Sep-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

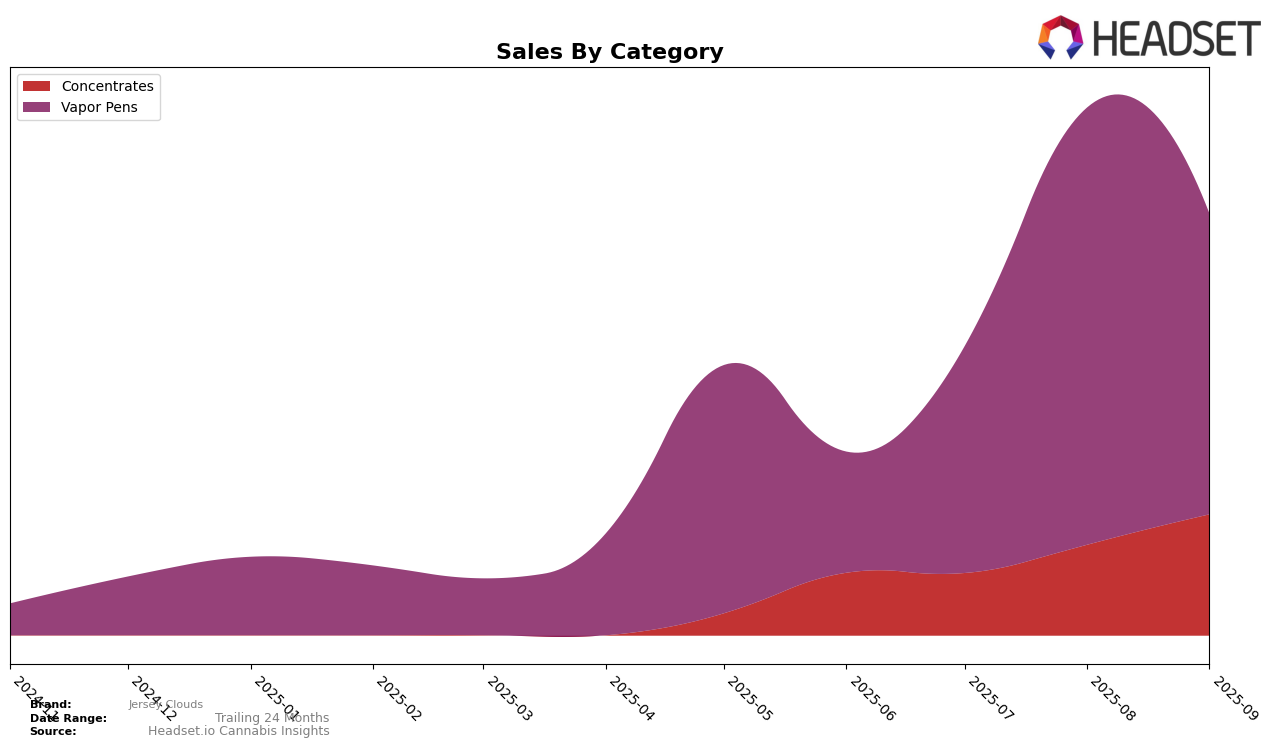

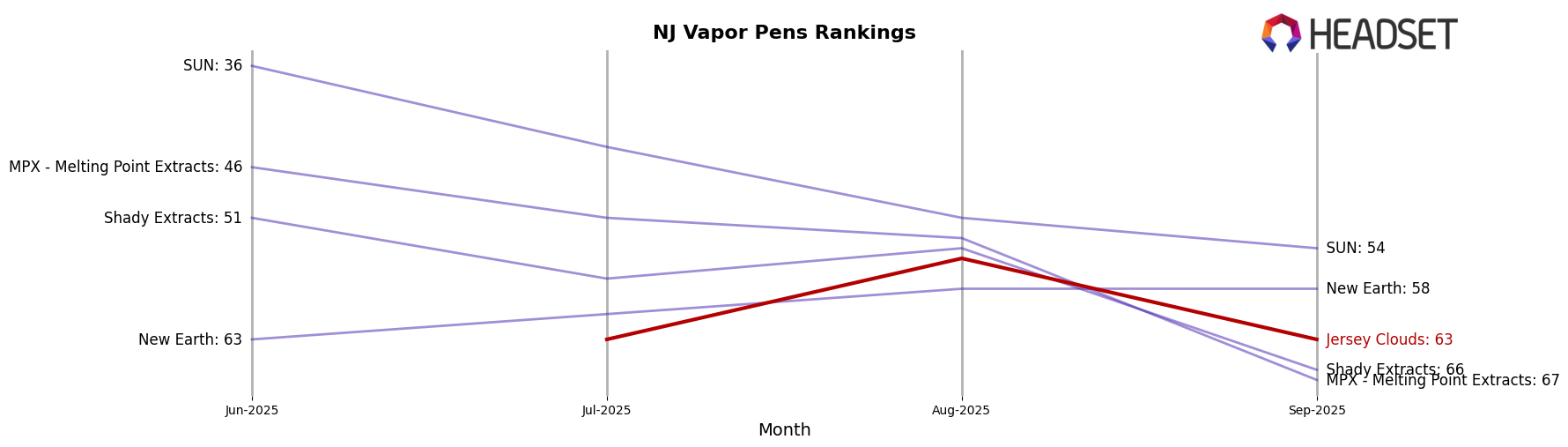

Jersey Clouds has shown a dynamic performance in the Vapor Pens category in New Jersey over the past few months. Despite not making it into the top 30 brands in June 2025, the brand made significant strides by July, climbing to the 63rd position. This upward trajectory continued into August, where it improved further to rank 55th. However, September saw a slight regression with Jersey Clouds dropping back to the 63rd spot. This fluctuation in rankings highlights the competitive nature of the market and suggests that while Jersey Clouds is gaining traction, it faces stiff competition from other brands in the state.

The sales figures for Jersey Clouds in New Jersey reflect a similar pattern to its rankings. The brand's sales saw a substantial increase from June to July, nearly doubling, which aligns with its improvement in rank during that period. However, the subsequent months saw a decline in sales, which coincides with the drop in ranking by September. This indicates that while Jersey Clouds has the potential to capture a larger market share, maintaining a consistent upward trend in both sales and rankings will be crucial for sustaining its growth in the New Jersey market.

Competitive Landscape

In the competitive landscape of vapor pens in New Jersey, Jersey Clouds has shown a fluctuating presence, with its rank moving from 63rd in July 2025 to 55th in August 2025, before dropping back to 63rd in September 2025. This indicates a volatile performance compared to its competitors. For instance, SUN has maintained a more consistent upward trajectory, improving its rank from 36th in June to 54th by September 2025, suggesting a more stable market presence. Meanwhile, MPX - Melting Point Extracts and Shady Extracts have experienced a decline in both rank and sales, with MPX dropping from 46th to 67th and Shady Extracts from 51st to 66th over the same period. Despite Jersey Clouds' temporary rise in August, its overall sales trend mirrors a similar decline seen in its competitors, suggesting a challenging market environment. Notably, New Earth re-entered the rankings in August and maintained its position in September, highlighting a potential resurgence. These dynamics underscore the competitive pressures Jersey Clouds faces, emphasizing the need for strategic adjustments to regain and sustain market share.

Notable Products

In September 2025, the top-performing product from Jersey Clouds was the Triple OG Full Spectrum Cartridge (0.5g) in the Vapor Pens category, maintaining its first-place ranking from the previous two months and achieving sales of 599 units. The Gelonade Full Spectrum Syringe (1g) in Concentrates climbed to the second position, up from fourth in August. The Black Cherry Runtz Full Spectrum Cartridge (0.5g) re-entered the rankings at third place with notable sales improvement. The Slurricane Full Spectrum Disposable (1g) made its debut in the rankings at fourth, while the Super Lemon Haze Full Spectrum Disposable (1g) dropped from second to fourth place. Overall, Vapor Pens dominated the top spots, indicating strong consumer preference for this category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.