Sep-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

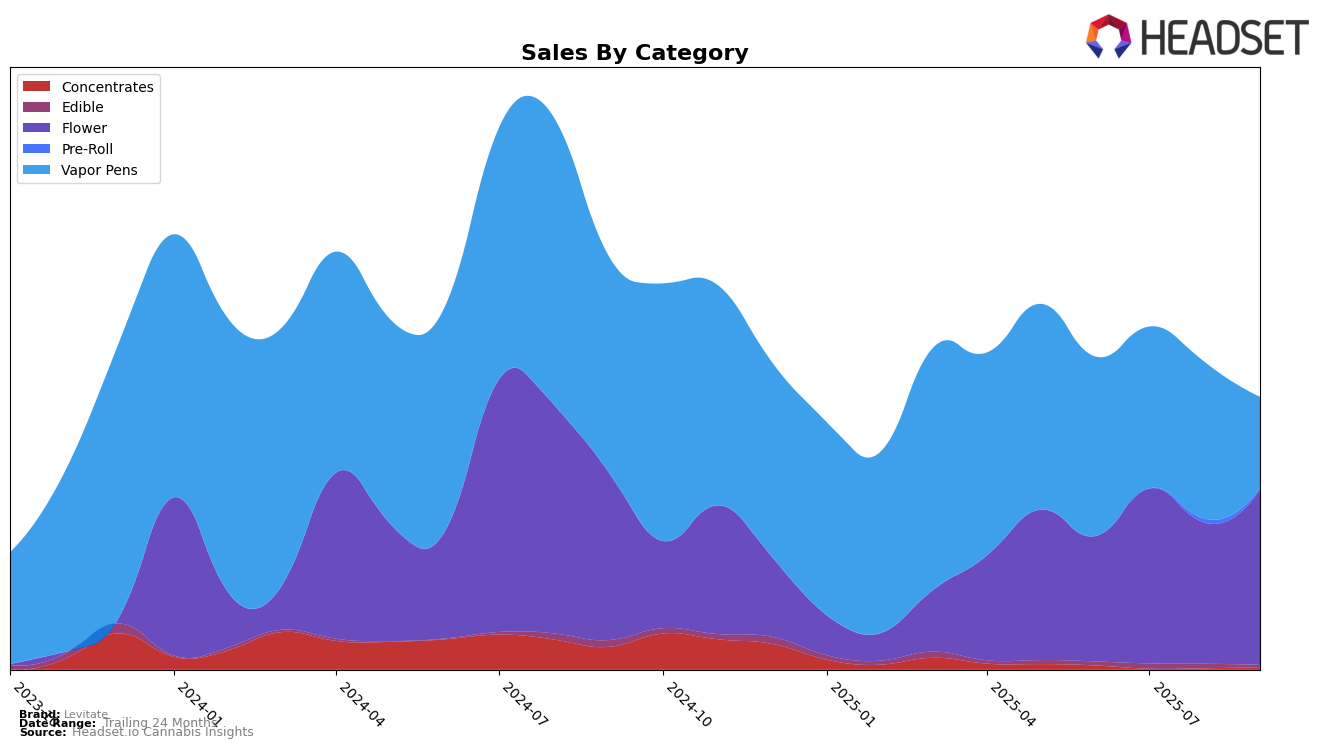

Levitate's performance in the Michigan market has shown notable fluctuations across different categories. In the Flower category, Levitate has seen a positive trend, moving from a rank of 63 in June to 39 in September 2025. This upward trajectory indicates a strengthening position in the market, likely driven by a consistent increase in sales from $421,060 in June to $588,865 in September. However, it is important to note that Levitate was not in the top 30 brands for Flower in any of these months, suggesting that while there is progress, there is still significant room for growth to break into the top tier.

In contrast, Levitate's performance in the Vapor Pens category in Michigan has been less stable. Starting at rank 14 in June, the brand has experienced a decline, falling to rank 27 by September. This drop is mirrored by a decrease in sales, particularly evident in September where the sales dropped to $305,351. The inability to maintain a top 20 position over the months highlights a competitive challenge in this category. The absence from the top 30 in the most recent month underscores the competitive pressure Levitate faces in the Vapor Pens market segment, indicating a need for strategic adjustments to regain its standing.

Competitive Landscape

In the competitive landscape of the Michigan flower category, Levitate has demonstrated a notable upward trajectory in rank over the past few months. Starting from a rank of 63 in June 2025, Levitate climbed to 39 by September 2025, showcasing a significant improvement in its market position. This upward movement is particularly impressive when compared to brands like Zips, which remained relatively stable but lower in rank, and Garcia Hand Picked, which showed fluctuations but ended slightly below Levitate in September. Meanwhile, The Fresh Canna experienced a dramatic rise in August but settled just below Levitate by September. The competitive dynamics indicate that while Levitate is gaining ground, it faces stiff competition from brands like Galactic, which, despite a downward trend, maintained a higher rank throughout the period. These shifts suggest that Levitate's strategic efforts are paying off, positioning it as a growing contender in the Michigan flower market.

Notable Products

In September 2025, the top-performing product for Levitate was Maui Wowie Distillate Cartridge (1g) in the Vapor Pens category, achieving the number one rank with sales of 3756 units. Blue Dream Distillate Cartridge (1g) maintained its strong performance in the Vapor Pens category, holding steady in second place, though its sales slightly decreased from the previous month. Super Runtz Pre-Roll (1g) in the Pre-Roll category climbed to third place, a drop from its previous top rank in August. Blue Raz Distillate Cartridge (1g), also in the Vapor Pens category, ranked fourth, showing a consistent presence in the top five despite slightly declining sales. Granddaddy Purple Distillate Cartridge (1g) entered the rankings this month in fifth place, marking its first appearance in the top five.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.