Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

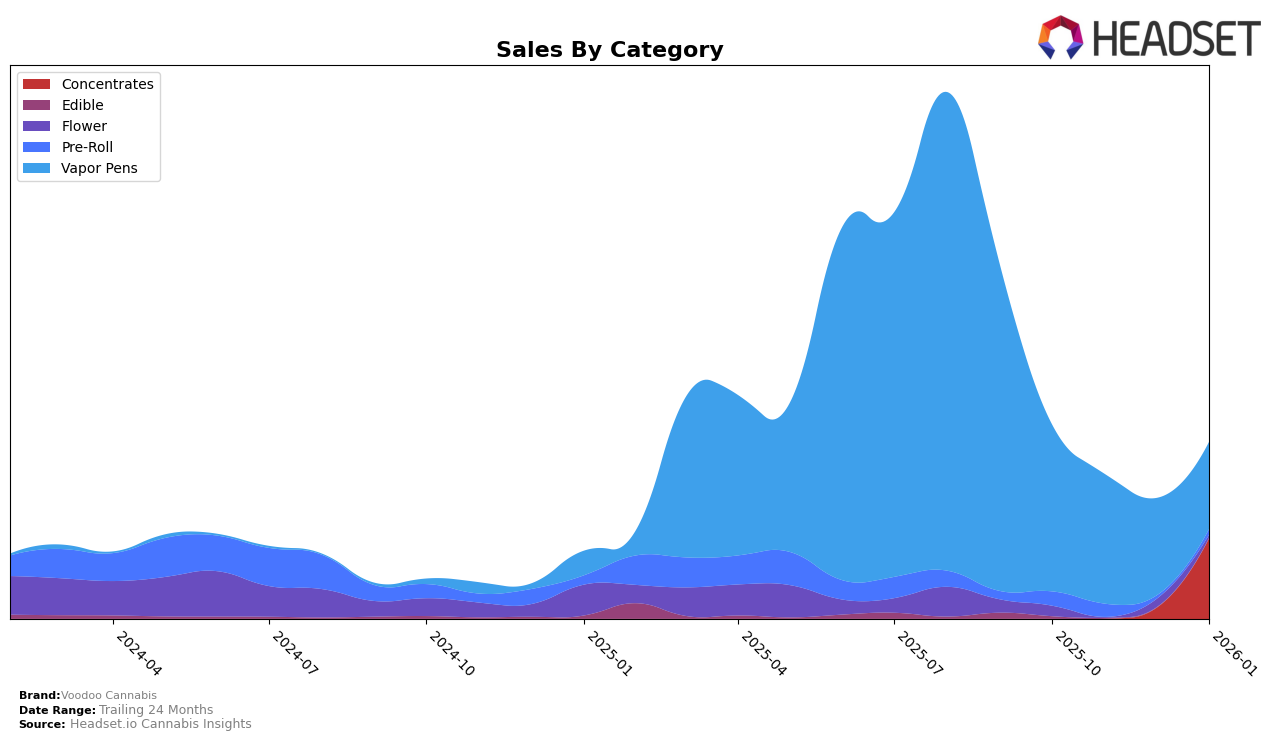

In the province of Alberta, Voodoo Cannabis has shown a notable presence in the Concentrates category, securing the 20th rank as of January 2026. This marks their entry into the top 30, which is a positive development, suggesting a growing acceptance and demand for their products in this category. However, in the Vapor Pens category, the brand did not make it into the top 30 rankings, indicating potential room for improvement or increased competition. The absence of a ranking in this category could imply that Voodoo Cannabis may need to enhance their product offerings or marketing strategies to capture a larger share of the market.

In the state of Michigan, Voodoo Cannabis faced challenges in maintaining a strong foothold in the Vapor Pens category. The brand's rank slipped from 63rd in October 2025 to 83rd by December 2025, before falling out of the top 30 entirely by January 2026. This decline in rankings reflects a significant drop in sales from $130,967 in October to $75,178 in December, suggesting issues with either market saturation or competitive pressures. The downward trend indicates that Voodoo Cannabis may need to reassess their strategy in Michigan to regain their position and improve their market performance.

Competitive Landscape

In the Alberta concentrates market, Voodoo Cannabis made a notable entry in January 2026, securing the 20th rank. This entry is significant as it marks Voodoo Cannabis's emergence into the top 20, suggesting a potential upward trajectory in a competitive landscape. In contrast, Lord Jones experienced a decline from 6th to 19th rank from October 2025 to January 2026, indicating a downward trend in sales performance. Meanwhile, Phyto Extractions hovered around the 20th position, showing some volatility but maintaining a presence in the top ranks. Adults Only also saw a decline, dropping from 16th to 22nd, while Headstone Cannabis showed a promising rise from 26th to 17th, indicating a strong sales performance. These dynamics suggest that Voodoo Cannabis's entry into the top 20 could capitalize on the shifting ranks of its competitors, potentially capturing market share from brands experiencing a decline.

Notable Products

In January 2026, the top-performing product from Voodoo Cannabis was Blue Nerdz Live Resin (1g) in the Concentrates category, achieving the number one rank with notable sales of 1158 units. Following closely, Snow Conez Live Resin (1g) also in the Concentrates category secured the second position. Blue Nerdz Live Resin Cartridge (1g) and Snow Conez Live Resin Cartridge (1g) took the third and fourth ranks respectively in the Vapor Pens category. Tangie Dream Distillate Cartridge (1g), which previously held the top position in December 2025, fell to the fifth rank in January 2026. This shift highlights a significant change in consumer preference towards the live resin products from Voodoo Cannabis.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.