Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

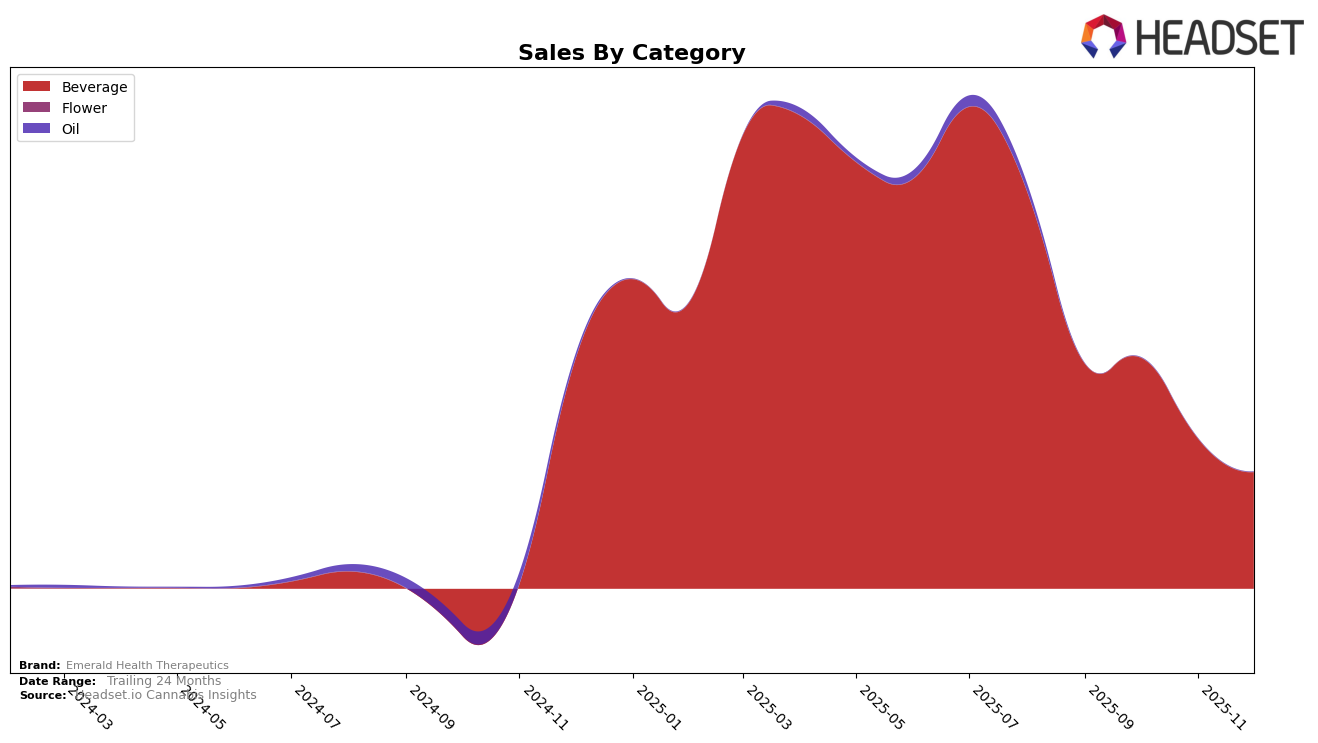

Emerald Health Therapeutics has shown a varied performance across different categories and regions, particularly in the beverage category in Ontario. Over the last few months of 2025, their ranking in the beverage category experienced fluctuations, starting at 23rd in September, slightly improving to 22nd in October, then dropping to 24th in November, and further down to 29th by December. This indicates a declining trend in their market position within this category, which could be concerning for the brand if the trend continues. Additionally, the decrease in sales from October to December suggests potential challenges in maintaining consumer interest or facing increased competition within the province.

It is notable that Emerald Health Therapeutics did not make it into the top 30 brands in any other states or provinces across different categories, which could imply a limited market presence or challenges in scaling their operations beyond Ontario. This lack of visibility in other regions might be a strategic area for the brand to explore if they aim to enhance their market share and overall brand recognition. The data highlights the importance of strategic growth and adaptation to changing consumer preferences to maintain and improve their standings in competitive markets.

Competitive Landscape

In the competitive landscape of the beverage category in Ontario, Emerald Health Therapeutics has experienced notable fluctuations in its market position from September to December 2025. Starting at rank 23 in September, Emerald Health Therapeutics improved slightly to 22 in October but then saw a decline to 24 in November and further to 29 in December. This downward trend in rank coincides with a significant drop in sales, particularly noticeable from October to December. Competing brands such as Deep Space and Snap Back also faced challenges, with Deep Space dropping out of the top 20 by November and Snap Back entering the rankings at 27 in November. Meanwhile, CQ (Cannabis Quencher) was not ranked in the top 20 during this period, indicating a competitive yet volatile market environment. These dynamics suggest that while Emerald Health Therapeutics is a significant player, it faces strong competition and market pressures that have impacted its sales and rank over the observed months.

Notable Products

In December 2025, Emerald Health Therapeutics maintained its top position with the Cranberry Citrus Live Rosin Beverage in the Beverage category, despite a decrease in sales to 790 units. The Lime Mint Beverage secured the second rank, maintaining its position from November, with steady sales figures. The Ginger Lime Live Rosin Beverage climbed back up to the third position after dropping to fourth in November. The Agave Lime Sea Salt Live Rosin Beverage, which was second in October, fell to fourth in December, indicating a significant decline in popularity. This month's rankings show a consistent leadership by the Cranberry Citrus Live Rosin Beverage, while the rest of the products experienced notable shifts in their standings over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.