Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

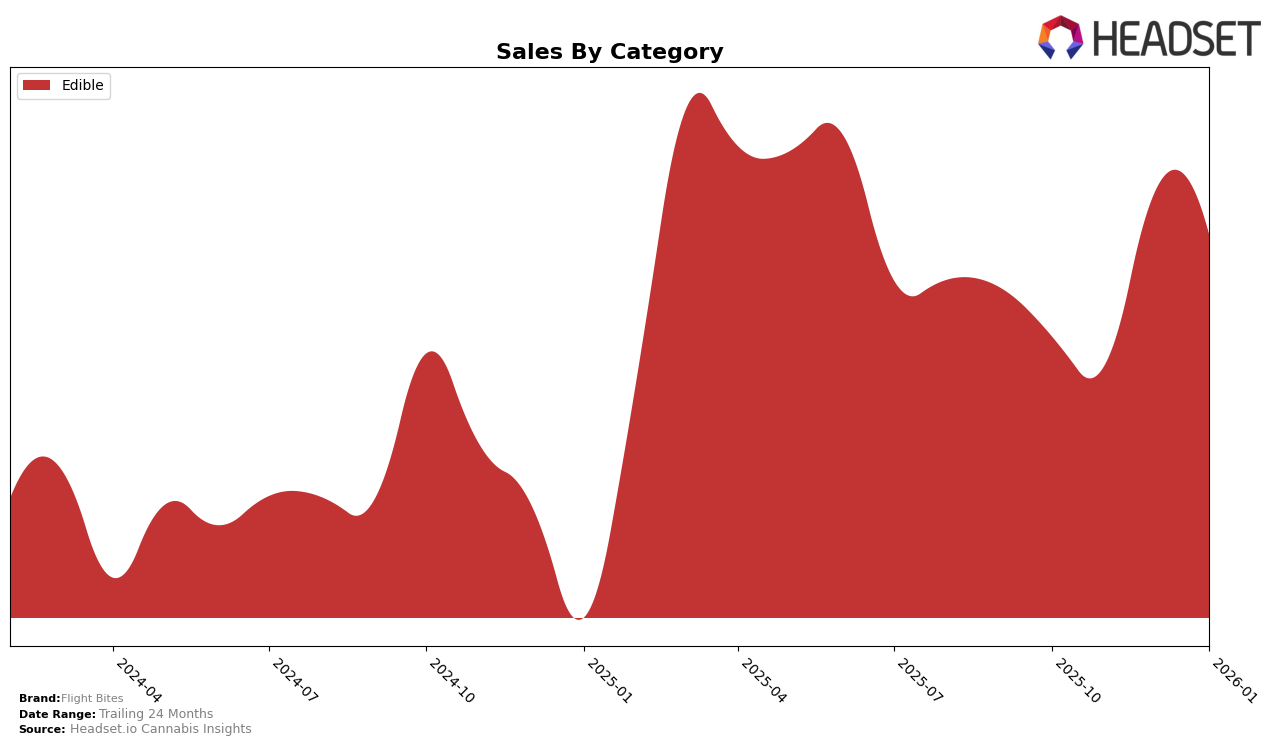

Flight Bites has shown a consistent performance in the Edible category within the state of Nevada. Over the observed months, the brand maintained a steady presence in the top 20 rankings, with a slight dip in November 2025 to the 20th position before bouncing back to the 17th position by December 2025 and maintaining that rank into January 2026. This stability suggests a strong foothold in the Nevada market, despite a minor fluctuation in rankings. The December 2025 sales figures highlight a notable increase, indicating a successful holiday season for the brand, possibly due to effective marketing strategies or seasonal demand for edibles.

Across other states, the absence of Flight Bites in the top 30 rankings could be interpreted as either a strategic focus on the Nevada market or a potential area for growth and expansion. The lack of data from other states might suggest limited distribution or brand recognition outside Nevada, which could be an opportunity for the company to explore. The consistent rankings in Nevada, however, underscore the brand's strength in retaining a competitive position within a single market. This could serve as a model for expansion strategies in other regions where the brand is currently not visible in the top rankings.

Competitive Landscape

In the Nevada edible market, Flight Bites has experienced a dynamic competitive landscape over the past few months. Starting from October 2025, Flight Bites held the 18th position, briefly dropping to 20th in November, then climbing to 17th in December and maintaining that rank in January 2026. This upward trend in rank is indicative of a positive reception and increasing consumer preference, despite the competitive pressures. Notably, Tyson 2.0 consistently outperformed Flight Bites, maintaining a top 15 position throughout the period, which suggests a strong brand presence and customer loyalty. Meanwhile, High Heads showed a fluctuating pattern, initially ranking below Flight Bites in October but surpassing it by November, indicating a potential threat if their growth continues. CAMP (NV) and Just Edibles trailed behind, with CAMP (NV) experiencing a decline in sales by January, which could be an opportunity for Flight Bites to capture more market share. Overall, Flight Bites' ability to improve its rank amidst these shifts suggests effective marketing strategies and product offerings that resonate well with Nevada consumers.

Notable Products

In January 2026, Aloha Sunrise Gummies 10-Pack (100mg) emerged as the top-performing product for Flight Bites, achieving the number one rank with impressive sales of 938 units. S'mores Gummies 10-Pack (100mg), which held the top spot in October 2025 and second place in the following months, maintained its second position with sales of 694 units. Mango Tajin Gummies 10-Pack (100mg), previously ranked first in November and December 2025, dropped to third place with sales of 509 units. Strawberry Shortcake Live Rosin Gummies 10-Pack (100mg) made a notable entry into the rankings, securing the fourth spot in January 2026, up from fifth in December 2025. Strawnana Rosin Gummies 10-Pack (100mg) consistently held the fifth position, experiencing a significant decline in sales to 53 units.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.