Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

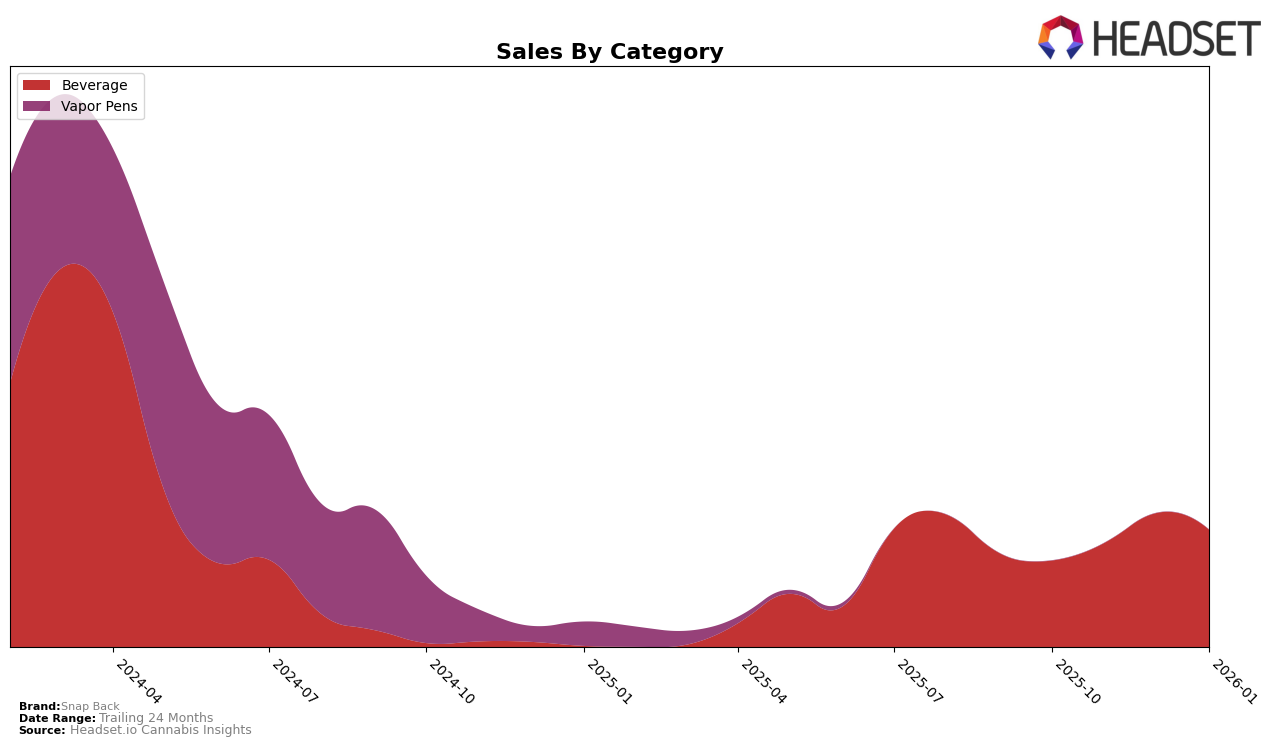

Snap Back has demonstrated a noteworthy presence in the cannabis beverage category in Ontario over the last few months. Although the brand did not make it into the top 30 rankings in October 2025, it successfully entered the rankings in November 2025 at 27th place. This upward trajectory continued with a slight improvement to 26th place in December 2025, before returning to 27th in January 2026. This fluctuation suggests a relatively stable presence within the competitive landscape of cannabis beverages in Ontario, indicating that Snap Back is maintaining its foothold despite market pressures.

The sales figures for Snap Back in Ontario provide additional insights into its performance. While the brand did not rank in October 2025, it recorded sales of $10,798 in November 2025, which increased to $13,862 in December 2025. Interestingly, there was a decrease to $12,122 in January 2026, which aligns with its slight drop in ranking. This pattern of sales and ranking movements suggests a competitive market environment where Snap Back is striving to maintain and grow its market share. The ability to sustain a ranking within the top 30 in such a dynamic market is a positive indicator of the brand's resilience and potential for future growth.

Competitive Landscape

In the competitive landscape of the beverage category in Ontario, Snap Back has shown resilience despite fluctuating ranks over the past few months. Starting from a non-top 20 position in October 2025, Snap Back climbed to rank 27 in November, maintained a steady position at 26 in December, and slightly dipped back to 27 in January 2026. This trajectory indicates a competitive struggle but a commendable effort to stay relevant amidst strong contenders. Notably, Summit (Canada) consistently outperformed Snap Back, peaking at rank 22 in November and maintaining a top 26 position throughout the period, suggesting a robust market presence. Meanwhile, Fetch Soda experienced a rank drop in December but recovered to 25 by January, indicating potential volatility. CQ (Cannabis Quencher) and Deep Space did not maintain consistent top 20 positions, highlighting the competitive pressure in the market. Snap Back's sales trajectory, with a notable peak in December, suggests a capacity to capture consumer interest, albeit with room for growth to match the higher sales figures of its competitors like Summit.

Notable Products

In January 2026, Snap Back's top-performing product was the Strawberry Vanilla Cream Soda in the Beverage category, maintaining its consistent number one rank from the previous months with a notable sales figure of 1,290 units. The Blackberry Vanilla Cream Soda also retained its second position, showing stability in its performance across the months. The Blood Orange Creamsicle Soda, which had a gap in December, returned to its third-place position in January, indicating a resurgence in sales. These rankings reflect a consistent preference for Snap Back's beverage offerings, with minimal fluctuations in their standings over the past months. The data highlights Snap Back's strong market presence in the Beverage category, with all three top products maintaining their ranks from October 2025 to January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.