suggests that the brand's influence may be limited to specific regions or product lines. This could represent a strategic opportunity for The Tablet to explore new markets or diversify its product offerings. The consistent performance in California provides a solid foundation from which the brand could potentially expand its reach, leveraging insights gained from its successful operations in the state.

Competitive Landscape

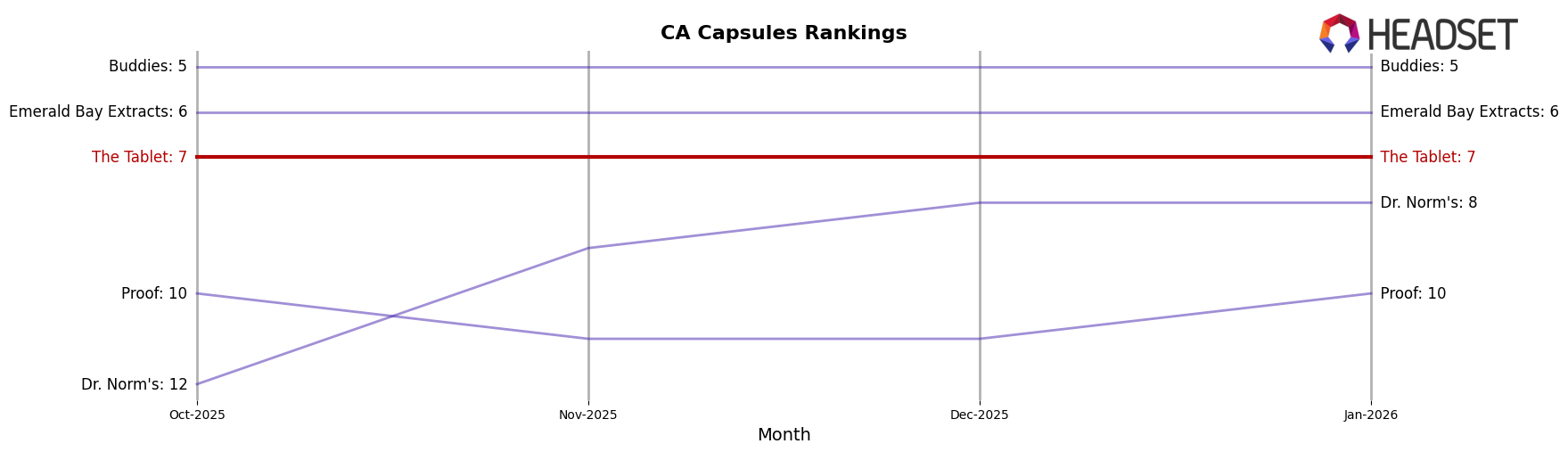

In the competitive landscape of the California capsules market, The Tablet consistently maintained its position at rank 7 from October 2025 through January 2026. Despite this stability in rank, The Tablet experienced a notable fluctuation in sales, peaking in December 2025 before dropping in January 2026. This trend suggests potential seasonal influences or market dynamics affecting consumer demand. In contrast, Buddies held a steady rank at 5, with sales consistently higher than The Tablet, indicating strong brand loyalty or market penetration. Meanwhile, Emerald Bay Extracts also maintained a consistent rank at 6, but experienced a decline in sales over the same period, which could indicate a potential opportunity for The Tablet to capture some market share if they can address the factors behind their January sales dip. Additionally, Dr. Norm's showed an upward trajectory in rank, moving from 12 to 8, with a significant increase in sales, suggesting a growing competitive threat that The Tablet needs to monitor closely to maintain its market position.

Notable Products

In January 2026, the top-performing product from The Tablet was Indica Tablets 20-Pack (1000mg) in the Capsules category, which rose to the number one spot with sales of 1114 units. This product consistently held the fourth rank in the previous three months, indicating a significant improvement in its performance. Sativa Tablets 20-Pack (1000mg) maintained a strong presence, ranking second, although it dropped from its second position in December 2025. Indica High Dose Tablets 50-Pack (1000mg), which was the top product from October to December 2025, fell to third place in January 2026. Sativa High Dose Tablets 50-Pack (1000mg) experienced a gradual decline, moving from second in November to fourth in January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.