Jul-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

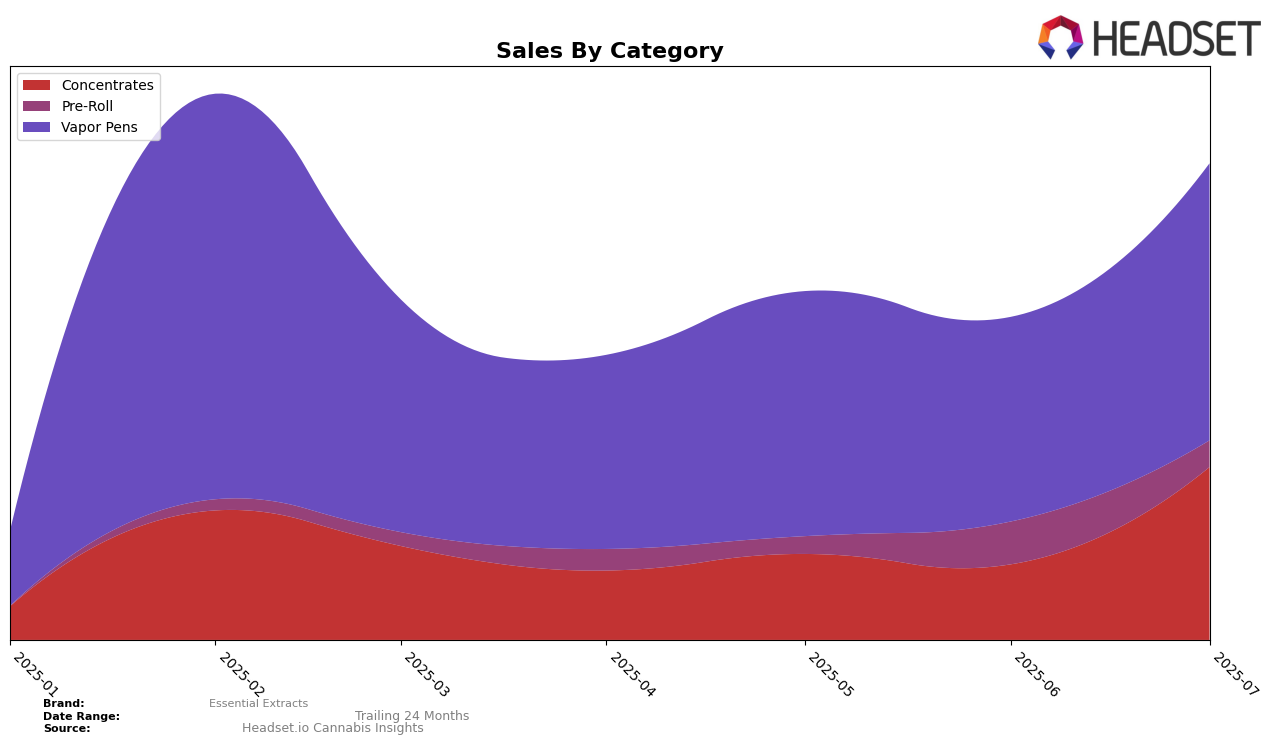

Essential Extracts has demonstrated a steady presence in the Vapor Pens category within the state of New Jersey. Despite not breaking into the top 30 rankings from April to July 2025, the brand has shown resilience by maintaining consistent sales growth over this period. Notably, their sales figures rose from $11,132 in April to $15,858 in July, indicating a positive trend in consumer demand. This upward trajectory, despite the absence from the top 30, suggests that Essential Extracts is gradually gaining traction in the New Jersey market, potentially positioning itself for future breakthroughs in the rankings.

The lack of a top 30 ranking in New Jersey's Vapor Pens category may initially seem like a setback for Essential Extracts; however, the consistent increase in sales suggests a growing consumer base that could lead to improved rankings in the future. This performance is indicative of a brand that is building its presence and reputation incrementally. While they have yet to secure a top-tier position, the sales growth trajectory is a promising sign of potential future success as they continue to expand their reach and influence within the market.

Competitive Landscape

In the competitive landscape of vapor pens in New Jersey, Essential Extracts has shown a consistent presence, although it faces stiff competition from brands like Lily Extracts and New Earth. Despite Essential Extracts' sales growth from April to July 2025, its rank remained relatively stable, hovering in the mid-60s. This suggests that while sales are increasing, competitors are also advancing, maintaining their lead. Lily Extracts started with a significantly higher rank and sales, but its sales have sharply declined over the months, closing the gap with Essential Extracts. Meanwhile, Full Tilt Labs emerged in June, entering the rankings closely behind Essential Extracts, indicating new competition. Jersey Clouds showed sporadic ranking, suggesting inconsistent market performance. Overall, Essential Extracts is in a competitive position where maintaining sales growth is crucial to improving its rank amidst fluctuating performances of its rivals.

Notable Products

In July 2025, the top-performing product for Essential Extracts was the Rainbow Guava Live Rosin Disposable (0.5g) from the Vapor Pens category, maintaining its number one rank for four consecutive months with a sales figure of 138. The Paloma Spritz Live Rosin Disposable (0.5g) entered the rankings for the first time, securing the second position. Rainbow Guava Cold Cure Live Rosin (0.5g) in Concentrates improved its standing from fourth in June to third in July. The Mimosa Pre-Roll (7g) dropped from second in June to fourth in July, indicating a shift in consumer preference. Lastly, the Triple OG Live Rosin Disposable (0.5g) remained consistent in its fifth position from June to July.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.