Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

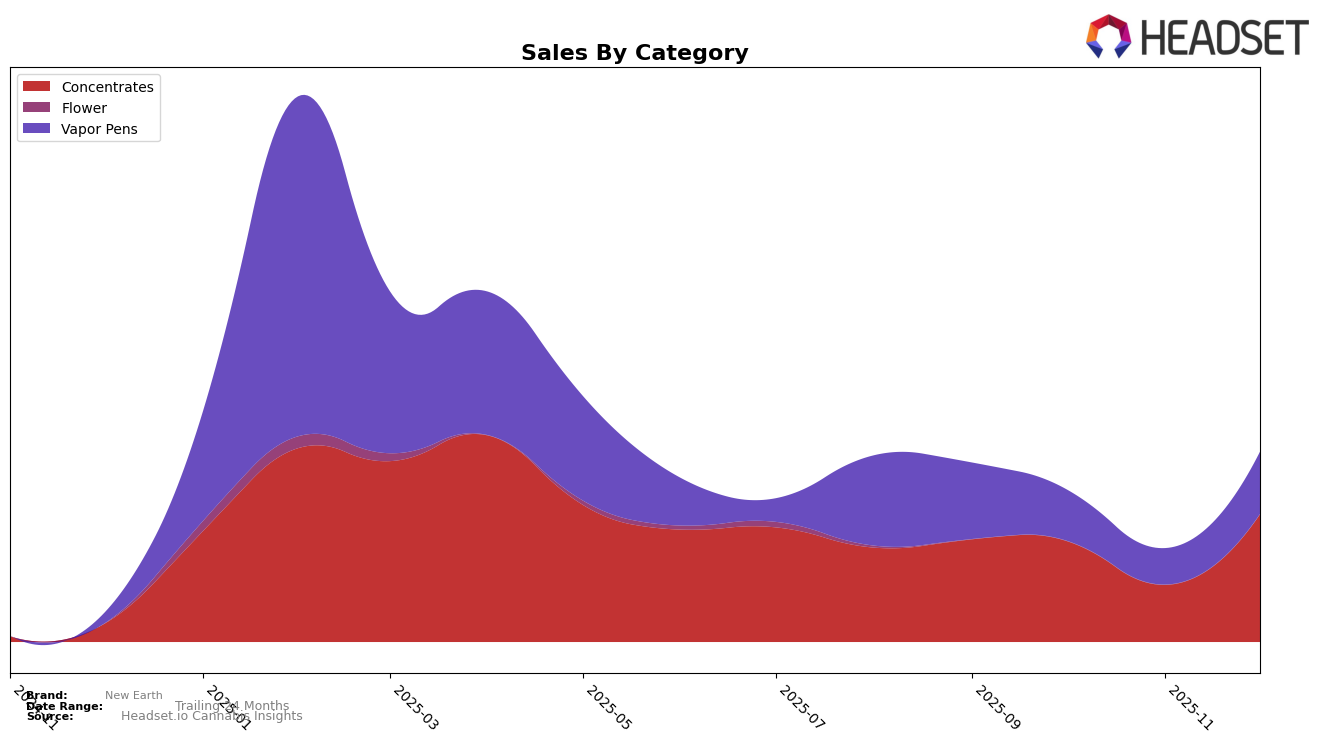

In the state of New Jersey, New Earth's performance in the Concentrates category has shown some fluctuations over the last few months of 2025. Notably, the brand maintained a consistent presence in the top 30, with a brief dip to the 27th position in November before rebounding to 19th in December. This recovery in ranking is indicative of a strong market response, possibly driven by strategic adjustments or seasonal demand. The December sales figure for Concentrates also reflects a significant improvement from the previous month, marking a positive trend for New Earth in this category.

Conversely, New Earth's position in the Vapor Pens category in New Jersey presents a more challenging scenario. The brand did not secure a spot in the top 30 for any month, with rankings hovering in the 60s and 70s. This suggests that New Earth is facing stiff competition or other market challenges in this category. The sales figures for Vapor Pens show a slight increase in December compared to November, but the overall trend indicates that there is room for improvement. Such insights could be crucial for stakeholders looking to understand market dynamics and New Earth's strategic positioning in the Vapor Pens segment.

Competitive Landscape

In the competitive landscape of New Jersey's concentrates market, New Earth has experienced notable fluctuations in its ranking and sales performance from September to December 2025. Initially ranked 20th in September, New Earth maintained this position in October but saw a decline to 27th in November, before rebounding to 19th in December. This volatility is contrasted by the performance of competitors such as Sneaky Pete's, which consistently improved its rank, moving from 19th in September to 16th by December, accompanied by a steady increase in sales. Meanwhile, SUN demonstrated a strong upward trend, peaking at 13th in November before settling at 17th in December, with sales significantly higher than New Earth's throughout the period. Interestingly, North Lake Supply made a remarkable leap from 32nd in November to 20th in December, indicating a potential emerging threat. These dynamics suggest that while New Earth has shown resilience in recovering its position, it faces stiff competition from brands that are either consistently climbing the ranks or making significant gains in sales, underscoring the need for strategic adjustments to maintain and improve its market standing.

Notable Products

In December 2025, the top-performing product for New Earth was Kamikaze FSO Syringe (1g) in the Concentrates category, which achieved the number one rank, with sales reaching 311 units. This product showed a significant rise in popularity, climbing from the third rank in both October and November. Candyland FSO Syringe (1g), also in the Concentrates category, secured the second position, showing a notable increase from the fourth rank in November. Maple Nectar Live Resin Badder (1g) entered the rankings for the first time, landing at the third position, while Maple Nectar Live Resin Cartridge (1g) and Fruity Gum Live Resin Badder (1g) took fourth and fifth places, respectively. The introduction of new products and shifts in consumer preferences contributed to these changes in rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.