Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

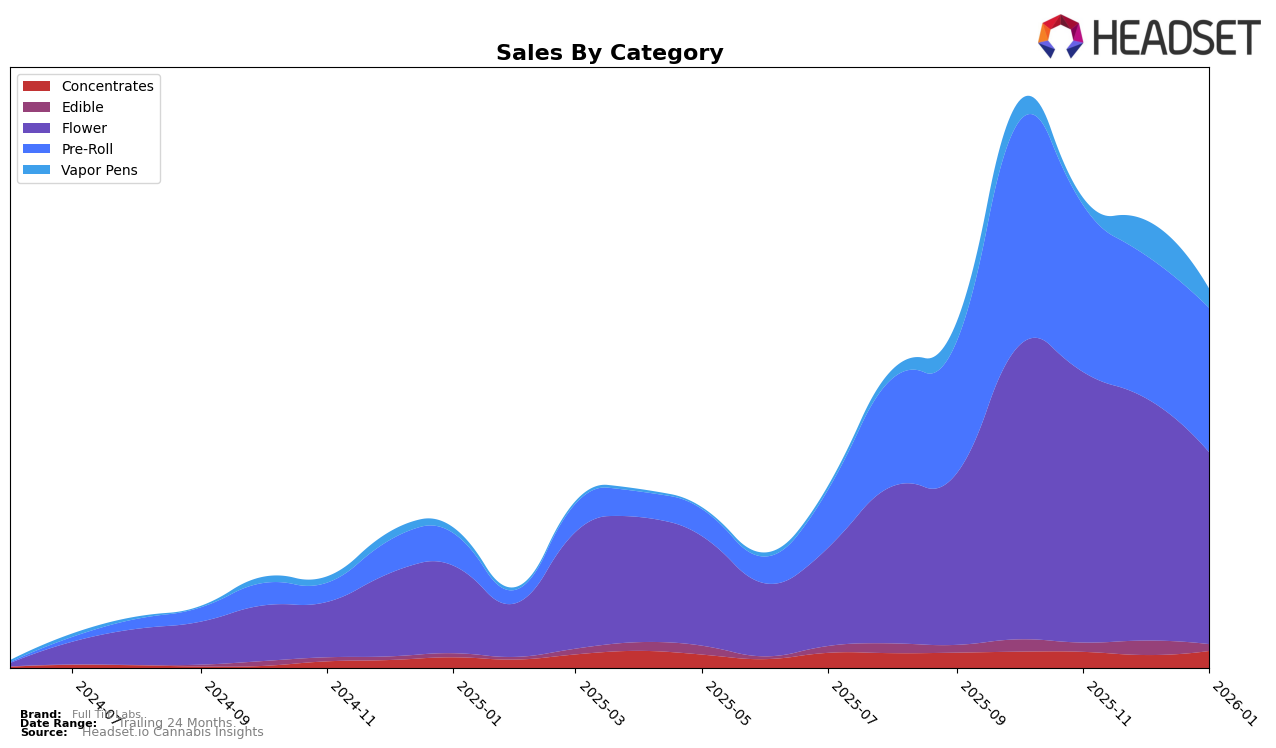

Full Tilt Labs has demonstrated varied performance across different product categories in New Jersey. In the Concentrates category, the brand experienced fluctuations in its rankings, moving from 16th place in October 2025 to 19th by January 2026. Notably, their sales in this category saw a resurgence in January 2026, indicating a positive trend despite the mid-period dip. The Pre-Roll category has been a strong performer for Full Tilt Labs, consistently maintaining a top 10 position, which underscores its stability and consumer preference in this segment. However, the Flower category saw a downward trajectory, dropping from 16th to 24th place over the four-month span, reflecting a potential area of concern or strategic reevaluation.

In other categories, Full Tilt Labs' presence was less consistent. The Edible category showed a momentary improvement in December 2025, securing the 38th position, but the absence from the top 30 in other months suggests challenges in maintaining a competitive edge. The Vapor Pens category also highlights an area for potential growth, with the brand only appearing twice in the top 30 rankings over the four-month period. While they achieved a 41st rank in December 2025, the lack of consistent presence in the rankings points to volatility or competitive pressure in this segment. These insights reveal a mixed performance across categories, suggesting that while some areas are thriving, others may require strategic adjustments to enhance their market position in New Jersey.

Competitive Landscape

In the competitive landscape of the New Jersey flower category, Full Tilt Labs experienced a notable decline in rank from October 2025 to January 2026, dropping from 16th to 24th place. This downward trend in rank coincides with a decrease in sales, suggesting potential challenges in maintaining market share. Meanwhile, competitors such as Green Lightning and (the) Essence have shown resilience, with Green Lightning maintaining a strong position in the top 11 for most of the period before a drop to 22nd in January, and (the) Essence rebounding to 14th in December before slipping again. The sales figures for these competitors are notably higher than those of Full Tilt Labs, indicating a competitive edge in consumer preference or distribution strategies. Additionally, Breakwater and Goodies have shown fluctuations in rank but have managed to stay within or return to the top 25, suggesting a volatile yet competitive market environment. These dynamics highlight the need for Full Tilt Labs to reassess its market strategies to regain its footing in this competitive sector.

Notable Products

In January 2026, the top-performing product for Full Tilt Labs was the Frost Donkey Pre-Roll 5-Pack (2.5g), which claimed the number one spot with notable sales of 1,636 units. The Columbian D Pre-Roll 5-Pack (2.5g) followed closely in second place, indicating strong performance in the Pre-Roll category. The Frost Donkey (3.5g) Flower product saw a significant drop from its first-place rank in December 2025 to third place in January 2026. The Frost Donkey Pre-Roll (1g) and Colombian D Pre-Roll 2-Pack (1g) rounded out the top five, ranking fourth and fifth, respectively. This shift in rankings highlights the growing popularity of Pre-Roll products over Flower in the new year.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.